Running a Shopify business is not an easy task, especially when it comes to managing your store’s finances. That’s when Shopify Balance, the company’s money management account, comes to the rescue. The question is, will it be the best option for you?

In today’s article LitExtension, the #1 Shopping Cart Migration Expert, will answer the question for you by going through the following key points:

- A quick summary of Shopify Balance

- How Shopify Balance works

- Detailed Shopify Balance reviews

- How to set up a Shopify Balance account

Let’s wait no more and get right into it!

A Glance At Shopify Balance

What is Shopify Balance?

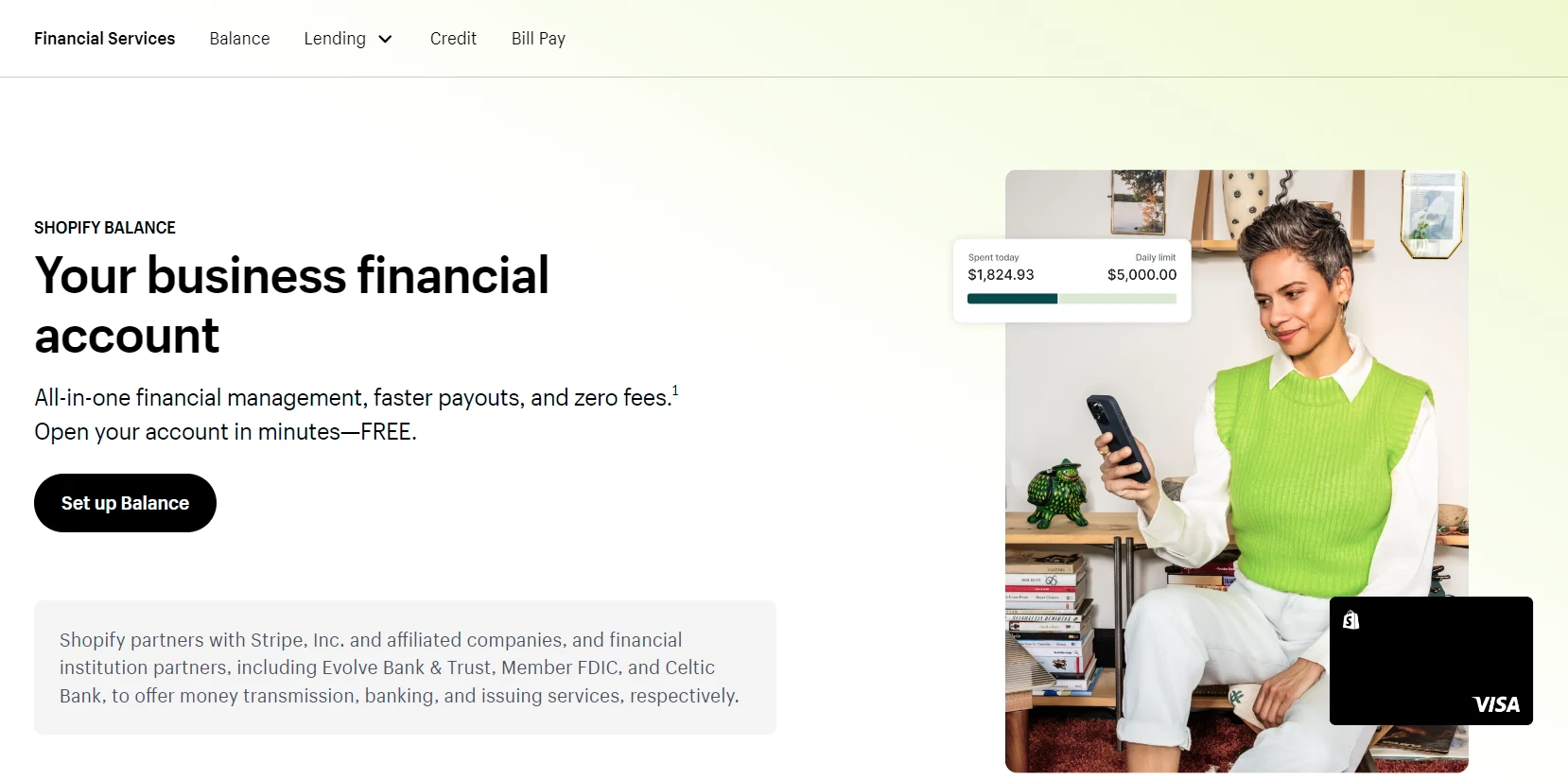

In 2020, Shopify first unveiled Shopify Balance, one of the leading financial value-added Shopify services designed for small and medium enterprises (SMEs). This is a money management account developed to improve how eCommerce merchants handle finance-relating problems.

Once you own a Shopify Balance account, you can easily manage your store’s transactions from one place. This solution can also help you earn cashback and get excellent partner offers through card spending.

Shopify Balance Pros And Cons

So what’s the point of using Shopify Balance?

Indeed, the biggest advantage of using this Shopify solution is that you can save more effort to complete transactions than traditional banks’ support.

Shopify Balance doesn’t charge transaction fees for collecting or receiving payments like traditional banks. Also, you can have a Shopify Balance login online instead of using the in-person application (e.g., paperwork), which greatly optimizes your time.

More impressively, the solution can help you earn up to $2,000 annually and many rewards. These programs are barely available in traditional banks.

If you want to have a quick consideration of Shopify Balance, here’s a recap of its pros and cons:

[wptb id=71129]How Does Shopify Balance Work?

Since Shopify Balance is the free business financial account built right into your Shopify store’s admin, it will cover:

- Balance Account: A one-stop shop powered by an intuitive dashboard where you can easily track your store’s cash flow, expenses, and bills. More importantly, you don’t need to pay a fee or have a minimum balance.

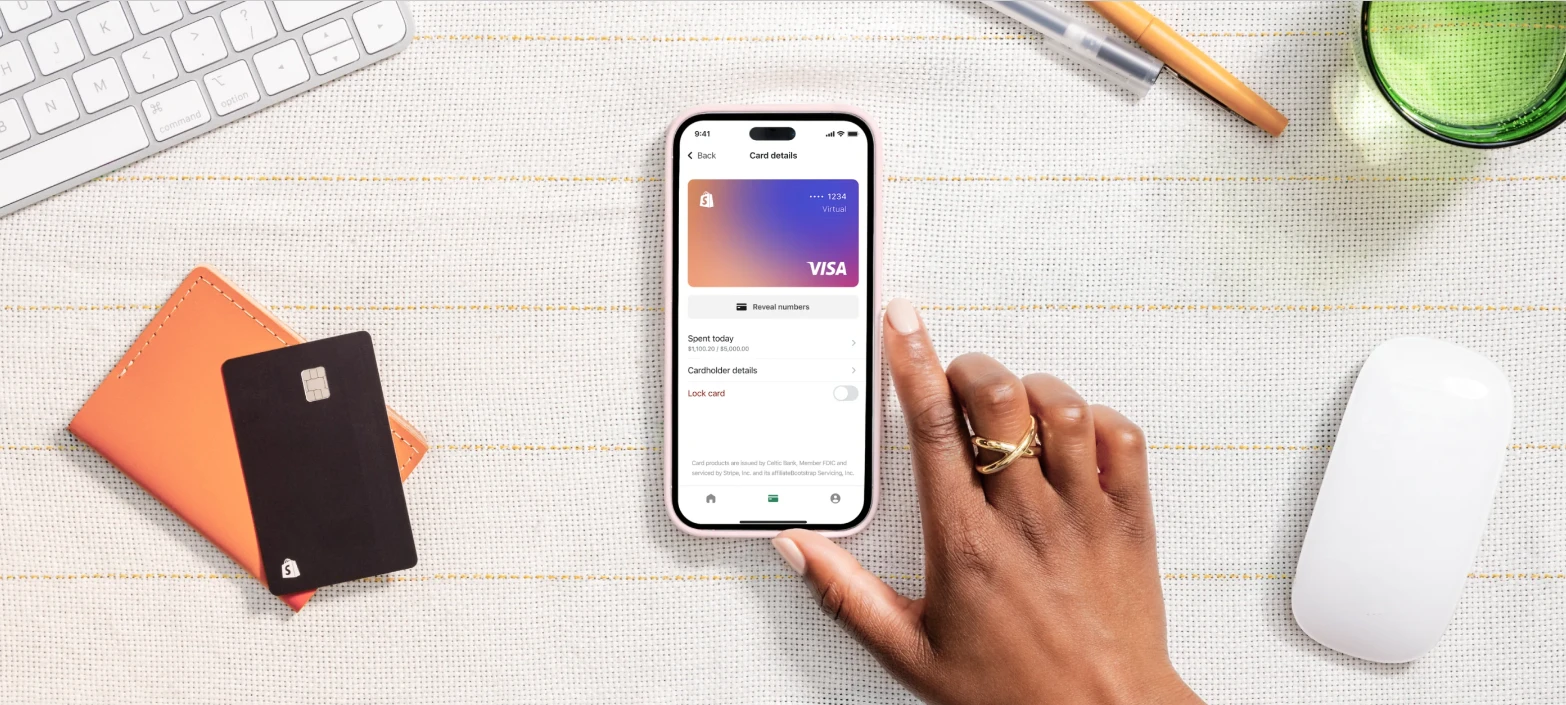

- Balance Card: An outstanding feature that helps you to control the expenses of operating your business. Your virtual card will be activated once you complete your Shopify store’s establishment. Plus, you can register for a physical card if necessary.

- Rewards: Depending on your daily business spending, you can receive various offers from the partners, like discounts or cashback.

Shopify Balance: Detailed Reviews

#1. Pricing

As previously mentioned, you don’t need to pay any monthly fee to maintain a Shopify Balance account. There is no transfer, hidden, or even ATM fees either. Additionally, Shopify doesn’t charge you any ATM withdrawal fees, yet ATM providers might charge you some.

To get started with Shopify Balance service, you have to register for one of the following Shopify pricing plans:

- Starter: $5/month.

- Basic Shopify: $39/month.

- Shopify: $105/month.

- Advanced Shopify: $399/month.

Note: Shopify Balance is not available for all eCommerce merchants. Here’s a list of requirements you need to satisfy to activate your Shopify Balance account:

- Have stores located in Puerto Rico or the United States.

- Set up Shopify Payments or sign up for Balance during the Shopify Payment registration process.

- Use a valid US Social Security Number (SSN).

- Have a legal representative with a physical personal address in Puerto Rico or the United States.

- Use a single account owner to manage Shopify Payment.

- Register for any Shopify plan other than Shopify Plus.

- Ensure merchants’ business does not belong to Stripe’s Prohibited and Restricted Businesses.

- Submit all documents related to partner institutions (SSN, mobile number, etc.) throughout the setup procedure.

- Always follow additional Shopify Balance terms and documents.

#2. Ease of use

Indeed, the Shopify Balance account works much like a bank account; however, it focuses on the Shopify owners’ values. You can easily control everything from one central dashboard, such as:

- Directly manage sales revenues and business expenses;

- Check financial statements and cash flow insights;

- Easy to filter relevant information;

- Make purchases and earn rewards.

However, Shopify Balance doesn’t have multi-store support, which might be a big challenge to growing the business. That’s why this financial solution is not an optimal option for cross-channel merchants or large enterprises.

#3. Integration & Compatibility

Shopify Balance allows third-party app integration without the need for advanced requirements. This can make your financial management effective, as well as save your effort.

That said, you can not directly connect to third-party apps. It required the support of Plaid, a powerful app page. In compensation, Shopify established an easy integration for this requirement. By that, you can have your Shopify Balance account connected to other apps immediately.

Below are several outstanding solutions you should consider for your Shopify Balance account, including:

- Mobile banking: MoneyLion, Varo, Chime, and M1 Finance.

- Saving and investing: Acorns, Oportun, Qapital, and Ellevest.

- Financial health: Rocket Money, YNAB, Copiliot, and Albert.

- Lending services: SoFi, Avant, Figure, and Petal.

- Payments for relatives: Wise, Mental, Venmo, and WorldRemit.

- Business performance improvement: Fundbox, Wave, Bench, and Expensify.

On top of that, you can easily install the Shopify Balance app on your mobile devices for flexible use. Currently, Shopify allows you to run this app on both iOS and Android, which is beneficial for your setups.

#4. Rewards

When signing up for Shopify Balance, you will surely impressed by how it offers rewards to merchants. Basically, this solution provides the 3 types of rewards, including:

- Annual Percentage Yield (APY)

It is estimated based on the amount of money in your Shopify Balance account. To receive the Shopify Balance APY rewards, your account must be open and in good status. More importantly, you need to ensure your store strictly follows both Shopify and Shopify Balance’s required terms.

Normally, you will get the APY reward monthly, which is paid out directly into your Shopify Balance account. Keep in mind that the APY rate can change constantly without notice. If so, let’s visit the Shopify admit for a detailed check.

Note: You will receive the APY reward on the 5th of the next month. If this day is on a holiday or weekend, the reward will be transferred into your account on the next business day.

- Partner offers

You can receive exclusive partner rewards through business spending cards, including virtual and physical. The more transactions you have with third-party partners, the more rewards you will get. These rewards can be used as high-valued discounts to optimize your Shopify store’s budget.

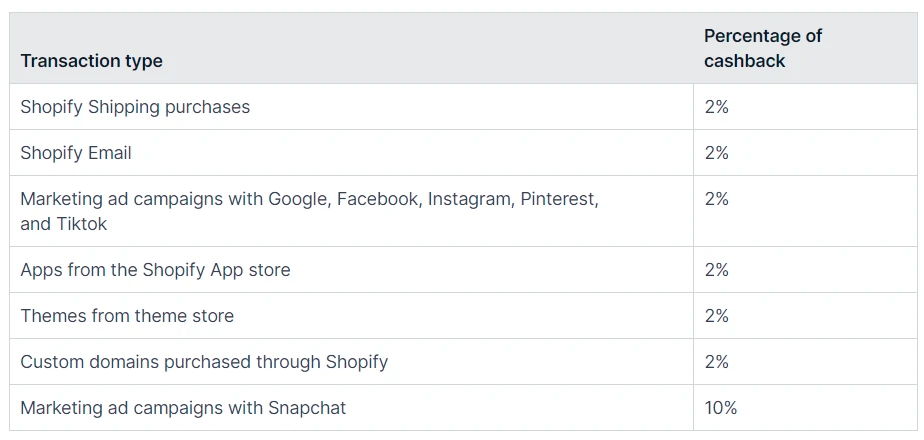

- Cashback

Whenever you make an eligible Shopify payment with your Shopify Balance card, you will get a cashback (2%-10% per transaction) into your account. The total amount of cashback is not over $2,000/year.

However, to get this reward, you need to set your Shopify Balance card as a primary payment method.

Note: You can not receive cashback rewards with purchases using ACH transfers.

#5. Card spending

After logging into Shopify Balance, your virtual card will be automatically activated. To use a physical card for your Shopify store, you need to have a request/ order from Shopify. These cards also allow you to withdraw funds from ATMs at no cost. Nevertheless, as said, you might have to pay transaction fees to ATM providers.

As mentioned above, card spending on Shopify Balance helps you earn cashback rewards. That’s why this Shopify money management solution is a more impressive solution compared to traditional banks.

#6. Customer support

When it comes to the Shopify Balance account review, it will be a mistake if we do not touch on Shopify’s customer service. Thanks to its 24/7 service, you can easily contact the Shopify professional team for any problem at any time.

Additionally, Shopify provides a wide collection of instruction resources available online, including handbooks, videos, common questions, and so forth. If you find these documents difficult to use, you can join the Shopify community board to get useful tips from experts.

How To Set Up Shopify Balance

After understanding how Shopify Balance works and its trump card, it’s time to start learning how to set up this system to manage your store’s financial budget.

#1. Shopify Balance account

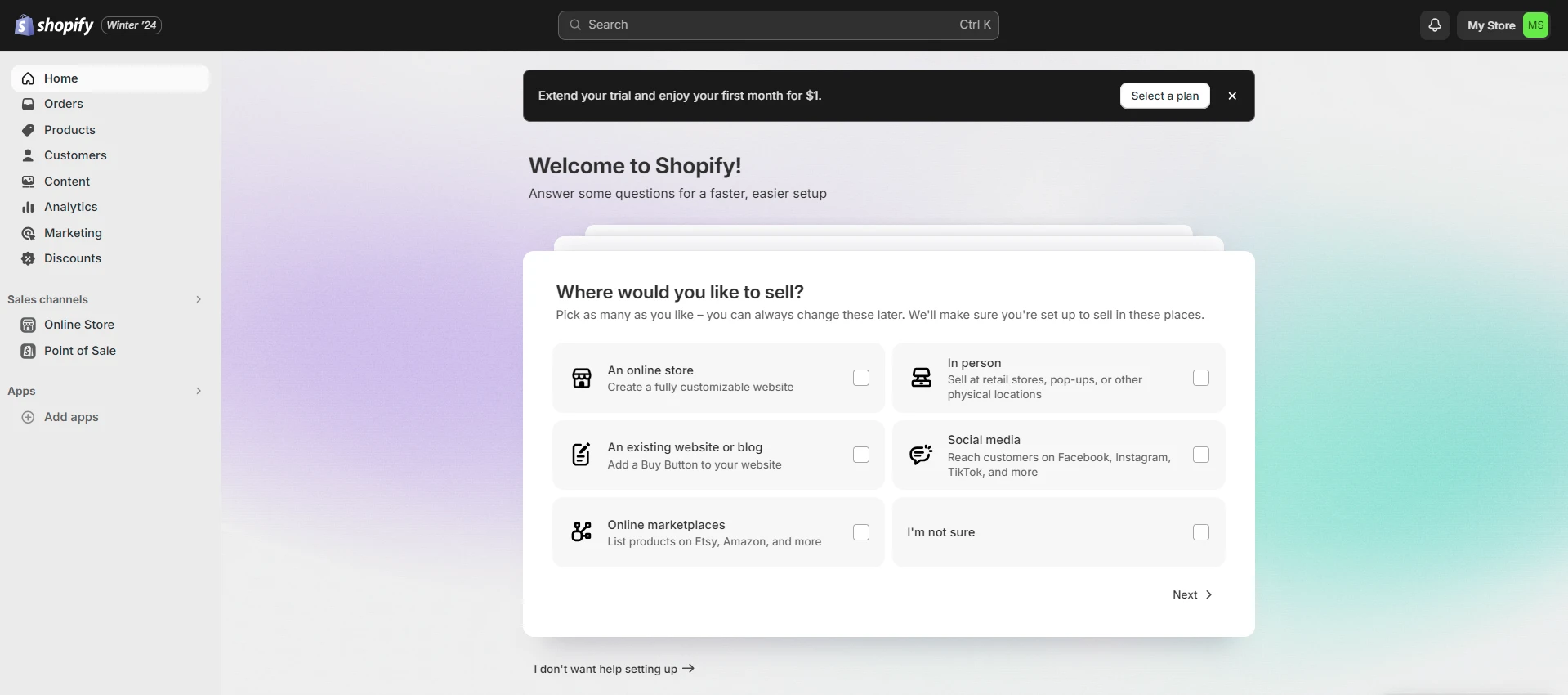

Here are the steps to sign up for a Shopify Balance account:

- In your Shopify admin, click Finances and select Balance.

- Then, click Open account and review all Shopify Payments-relating information.

- Next, click Confirm and enter your valid SSN and mobile number.

- After that, click Confirm and check the Shopify Balance account and Shopify Balance card agreement.

- Finally, click Open account to end.

Note: You need to set up Shopify Payments first to get a Shopify Balance account and spending card.

Caution: All payouts will be deposited into your main Shopify Balance account, covering all financing from Shopify Capital. Thus, you must ensure that your account has enough funds for Shopify Capital-relating repayments or remittances. Or else, let’s change your payout account.

#2. Shopify Balance physical cards

Besides an available virtual card, you can use a physical card to optimize your Shopify Balance capabilities. If so, what can you do with this card? Here are several establishments relating to your Shopify Balance physical card.

2.1. Request card

To have a physical card order, you can follow our detailed guide below:

- In your Shopify admin, select Finances and click Balance.

- Secondly, select your main Shopify Balance account and click Order a physical card.

- Thirdly, customize your business name if necessary.

- In the final, confirm shipping information and select Order card.

Note: With your business name on the Shopify Balance card, Shopify will review everything carefully. This aims to restrict profanity, explicit, violent content, as well as copyright infringement.

2.2. Reorder card

In case your business name is not approved or there is a mistake with your card delivery, you should have a reorder. If so, refer to our instructions here:

- In your Shopify admin, click Finances and navigate to Balance.

- Then, select your main Shopify Balance account.

- Next, click the physical card in Your Balance cards.

- After that, select Order new card/ Cancel and replace.

- Finally, confirm with the Card not received and click Next to finish.

Note: You always check your shipping details in Your Balance cards to ensure you have provided exact delivery information for your Shopify Balance card shipment.

2.3. Activate card

After receiving your Shopify Balance card, you need to activate it to start experiencing the Shopify Balance service. To attain that, follow the simple steps below:

- In your Shopify admin, go to Finances and select Balance.

- Secondly, select your main account and click Activate physical card in Your Balance cards.

- Then, enter your card’s last four digits and click Next.

- Next, enter your card’s PIN and click Next.

- Following that, click Confirm for your PIN to get the confirmation code.

- Finally, enter a received code and click Activate.

Note: You can change your phone number for confirmation; however, you can only activate your card after a 24-hour change.

#3. Shopify Balance on mobile devices

If you want to use your Shopify Balance on mobile devices, you need an active Shopify Balance account and an Android/iOS-supported mobile device. This app doesn’t run on tablet devices.

To begin with, you need to download the Shopify Balance app from the AppStore or Google Play. After that, you need to do the following steps:

- First, open your Shopify Balance app and click Log in.

- Then, enter your Shopify account in the Login box.

- Finally, pick a proper store that you want to run Shopify Balance (in case you manage multi-store).

Shopify Balance: FAQs

[sp_easyaccordion id=”71127″]

Conclusion

Our blog has just introduced Shopify Balance in detail. Besides an in-depth review of its features, we also evaluate the pricing, as well as how to set up a new Shopify Balance account. Keep in mind that you can only use this service for the dollar-transferring funds.

LitExtension, the #1 Shopping Cart Migration Expert, hopes you have a wonderful experience with Shopify Balance. Check out our LitExtension Blog or join our Facebook Community Group for valuable insights.