In the world of online payments, Stripe and Shopify Payments have emerged as two leading contenders. As businesses increasingly rely on eCommerce, choosing the right payment gateway becomes crucial.

Stripe vs Shopify Payments offer reliable online payment solutions, each with strengths and target audiences. The decision between Stripe and Shopify Payments depends on your specific business needs, technical capabilities, and preferences.

Stripe is more suitable if you value customization, technical control, and extensive global coverage. On the other hand, if you prioritize simplicity, seamless integration within the Shopify ecosystem, and user-friendly interfaces, Shopify Payments can be a strong contender. Consider evaluating these key differences and assessing which factors align best with your requirements to make an informed decision for your online payment processing solution.

In this article, LitExtension – #1 Shopping Cart Migration Expert will compare Shopify Payments vs Stripe to determine which one is better suited for your business. By understanding the strengths and limitations of each payment processor, you can make an informed decision that optimizes your payment processing capabilities and enhances your online business’s success.

This article will give you detailed comparison of 8 factors:

- Ease of use

- Pricing and transaction fees

- Payout time

- Chargebacks rate

- Countries available

- Customization and configuration

- Fraud protection

- Customer support

Now, let’s dive in!

Shopify Payments vs Stripe: 8 Key Differences

Stripe and Shopify Payments are both reliable online payment solutions, each with its own set of advantages and target audience. To make an informed decision about which platform is better suited to your needs, it’s important to consider several key differences between the two.

Let’s dive into an in-depth comparison of Stripe and Shopify Payments in eight crucial areas:

Ease of use

- Stripe: Stripe is known for its developer-friendly environment, providing robust APIs and extensive documentation. It offers flexibility and customization options, making it ideal for businesses with technical expertise or those requiring more control over their payment processes. However, it may have a steeper learning curve for users without coding knowledge.

- Shopify Payments: Shopify Payments is user-friendly and accessible, particularly for merchants operating on the Shopify eCommerce platform. It offers a seamless integration experience, allowing users to set up and manage payments directly within their Shopify store. Shopify Payments requires minimal technical knowledge, making it an ideal choice for beginners or non-technical users.

Verdict: Shopify Payments is the winner thanks to its user-friendly and intuitive setup process.

Pricing and transaction fees

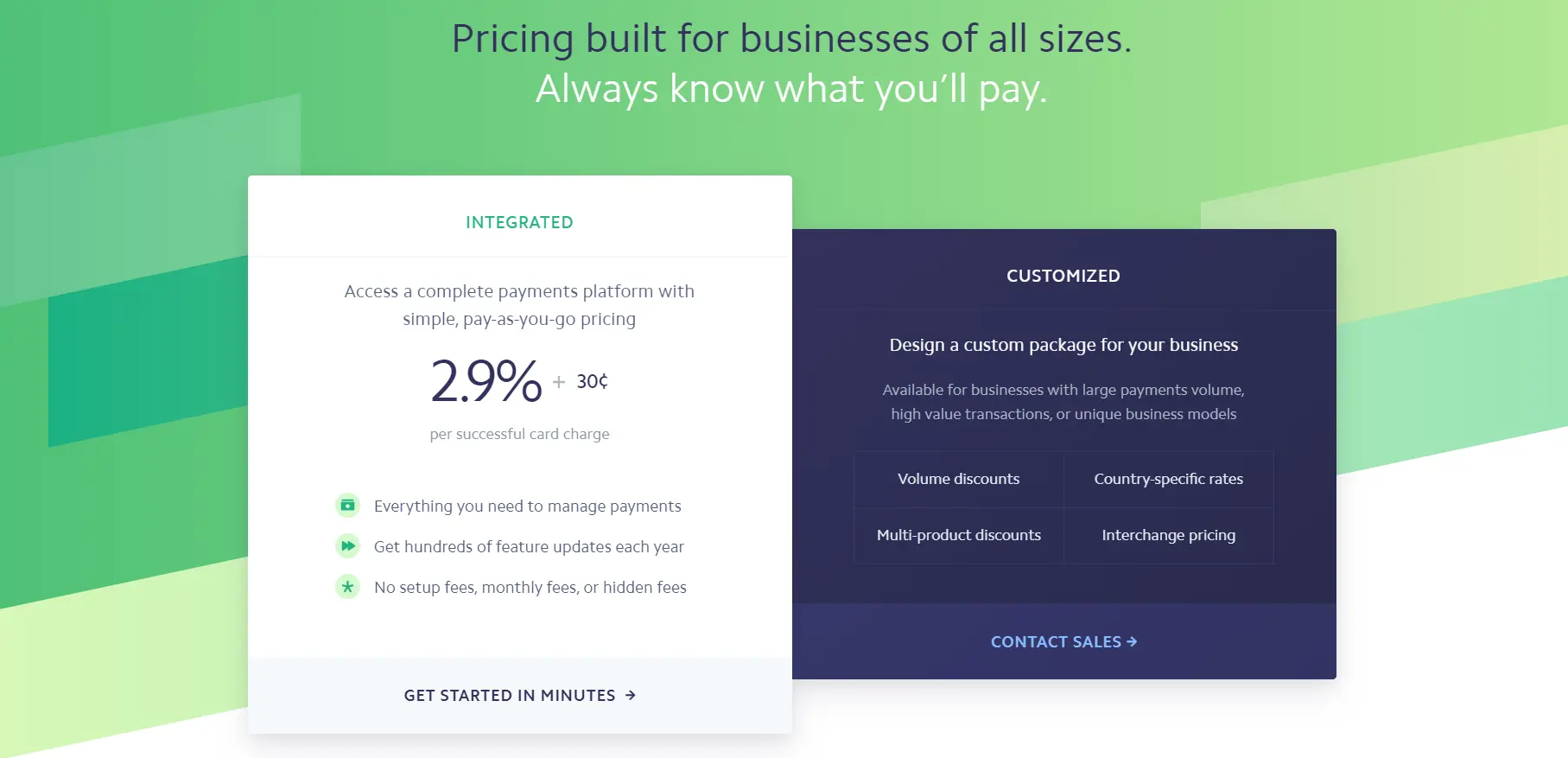

- Stripe: Stripe doesn’t charge a subscription fee but imposes transaction fees based on the payment type. For online debit and credit card payments, the fee is 2.9% plus $0.30 per transaction, while in-person payments incur a fee of 2.7% plus $0.05 per transaction. Additional fees apply for international card payments, local payment methods, ACH direct debit, ACH credit, and as online invoicing software for small business.

Let’s read the article about Stripe fees to understand more about it.

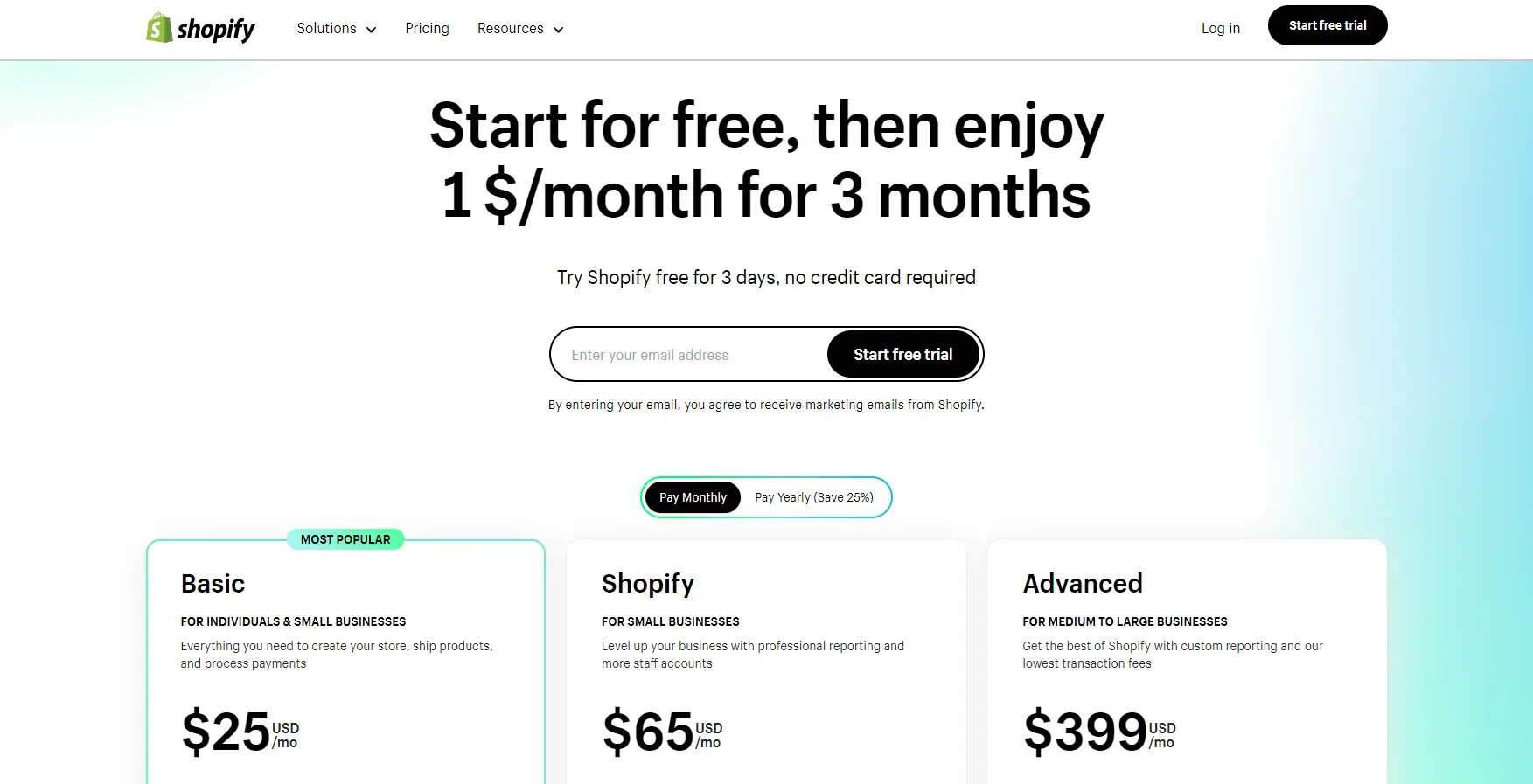

- Shopify Payments: Shopify Payments follows a two-tier pricing structure consisting of a monthly subscription fee and transaction fees. Shopify Payments’ subscription fees range from $25 per month for Basic Shopify to $399 per month for Advanced Shopify. Transaction fees vary between 2.6% to 2.9% plus $0.30 per transaction for online payments, and 2.4% to 2.7% for in-person transactions. Advanced Shopify has the lowest transaction fees across the board.

However, you can now start a Shopify store and enjoy Shopify at the cost of $1 per month for the first 3 months.

Verdict: In terms of Shopify vs Stripe pricing, Shopify Payments is advantageous because you only pay a predictable monthly fee structure tied to the selected Shopify plan. With Stripe, you need to pay extra transaction fees (0.5%-2%).

Payout time

- Stripe: Stripe offers flexible payout options, allowing businesses to customize their payout schedules. By default, funds are transferred to the connected bank account on a rolling basis with a two-day delay. However, Stripe also provides options for faster payouts, such as instant payouts or manual payouts. These options may be subject to additional fees or eligibility criteria.

- Shopify Payments: Shopify Payments has a standard payout schedule for most merchants. In the United States, funds are deposited into the connected bank account within two business days. International merchants may experience longer payout times depending on their country. While Shopify Payments does not offer instant or manual payouts, the standard payout schedule is generally sufficient for most businesses.

Verdict: Within payout time, Stripe wins as it provides you with more control over your payout schedule or need faster access to funds.

Chargebacks rate

- Stripe: Stripe provides robust tools and features to help you manage chargebacks effectively. It offers real-time notifications for chargebacks, allowing you to respond promptly and provide the necessary evidence to dispute the chargeback. Stripe provides comprehensive documentation and guidelines to assist merchants in navigating the chargeback process and minimizing their impact on the business.

- Shopify Payments: Shopify Payments also offers chargeback management features to help you handle disputes. You receive notifications when chargebacks occur, and you can respond through the Shopify admin panel. However, Shopify Payments’ chargeback management may not provide the same customization and control as Stripe’s dedicated chargeback tools.

Verdict: Within Shopify Payments vs Stripe chargeback rate, Stripe is in the pros side because it provides robust tools and real-time notifications.

Countries available

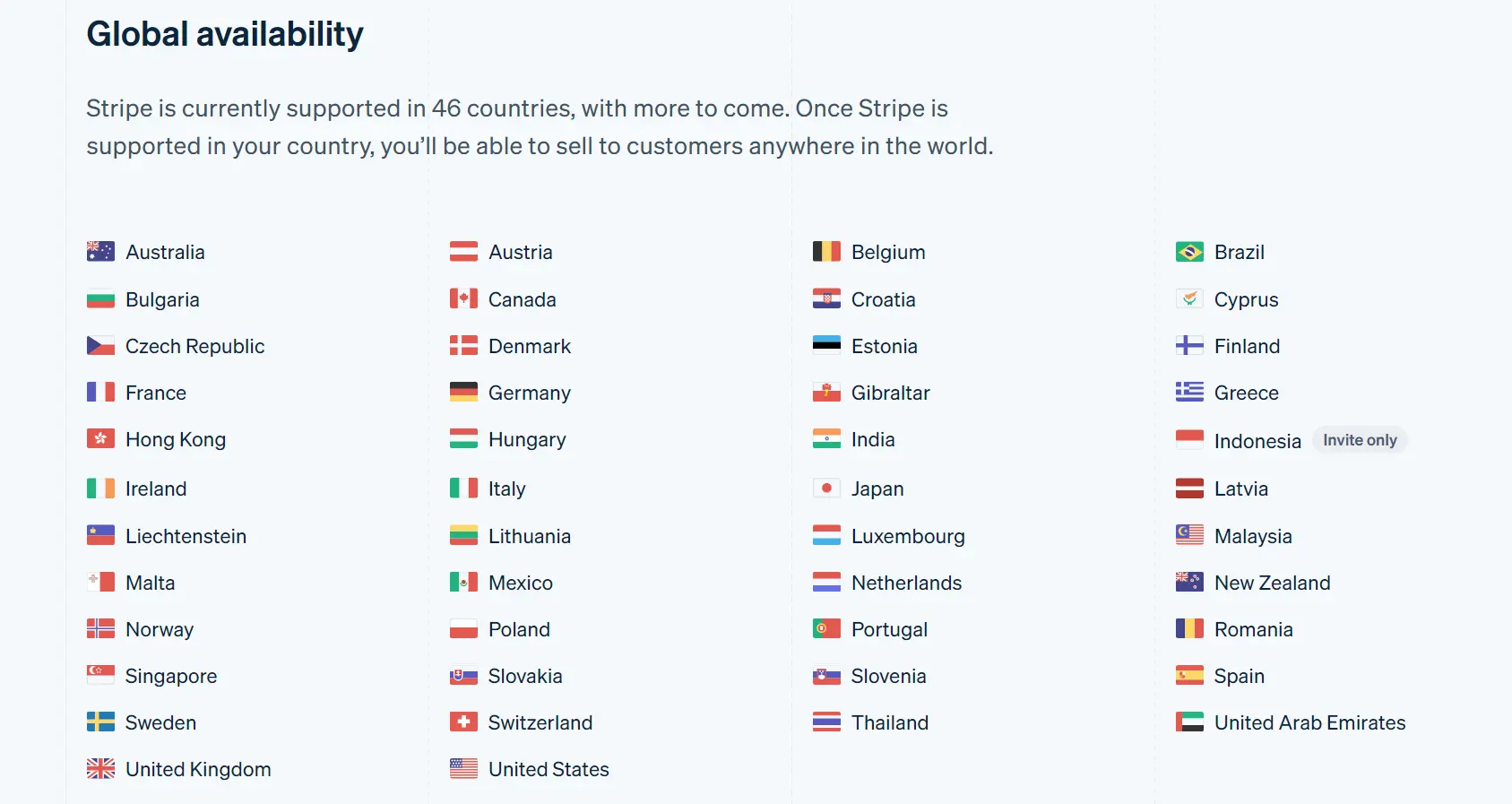

- Stripe: Stripe has a global presence and supports businesses in many countries. It is available in over 40 countries, including major markets like the United States, United Kingdom, Canada, Australia, and various European countries. Stripe’s extensive international coverage suits businesses with a global customer base.

- Shopify Payments: Shopify Payments is available in fewer countries than Stripe. It is primarily offered in countries where Shopify itself operates as a platform. As of the time of writing, Shopify Payments is available in more than 20 countries such as the United States, Canada, United Kingdom, Australia, and a few European countries. Before selecting Shopify Payments, it is essential to ensure it is available in your target market.

Verdict: In this section, Stripe wins since it offers the broader availability all over the world, which can better cater to your needs.

Customization and configuration

- Stripe: Stripe provides extensive customization options, allowing you to tailor your payment processes to your needs. With Stripe, you have greater control over the checkout experience, including creating custom payment forms, embedding payment buttons, and customizing the user interface. Stripe’s APIs and developer-friendly tools enable you to integrate and customize payment flows with ease.

- Shopify Payments: Shopify Payments prioritizes simplicity and ease of use, offering a more streamlined and user-friendly configuration process. While Shopify provides basic customization options, it is limited compared to the level of control offered by Stripe.

Verdict: When it comes to customization and configuration options, Stripe offers more flexibility and advanced capabilities compared to Shopify Payments.

Fraud protection

- Stripe: Stripe offers advanced fraud protection tools to help you mitigate the risk of fraudulent transactions. It employs machine learning algorithms and customizable rules to detect and prevent fraudulent activities. Stripe Radar, their fraud prevention tool, provides real-time risk assessments and enables you to set up custom fraud rules tailored to your specific requirements.

- Shopify Payments: Shopify Payments includes built-in fraud analysis and protection measures to help you identify and prevent fraudulent transactions. It utilizes data-driven algorithms to flag suspicious activities and provides a fraud analysis dashboard for monitoring and managing potential risks. While Shopify Payments offers fraud protection, it may not have the same customization and granularity as Stripe’s dedicated fraud prevention tools.

Verdict: Regarding Stripe vs Shopify Payments fraud protection, the winner is Stripe thanks to its advanced fraud protection and customizable fraud rules.

Customer support

- Stripe: Stripe provides customer support primarily through email and a self-service knowledge base. While they offer assistance for technical issues and payment-related inquiries, the level of support may vary depending on the plan and user status. Access to phone support is available if you choose higher-tier plans or specific requirements.

- Shopify Payments: Shopify offers customer support through multiple channels, including 24/7 live chat, email, and phone support. They provide dedicated support for Shopify Payments, ensuring prompt assistance for payment-related inquiries and issues. The availability of round-the-clock support makes it convenient for businesses with time-sensitive concerns.

Verdict: As for Stripe vs Shopify Payments customer support, Shopify Payments is better than Stripe because it allows you to access to comprehensive 24/7 customer support.

Other articles about Stripe and Shopify Payments you may like to read:

- How To Test Shopify Payments?

- Shopify Payments Review & Set up in 4 Steps

- How To Add Stripe For Shopify?

Shopify Payments vs Stripe: Which One Should You Use?

Both Shopify Payments vs Stripe offer reliable online payment solutions, each with its own strengths and target audience. Consider the situations below to determine which platform is better for your business.

When to use Stripe?

Go for Stripe payment if you:

- Have specific customization needs and require a developer-friendly environment.

- Prioritize flexibility and control over your payment processes.

- Have high transaction volumes and prefer a transparent pay-as-you-go pricing model.

- Need advanced fraud protection tools and customizable fraud rules.

- Operate globally and require extensive coverage in multiple countries.

- Have technical expertise or access to developers for seamless integration.

- Prefer self-service support and have specific technical inquiries.

- Need faster payout options or more control over your payout schedule.

When to use Shopify?

Select Shopify Payments as your Shopify payment gateway if you:

- Are already using the Shopify eCommerce platform for your online store.

- Prioritize simplicity and a user-friendly interface.

- Want a seamless integration experience without needing third-party payment gateways.

- Value built-in fraud analysis and basic fraud protection measures.

- Prefer a straightforward pricing model tied to your Shopify plan.

- Require 24/7 customer support and round-the-clock availability.

- Operate in countries where Shopify Payments is available and don’t require extensive global coverage.

- Prefer a hassle-free payment solution.

Shopify Payments vs Stripe: FAQs

[sp_easyaccordion id=”61783″]