Shopify Transaction Fees Explained: What You’ll Actually Pay Per Sale

When you sell on Shopify, understanding Shopify transaction fees helps you know exactly how much profit you keep from each order. These fees depend on your Shopify plan and the payment method you use, and they can directly affect your real earnings.

In this guide, you will learn:

- What Shopify transaction fees are and how they differ from credit card processing fees

- How fees vary by plan and which plan gives you better value

- How to calculate the amount deducted from each sale

- Simple ways to reduce or avoid Shopify transaction fees

This guide is designed to help current and future Shopify users see clearly how much Shopify charges per sale and how to keep more of their revenue.

What Are Shopify Transaction Fees?

Before you compare plans or payment setups, it’s essential to understand how Shopify transaction fees actually work. These fees are part of your total cost of selling on Shopify and can vary depending on how you process payments.

Understand Shopify transaction fees

Shopify transaction fees are the percentage Shopify charges when your store uses a third-party payment provider instead of Shopify Payments. These fees cover the cost of maintaining a secure checkout and integrating with external gateways such as PayPal, Stripe, or Authorize.net.

These deductions are made automatically from each sale before the remaining balance is transferred to your account.

Transaction fees vs credit card processing fees

As said above, Shopify charges two main types of fees when you process a sale: transaction fees and credit card processing fees. They are often confused, but they apply in different situations and serve different purposes.

| Transaction fee | Credit card processing fee | |

| When it applies | When you use a third-party gateway such as PayPal, Stripe, or Authorize.net | When you use Shopify Payments to process credit or debit cards |

| Who charges it | Shopify | Shopify |

| What it covers | The cost for Shopify to support and connect to an external payment provider | The cost of processing card payments through Shopify Payments |

| Rate range | Varies by plan, usually 0.5% → 2% | Varies by plan, usually 2.9% + 30¢ → 2.5% + 30¢ |

The important takeaway is simple:

- If you use Shopify Payments, you only pay the credit card processing fee.

- If you use a third-party gateway, you pay both fees: the Shopify transaction fee and your provider’s own processing fee.

When Shopify applies transaction fees

Shopify only charges transaction fees in specific cases. You’re charged transaction fees when:

| Scenario | Explanation |

| Using a third-party payment provider | Shopify applies transaction fees on every order processed through gateways other than Shopify Payments, such as PayPal, Stripe, or Authorize.net. |

| Using store credit or gift cards (for newer stores) | Stores created on or after May 12, 2025 pay transaction fees on the portion of any order paid with store credit or gift cards, even if Shopify Payments is enabled. Example: If a customer pays $50 by card and $10 with store credit, fees apply only to the $10 portion. |

You’re not charged transaction fees when:

- You use Shopify Payments, Shop Pay, Shop Pay Installments, PayPal Express Checkout, or manual payment methods (cash, COD, bank transfer).

- POS orders are processed.

- Draft orders marked as paid or pending are processed.

- Shopify Plus stores using Shopify Payments as their main gateway have transaction fees waived for all payment methods, including store credit and gift cards.

A clear understanding of Shopify transaction fees helps you see your real costs and choose the best payment setup for your store.

In addition, offering digital wallets like Apple Pay can reduce abandoned checkouts, and it also affects what you pay per order. When you enable Apple Pay on Shopify, all Apple Pay transactions are processed through Shopify Payments, which means they follow Shopify’s standard card-processing rates with no extra Apple Pay surcharge. If you’re using an external payment provider, Apple Pay is not available and you’ll incur additional Shopify transaction fees instead, making it more cost-efficient to enable Apple Pay on Shopify through Shopify Payments.

Shopify Transaction Fees by Plan

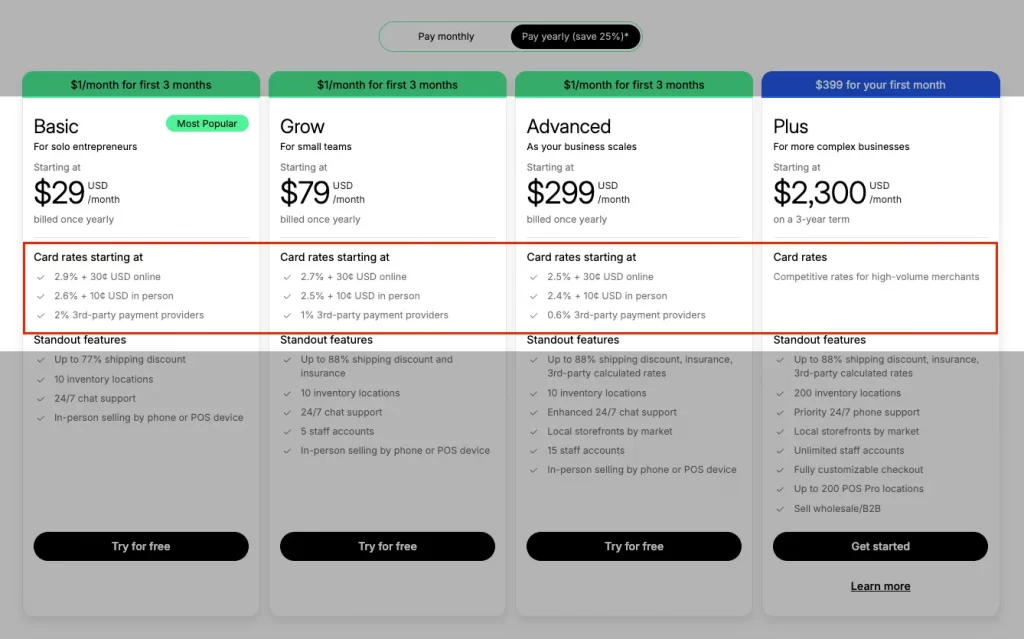

Shopify’s transaction fees depend on the subscription plan you choose. Higher plans offer lower fees per sale, which means your overall cost decreases as your store grows. Below is a clear comparison of transaction and credit card fees for each plan.

| Shopify Plan | Online credit card rate (Shopify Payments) | In-person rate | Additional transaction fee (if NOT using Shopify Payments) |

| Basic | 2.9% + 30¢ | 2.6% + 10¢ | 2.0% |

| Grow | 2.7% + 30¢ | 2.5% + 10¢ | 1.0% |

| Advanced | 2.5% + 30¢ | 2.4% + 10¢ | 0.6% |

| Plus | Custom rates (typically from ~2.15% + 30¢) | Custom | 0.15% |

1. Basic plan

Best for solo entrepreneurs or new stores starting online. You’ll pay 2.9% + 30¢ per online sale through Shopify Payments, or 2.0% extra per transaction if you use a third-party gateway. This plan keeps costs simple while you build early traction.

2. Grow plan

This plan is ideal for small teams or growing stores. Rates drop to 2.7% + 30¢ online and 1.0% for third-party gateways. This tier fits merchants processing regular monthly orders who want to retain more profit per transaction.

3. Advanced plan

This Shopify pricing tier is designed for scaling businesses with higher order volumes. You’ll pay 2.5% + 30¢ online or 0.6% for third-party gateways. These lower fees can lead to meaningful savings for stores handling large monthly revenue.

4. Shopify Plus

This plan is built for enterprise-level or high-growth brands. Shopify Plus offers custom-negotiated credit card rates (starting around 2.15% + 30¢) and a 0.15% transaction fee for external gateways. It’s designed for large operations needing advanced checkout control, faster processing, and deeper integration flexibility.

From our experience working with growing Shopify stores, moving up to a higher plan can make a real difference in what you keep from each sale. Once you switch to Shopify Payments, you stop paying extra transaction fees and start keeping more of your hard-earned revenue.

How to Calculate Your Total Shopify Fees per Transaction

To find out how much you actually earn from each sale, start by calculating your transaction and processing fees together. Let’s begin by knowing two pieces of information:

- Your Shopify plan rate (for example, 2.9% + 30¢ on the Basic plan).

- Whether you use Shopify Payments or a third-party gateway.

If you use a third-party gateway, remember to include the extra transaction fee (for example, 2% on Basic).

1. Using Shopify Payments

If you use Shopify Payments, you only pay the credit card processing fee and no additional transaction fee.

Formula: Total Fees = (Order Amount × Processing Rate) + Fixed Fee

Example: A $100 order on the Basic plan (2.9% + $0.30)

→ (100 × 2.9%) + 0.30 = $3.20 total fee

You keep $96.80 after fees.

2. Using a third-party payment provider

If you use an external gateway like PayPal or Stripe, Shopify charges an additional transaction fee on top of the provider’s processing fee.

Formula: Total Fees = Credit Card Processing Fee + Shopify Transaction Fee

Example: A $100 order on the Basic plan with a 2% Shopify transaction fee.

→ PayPal fee ≈ $3.00

→ Shopify fee = $100 × 2% = $2.00

→ Total = $5.00 in fees

You keep $95.00 after fees.

Even small differences add up over hundreds of transactions each month, which is why choosing the right plan and payment method makes a big impact on your profit margin.

To see the exact fees for any order, open your Shopify admin and go to Settings → Payments → View payouts. You can check a detailed breakdown of both processing and transaction fees for every sale.

How to Avoid or Reduce Shopify Transaction Fees

Shopify transaction fees are a normal part of doing business online, but you can easily lower or even eliminate them with the right setup. Here are four proven ways to reduce your costs and keep more of your earnings.

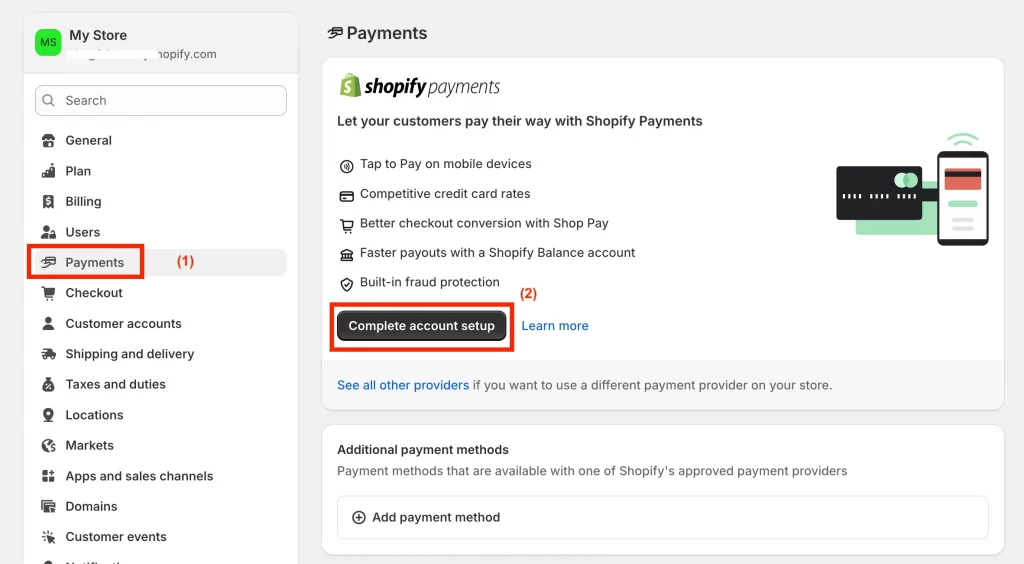

1. Activate Shopify Payments

If your business is based in a country that supports Shopify Payments, this is the easiest and most effective way to remove transaction fees. When you use Shopify Payments, you only pay the standard credit card processing rate, and Shopify completely waives the additional transaction fee.

If you are still using PayPal, Stripe, or another external provider, switching to Shopify Payments can instantly save up to 2% per sale, depending on your plan. You can activate it in your Shopify admin under Settings → Payments.

2. Choose the right plan for your sales volume

As your business grows, upgrading your plan can significantly lower your per-sale rate. For example, a store earning $10,000 per month could save over $100 per month just by moving from Basic to Grow.

You should review your average monthly sales and fee percentage to find the point where upgrading becomes more cost-effective. The savings usually outweigh the higher subscription cost once your sales volume increases.

3. Minimize use of third-party gateways

If you accept payments through external gateways, Shopify charges an additional transaction fee on top of the provider’s rate. To reduce this cost:

- Use Shopify Payments for most orders.

- Keep third-party gateways only if required for specific customers or markets.

- Offer popular options like Shop Pay and Shop Pay Installments, which are included under Shopify Payments and have no extra fee.

4. Monitor chargebacks and refund patterns

Chargebacks and frequent refunds can add hidden costs to your payment processing. You can track these metrics in your Shopify admin → Orders → Risk analysis to identify recurring issues such as unclear product descriptions or slow shipping times.

As you can sê, a quick review of your checkout and payment methods can reveal easy wins that save you money every month.

Bonus: Additional Shopify Fees to Know

Beyond transaction and processing fees, Shopify has a few other charges that can affect your total cost per sale. Most of these depend on how and where you sell, but it’s useful to know what they cover so you can plan ahead.

Here’s a quick overview of what they are, when they apply, and how to manage them.

| Fee type | When it applies | Typical rate or amount | How to manage it |

| Currency conversion fee | When selling in multiple currencies | 1.5% of the order value | Use local currency payouts where possible |

| Chargeback fee | When a customer disputes a transaction | $15 USD per chargeback | Reduce disputes with clear policies and proof of delivery |

| App and subscription fees | For paid apps, themes, or services in your store | Varies by app or service | Audit apps monthly and remove unused ones |

| Shipping and duty fees | When using Shopify Shipping or duties calculator | 0.5% (for duties) or based on carrier rates | Review carrier options and automate shipping rules |

If you sell in multiple currencies, enable local payouts where possible. This move helps you avoid extra currency conversion fees.

Shopify Transaction Fees: FAQs

What’s the difference between Shopify transaction fees and credit card fees?

Shopify transaction fees per sale are charged only when you use a third-party payment provider instead of Shopify Payments. Credit card fees are charged for processing card payments through Shopify Payments and apply to every sale.

Why does Shopify charge transaction fees?

Shopify charges these fees to cover the cost of securely processing payments through external gateways and maintaining reliable checkout integrations.

How do I avoid Shopify transaction fees?

You can activate Shopify Payments. When you use Shopify’s built-in payment gateway, the extra transaction fee is completely removed, and you only pay the standard credit card processing rate.

Who pays the transaction fee on Shopify?

The merchant pays the transaction fee, not the customer. It’s automatically deducted from each sale before your payout is sent.

Does Shopify charge you for every transaction?

Yes, every sale processed through your store includes either a credit card fee (if you use Shopify Payments) or both a credit card fee and a transaction fee (if you use a third-party gateway).

Final Takeaway

Shopify fees can look complicated at first, but once you understand how they work, it becomes clear where your money goes and how to save more from each sale. The best place to start is with Shopify Payments, which removes extra transaction fees completely.

As your business grows, upgrading your plan and reviewing your payment setup regularly can make a real difference to your bottom line.

Build a Shopify store that’s efficient, polished, and ready to scale!

At LitOS, we help merchants set up and design Shopify stores that stand out and perform smoothly. From layout planning and theme customization to launch-day setup, our team ensures your store looks professional and works perfectly from the start.