What is Shop Pay and How Does Shop Pay Work?

What is Shop Pay? Shop Pay is Shopify’s accelerated checkout solution that transforms how customers complete purchases. With fast, secure, one-tap payments, it saves customer details for future use and supports flexible payment options like Shop Pay Installments. For Shopify merchants, it’s designed to reduce checkout friction, serve mobile-first buyers, and simplify order tracking through the Shop app.

In this guide, we’ll explain:

- What Shop Pay does and why it matters

- How it works for shoppers and merchants

- Its impact on conversion rates

- Why it’s one of the most trusted checkout tools on Shopify

Let’s get started.

What Is Shop Pay?

Shop Pay is Shopify’s native accelerated checkout that lets customers save payment and shipping details for instant, one-tap purchases across any participating Shopify store. Once customers opt in, their information is securely stored and auto-filled during future checkouts, creating a faster, smoother experience that drives higher conversions.

Trusted by leading brands like Allbirds, Gymshark, and Olaplex, Shop Pay delivers seamless buying experiences across mobile and desktop while integrating with the Shop app for real-time order tracking.

Shop Pay is included with Shopify Payments at no additional cost. There are no separate fees to use Shop Pay itself: transactions are processed at your store’s standard Shopify Payments credit card rates, which vary depending on your Shopify plan. You can view your specific rates by going to Settings > Payments > Manage > View payment rates in your Shopify admin.

How Does Shop Pay Work?

Shop Pay powers faster, more seamless checkouts by saving customer information and automating the process across any Shopify store that supports it. Here’s how it works from both the customer and merchant perspectives:

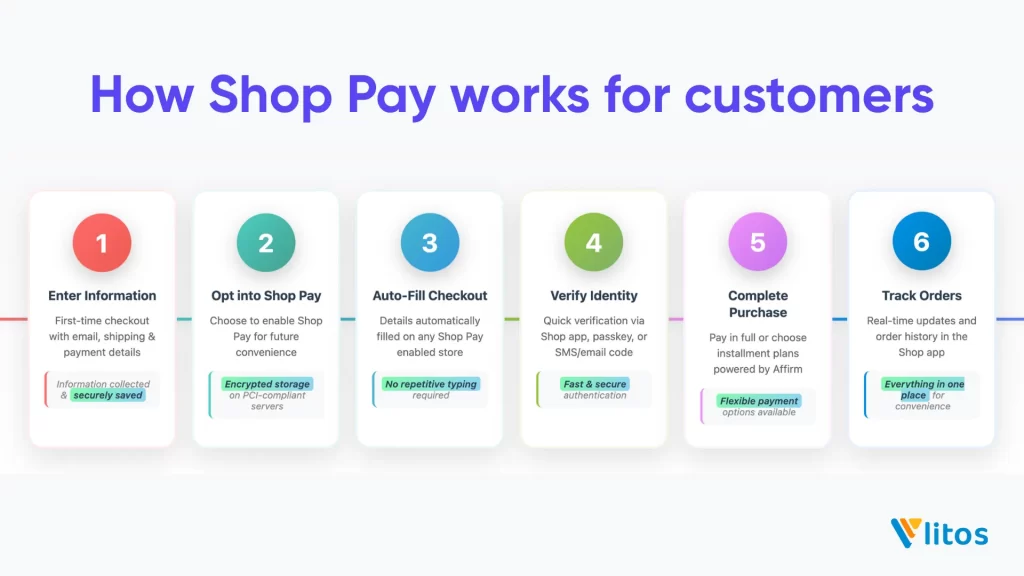

How Shop Pay works for customers (checkout flow)

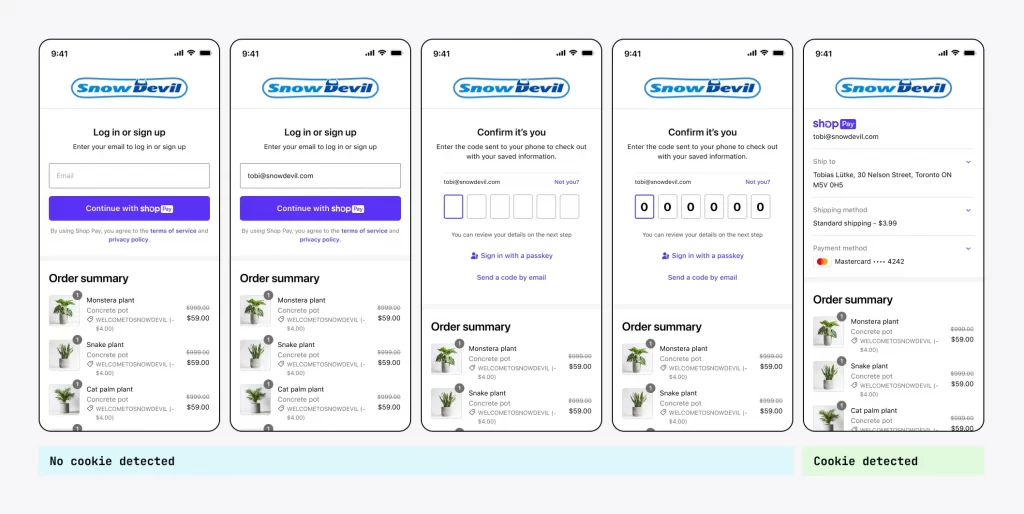

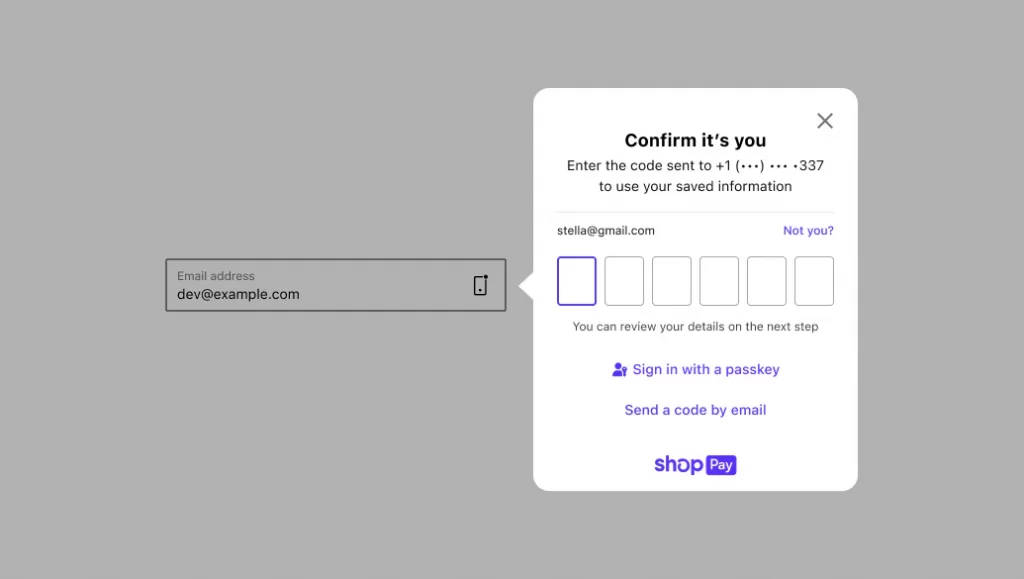

Shop Pay follows a “set it up once, use it everywhere” model. Customers enter their checkout info once, opt in to Shop Pay, and enjoy faster future purchases across any Shopify store.

The opt-in step builds trust by being transparent and secure (PCI-compliant). Auto-fill speeds up checkout and gets more valuable the more stores support it. Identity verification balances security with ease of use, offering options like app-based approval or SMS codes. Installments via Affirm add payment flexibility, and order tracking through the Shop app encourages repeat engagement.

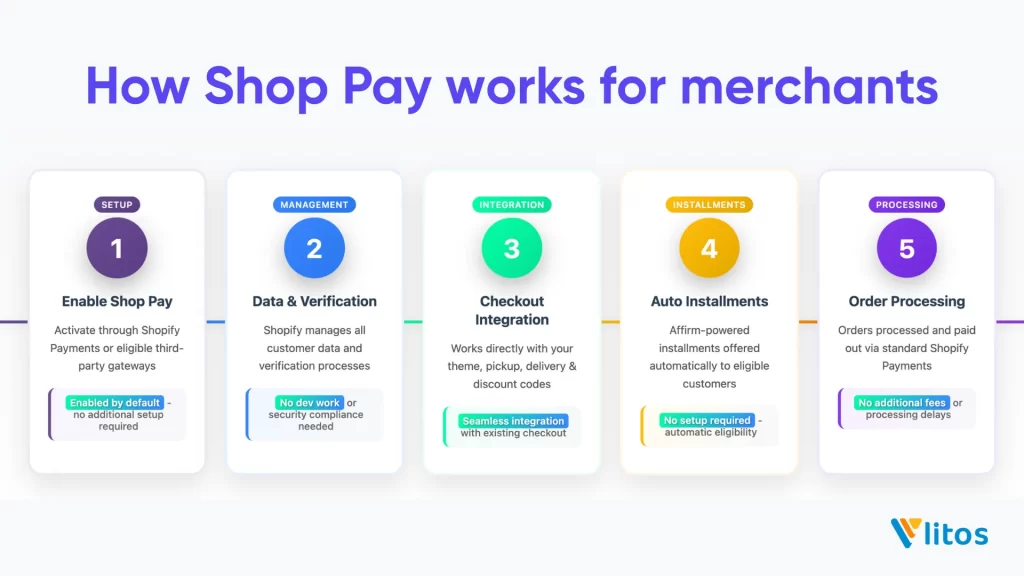

How Shop Pay works for merchants (behind the scenes)

For merchants, Shop Pay is designed for zero-effort adoption. It activates automatically with Shopify Payments (or select third-party gateways), encouraging native integration. Shopify handles all data and security compliance, removing merchant liability.

Shop Pay integrates seamlessly with your existing checkout, eliminating the need for development work, and supports features like local pickup and discounts. Installments are offered to eligible customers without merchant risk. Affirm handles approvals and payouts. Everything runs through your usual Shopify Payments flow, with no extra fees.

As you can see, Shop Pay eliminates friction for both shoppers and merchants. Once enabled, it operates automatically: Shopify manages security, auto-fills customer details, and handles installment offers. You build nothing, maintain nothing.

For customers, Shop Pay removes the barriers that cause cart abandonment. When returning customers can complete purchases with one tap, eliminating the need for typing addresses or card numbers, they’re significantly more likely to convert.

Additionally, If you sell on blogs or external sites, using the Shopify Buy Button for faster checkout can complement Shop Pay by giving customers another streamlined way to purchase without leaving the page.

At LitOS, we view Shop Pay as one of the most impactful native tools available to Shopify merchants, particularly for stores focused on mobile UX, repeat purchases, or high average order value (AOV) products. It’s simple to activate, easy to maintain, and consistently delivers measurable upside across the funnel.

Key Benefits of Shop Pay

Shop Pay improves the checkout experience for both merchants and customers. It helps increase conversions, reduce friction, and support growth without adding complexity to your store.

1. Faster checkout

Shop Pay saves a customer’s email, payment, and shipping details after their first purchase. From then on, it auto-fills this info at checkout, enabling one-tap purchases across any Shopify store.

This dramatically speeds up the checkout process, reduces cart abandonment, and is especially impactful for mobile shoppers who prefer a frictionless path to purchase.

2. Higher conversion rates

By reducing friction at checkout, Shop Pay helps you capture more completed orders. According to Shopify, stores using Shop Pay often see significantly higher conversion rates compared to guest checkout, which has a direct impact on your revenue.

3. Support for local delivery & pickup

If your store offers in-store pickup or local delivery, Shop Pay supports these options right in the checkout flow. It’s fully compatible with Shopify’s local fulfillment tools, helping you serve nearby customers more efficiently.

4. Secure data storage

Customer data is encrypted and stored on Shopify’s PCI-compliant servers. No sensitive information is shared with merchants until a purchase is made, and Shopify handles all verification, reducing your security liability and compliance overhead.

5. Built-in Shop features

Enabling Shop Pay also unlocks additional value through the broader Shop ecosystem:

- Sell with Shop: Eligible products are listed in the Shop app

- Sign in with Shop: Customers can log into your store using their Shop credentials

These features help improve personalization, increase repeat visits, and enhance post-purchase visibility, all without requiring additional setup.

How to Set Up and Customize Shop Pay on Your Store

Shop Pay setup requirements

To use Shop Pay, your store must be using Shopify Payments or a supported third-party gateway in Australia, France, or the United States. The feature is automatically available when Shopify Payments is active, so no app installation is needed.

If you’re using a third-party payment provider, you’ll need to meet Shopify’s eligibility criteria to activate Shop Pay. You can check your eligibility and gateway status by going to Settings > Payments in your Shopify admin.

Once active, Shop Pay runs on your standard Shopify Payments credit card processing rates. There are no additional fees for using Shop Pay itself.

How to set up Shop Pay

Shop Pay is included by default when using Shopify Payments, and setup only takes a few steps:

- In your Shopify admin, go to Settings > Payments

- Under Shopify Payments, click Manage

- Scroll to the Accelerated checkouts section

- Check the box for Shop Pay

- Click Save to confirm

If you haven’t already set up Shopify Payments, you’ll be prompted to enter your business and banking details. Please note that your first payout may take up to 21 business days to process.

Once enabled, Shop Pay is fully integrated into your checkout, and there’s no app or code needed.

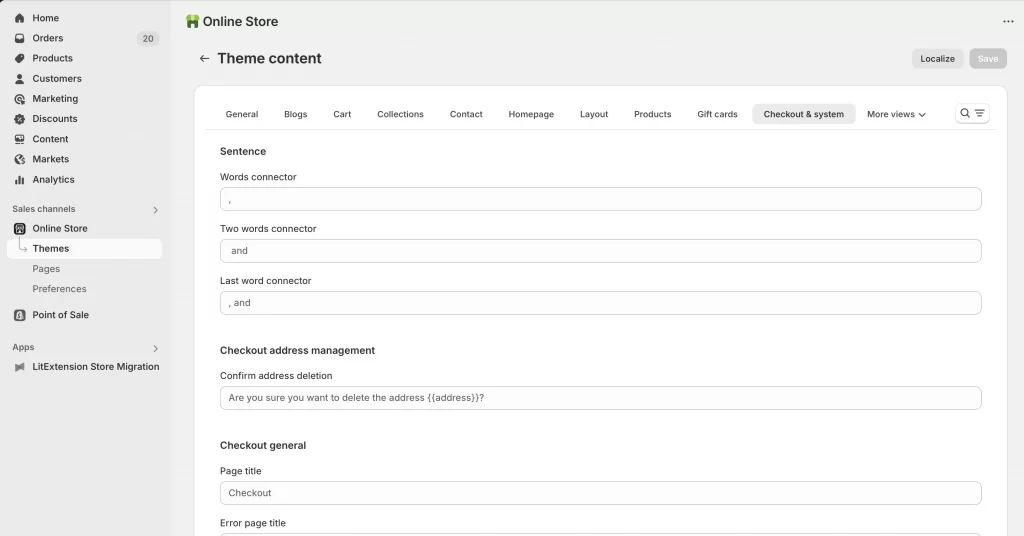

How to customize the Shop Pay checkout flow

You can customize parts of the Shop Pay experience through your theme language editor to better align with your store’s tone and messaging.

To customize the language:

- Go to Online Store > Themes

- Click Actions > Edit default theme content

- Navigate to the Checkout & system section

- Edit labels and messages related to checkout, shipping, errors, and policy text

However, there are some limitations you must pay attention to. First, Shop Pay branding (e.g., logo, button color) can’t be changed due to Shopify’s trademark guidelines. Next, Installment-related wording (for Shop Pay Installments) is standardized for compliance reasons.

Despite these limits, merchants can still adjust their messaging to maintain a consistent, branded checkout experience. Customers who prefer stored credit may also rely on checking a Shopify gift card balance during checkout, even when using accelerated payment methods like Shop Pay.

How to uninstall or deactivate Shop Pay

If you decide to turn off Shop Pay, you can do so directly from your Shopify Payments settings:

- Go to Settings > Payments in your Shopify admin

- Click Manage under Shopify Payments

- In the Accelerated checkouts section, uncheck Shop Pay

- Click Save to apply the changes

Deactivating Shop Pay will remove it from your checkout. However, customers who have previously used it can still manage their saved information via the Shop app or the Shop Pay login page.

Shop Pay is simple to activate, but if you need help customizing the checkout experience, integrating other payment gateways, or building a high-performing Shopify store, LitOS can help. From payment setup to full-site optimization, we support merchants at every stage of growth.

Shop Pay vs Other Payment Options (Quick Comparison)

Shop Pay is often compared to other popular checkout methods like PayPal, Apple Pay, Google Pay, Afterpay, or Klarna. But not all options serve the same purpose. Below, we’ve broken the comparison into two focused categories: accelerated checkout options and buy now, pay later (BNPL) solutions, so you can better evaluate what fits your store’s needs.

Accelerated checkout comparison table:

| Feature | Shop Pay | PayPal | Apple Pay / Google Pay |

| Integration | Native to Shopify via Shopify Payments | External setup (Shopify + PayPal fees apply) | Requires Stripe and device/browser support |

| Checkout speed | One-tap, auto-filled | Fast login-based | Tap-to-pay on compatible devices |

| Customer experience | Pre-filled info + Shop App tracking | Familiar but often redirects | Seamless on mobile, device-tied |

| Security & verification | Encrypted + 2FA via app/code/passkey | PayPal-managed | Device-level (Face ID, Touch ID, etc.) |

| Branding control | Limited (Shop Pay branding is fixed) | Some flexibility | Inherits device/browser styling |

| Conversion impact | Highest-performing accelerated checkout | Medium | Medium |

| Merchant fees | No extra fee beyond Shopify Payments rate | Additional per-transaction PayPal fees | Included in Stripe or Shopify Payments fees |

| Payouts | Standard Shopify Payments payout | Sent to PayPal, manual transfer to bank | Sent via Stripe or Shopify Payments |

BNPL provider comparison table:

| Feature | Shop Pay Installments (Affirm) | Afterpay / Klarna |

| Integration | Included with Shop Pay | Requires separate app + approval |

| Setup time | Instant (Shopify + Affirm manage everything) | Setup, contracts, and onboarding required |

| Eligibility management | Fully managed by Shopify + Affirm | Managed by provider (merchant has limited view) |

| Credit risk | None for merchants | Provider assumes risk |

| Branding control | Installment language is fixed | Some branding customization allowed |

| Merchant fees | No extra fee beyond Shopify Payments rate | Additional transaction fees apply |

| Payout timing | Paid in full via Shopify Payments | Varies; may have delays |

| Customer experience | Native checkout + real-time installment offer | Often involves third-party redirect/approval |

Shop Pay covers both sides; it’s a fast, accelerated checkout and includes BNPL through Shop Pay Installments. That means fewer apps, fewer redirects, and less friction for both you and your customers.

You should use Shop Pay as your default if:

- You’re using Shopify Payments

- You want higher conversion rates with minimal setup

- You want to offer BNPL but avoid additional contracts or fees

Or else, you can use PayPal, Apple Pay, or others to support specific customer preferences, but not as your primary checkout path.

What Is Shop Pay: FAQs

How does Shop Pay work?

Shop Pay saves a customer’s checkout information (email, shipping, and payment details) after their first purchase. On future checkouts, that info is auto-filled and verified using a code sent via SMS, email, or through the Shop app. Customers can also choose to pay in full or in installments.

What is Shop Pay Installments?

Shop Pay Installments is a buy-now-pay-later feature powered by Affirm that allows customers to split purchases into multiple payments over time. It's built directly into the Shop Pay checkout experience, with no additional setup required for merchants. Affirm handles all credit decisions, risk management, and customer payments, while merchants receive full payment upfront.

What are the disadvantages of Shop Pay?

Shop Pay’s branding and messaging can’t be customized, and Affirm, not the merchant, manages installment eligibility. Customers also need to use the same device or email to access saved info, which can be a limitation in some cases.

Do you get charged for using Shop Pay?

There are no additional fees for using Shop Pay. Transactions are processed at your standard Shopify Payments credit card rates, which vary by plan. You can view your rates in Settings > Payments > Manage > View payment rates.

Which cards are accepted with Shop Pay?

Shop Pay supports most major credit and debit cards, including Visa, Mastercard, American Express, and Discover. For Shop Pay Installments, some cards like Capital One and Chase credit cards are not accepted.

How did Shop Pay get my info?

Shop Pay only stores your information if you opted in during a previous purchase at a Shopify store. Your data is securely encrypted and managed by Shopify. You can view or manage your saved info by logging into Shop Pay.

Is Shop Pay the same as Afterpay?

No. Shop Pay is an accelerated checkout built into Shopify, while Afterpay is a third-party BNPL service. However, Shop Pay Installments (powered by Affirm) provides similar pay-over-time functionality directly within your Shopify store.

Final Words: Is Shop Pay Safe and Should You Use It?

Yes. Shop Pay is safe, fast, and purpose-built to increase Shopify merchant conversions without added complexity. Customer information is encrypted, stored on PCI-compliant servers, and never shared unless an order is placed. Identity verification via passkey, SMS, or the Shop app provides additional security.

From a business perspective, Shop Pay delivers high-impact benefits with minimal effort:

- Improves checkout speed

- Supports flexible payment options

- Unlocks Shop ecosystem value

- Requires no extra fees or development work

If you’re using Shopify Payments, enabling Shop Pay is a simple but strategic move that can meaningfully impact your bottom line.

Ready to optimize your checkout experience? Contact LitOS to get the most out of Shop Pay and your entire Shopify store.