If you’re anything like us, sales tax just gives you a huge headache and it’s constantly frustrating. But calm down, my friends! Today, LitExtension – #1 Shopping Cart Migration Expert has come to rescue all Shopify store owners with the easiest way to collect Shopify sales tax, including:

- What is Shopify sales tax?

- How to charge sales tax on your Shopify store?

- Best Shopify sales tax apps

- Why choose Shopify?

Please note that this kind of tax depends on which country and the specific location you’re in. In the scope of this article, we’re going to talk specifically about sales tax in the U.S.

Let’s get started!

Let the Experts Help You Move to Shopify!

Focus on growing your business and leave your Shopify migration in good hands with LitExtension All-in-One Migration Package. Let our Personal Assistant lift the weight of manual tasks off your shoulder and provide regular updates on how your project is going.

What is Shopify Sales Tax?

Shopify sales tax is a tiny percentage of a sale that is paid to a governing body for the sales of certain goods and services. Although tax laws and regulations are complex and can change often, you can set up Shopify to automatically handle the most common sales tax calculations.

Nonetheless, you’ve got to be aware that Shopify doesn’t file or remit the sales tax for you. You might need to register your business with your local or federal tax authority to handle your sales tax. The calculations and reports that Shopify provides should help make things easier when it’s time to file and pay your taxes.

Remember that any sales tax you collect, you technically don’t own. Shopify sales tax is typically collected from shoppers, by the seller, and then passed on to that state. One of the beauties we have being an online business is that we don’t just sell in our state locally. We sell all over the U.S and maybe around the globe. And guess what? We don’t have to pay sales tax on any sales outside of our state of residence!

That’s a completely different story when it comes to a marketplace like Amazon. Amazon has fulfillment centers and offices all around the U.S. Hence, Amazon has to charge taxes in most states in the U.S.

But luckily, for small businesses, you most likely have one location so you’re only going to collect Shopify sales tax inside your state of residence only.

Want to learn more about Shopify? Here’re some extra resources that you might like

How to Charge Sales Tax On Your Shopify Store?

If you don’t collect Shopify sales tax when you should, you’ll have to pay that sales tax out-of-pocket if the state comes after you. And you may owe some penalty fees. With this in mind, let’s learn how to set up taxes on Shopify.

Setting Shopify tax calculation is just an easy pie if you follow these basic steps.

1. Tell Shopify Where to Collect Sales Tax

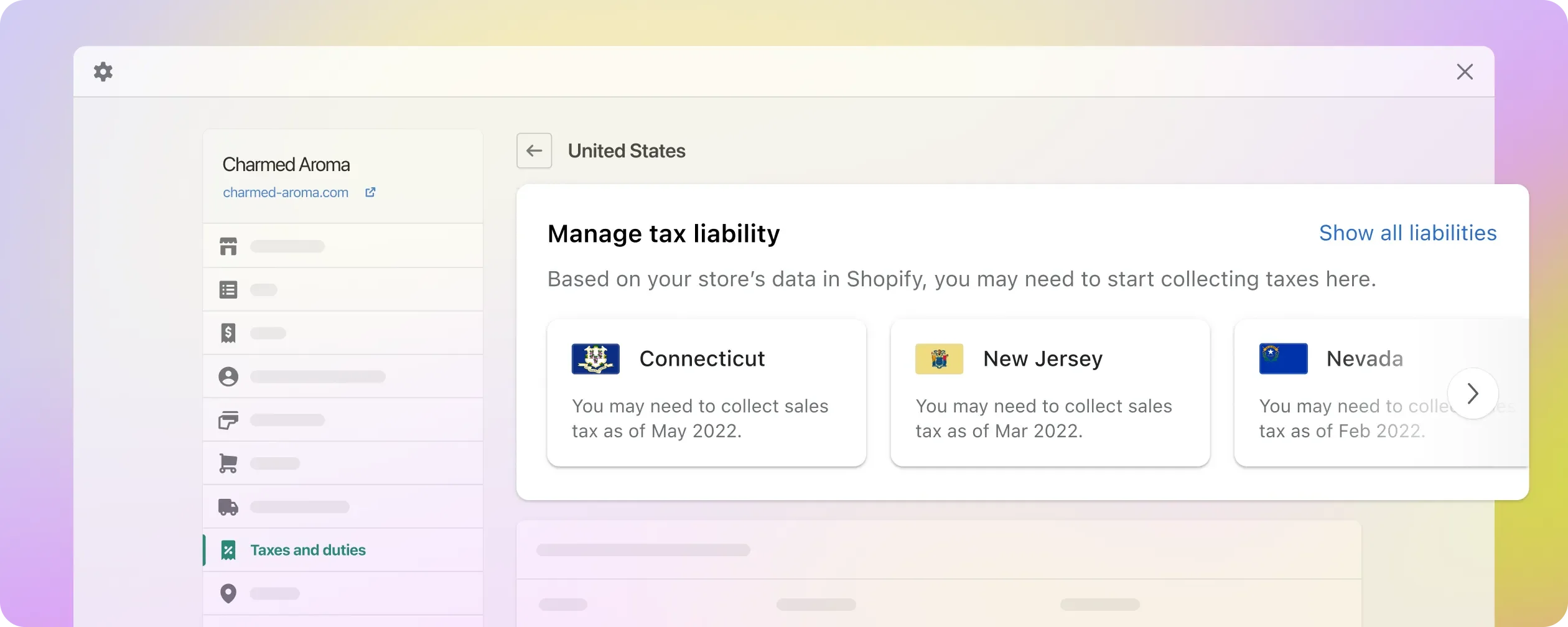

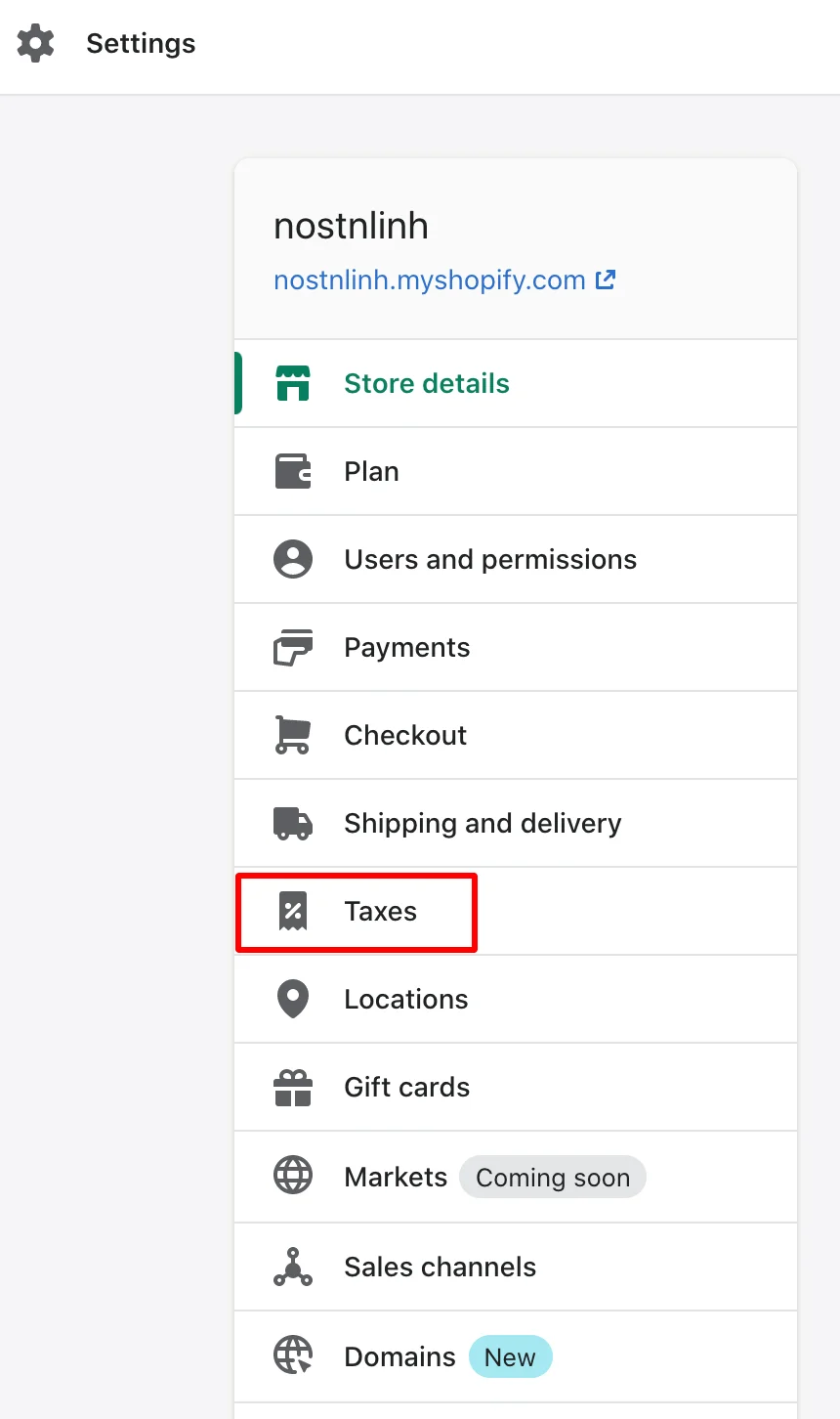

First off, you need to tell Shopify in which state it should collect sales tax from shoppers. On the homepage, click Settings, then choose Taxes.

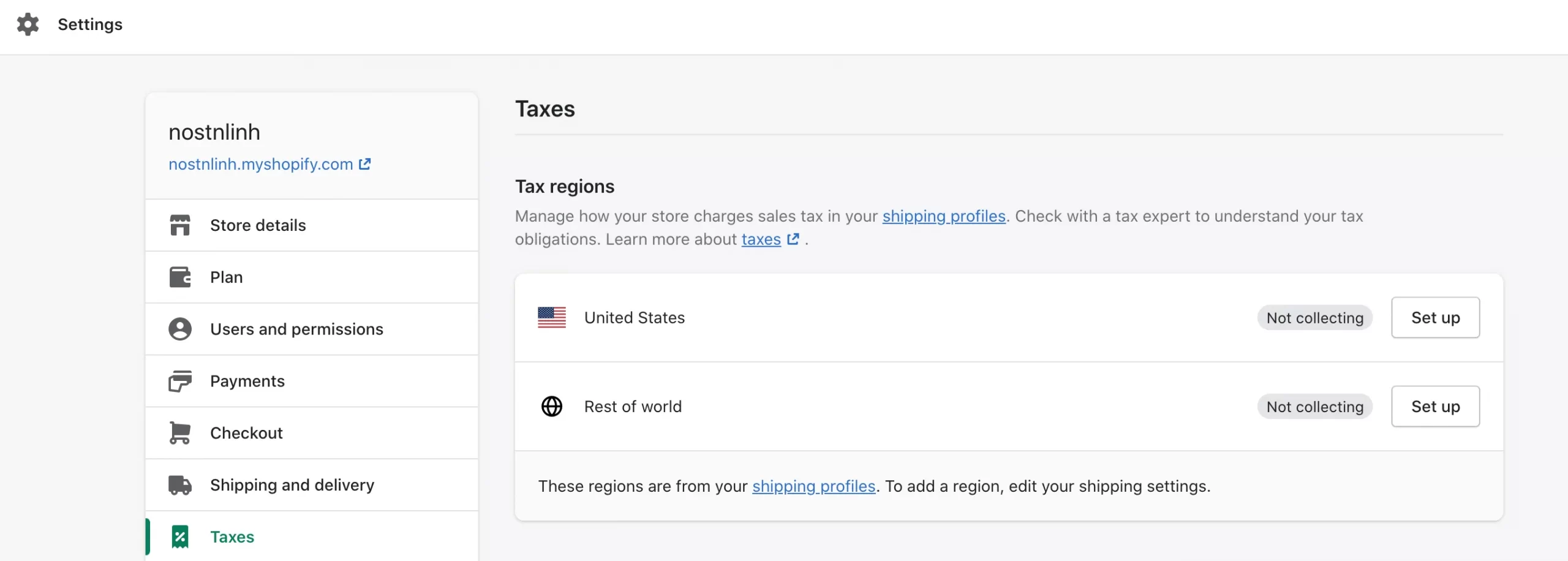

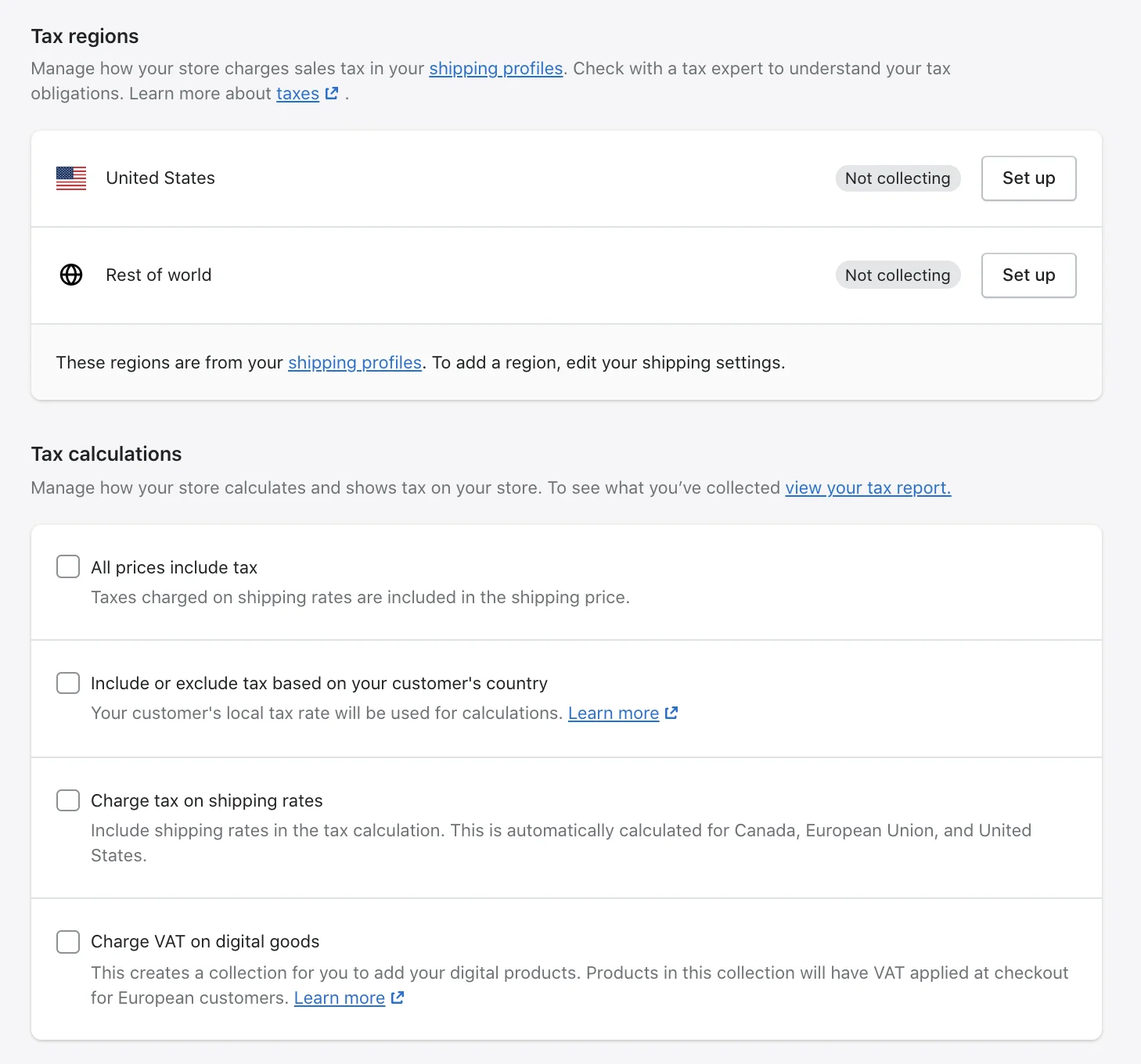

In the Tax Region section, besides the United States, click Set up.

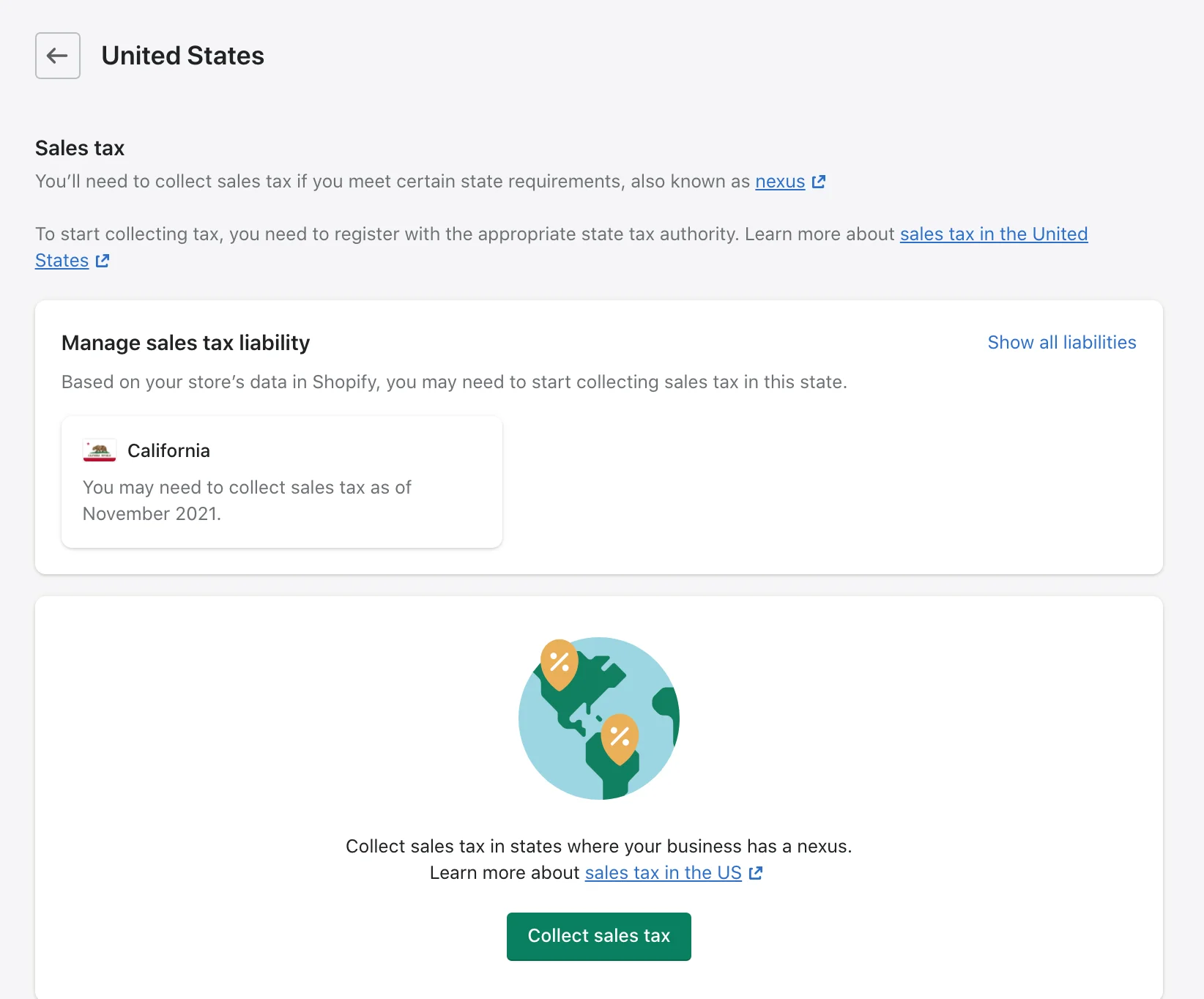

As you can see, based on our demo store’s data on Shopify, sales tax will be collected in California state – where our business locates.

Next, click on Collect sales tax. A pop-up window will appear on your screen. There, you need to fill in your state name and sales tax ID.

If you have applied for a sales tax ID but don’t yet have one, then leave this field blank. You can update it when you receive your sales tax ID.

2. Set Up Shopify Tax Calculations

Once you’ve finished filling in the information in the Tax Region section, move on to the next section – Tax Calculations.

There are four options for you to choose from. You can tick more than 1 box.

- All prices include tax

- Include or exclude tax based on your customer’s country

- Charge tax on shipping rates

- Charge VAT on digital goods

If your business is located in a state where tax laws regarding shipping vary (e.g: California, Colorado, Florida, etc), then you can choose whether you want to charge tax on shipping.

Or if you’re unsure whether you should charge taxes on shipping, then leave this option on the default setting and check with US state tax authorities or a tax consultant.

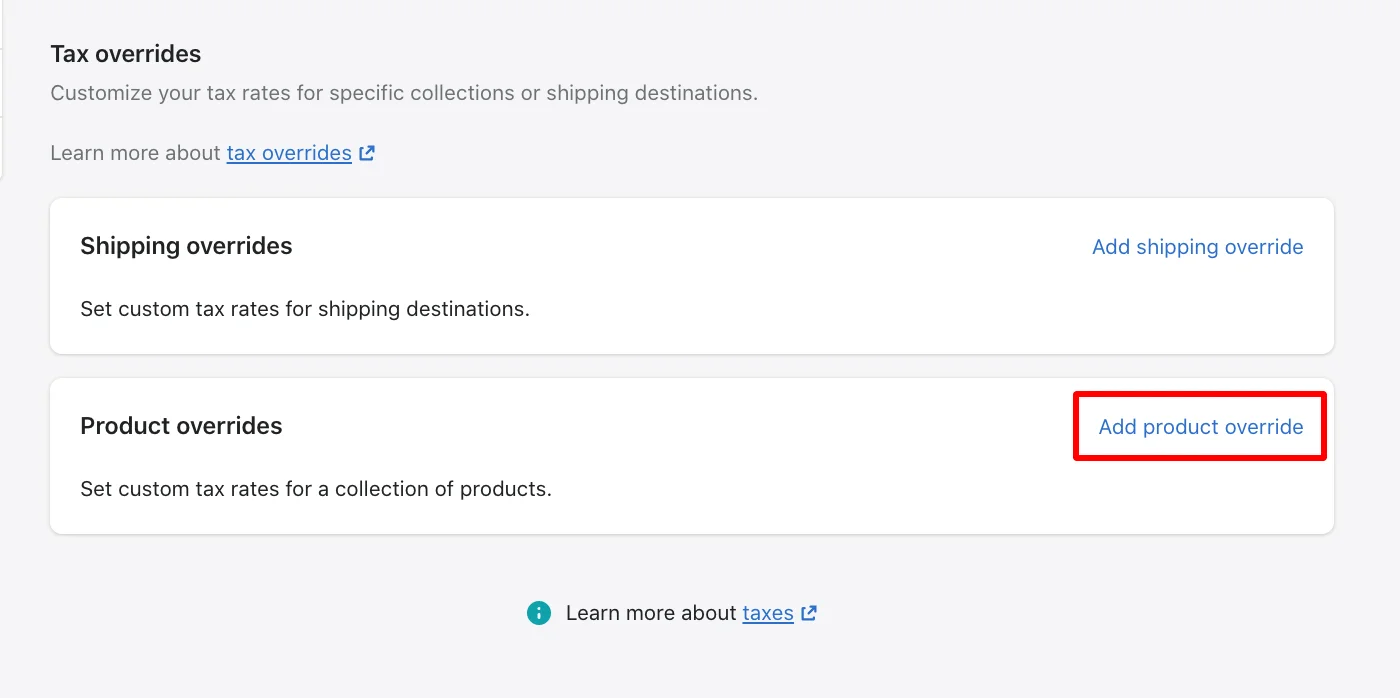

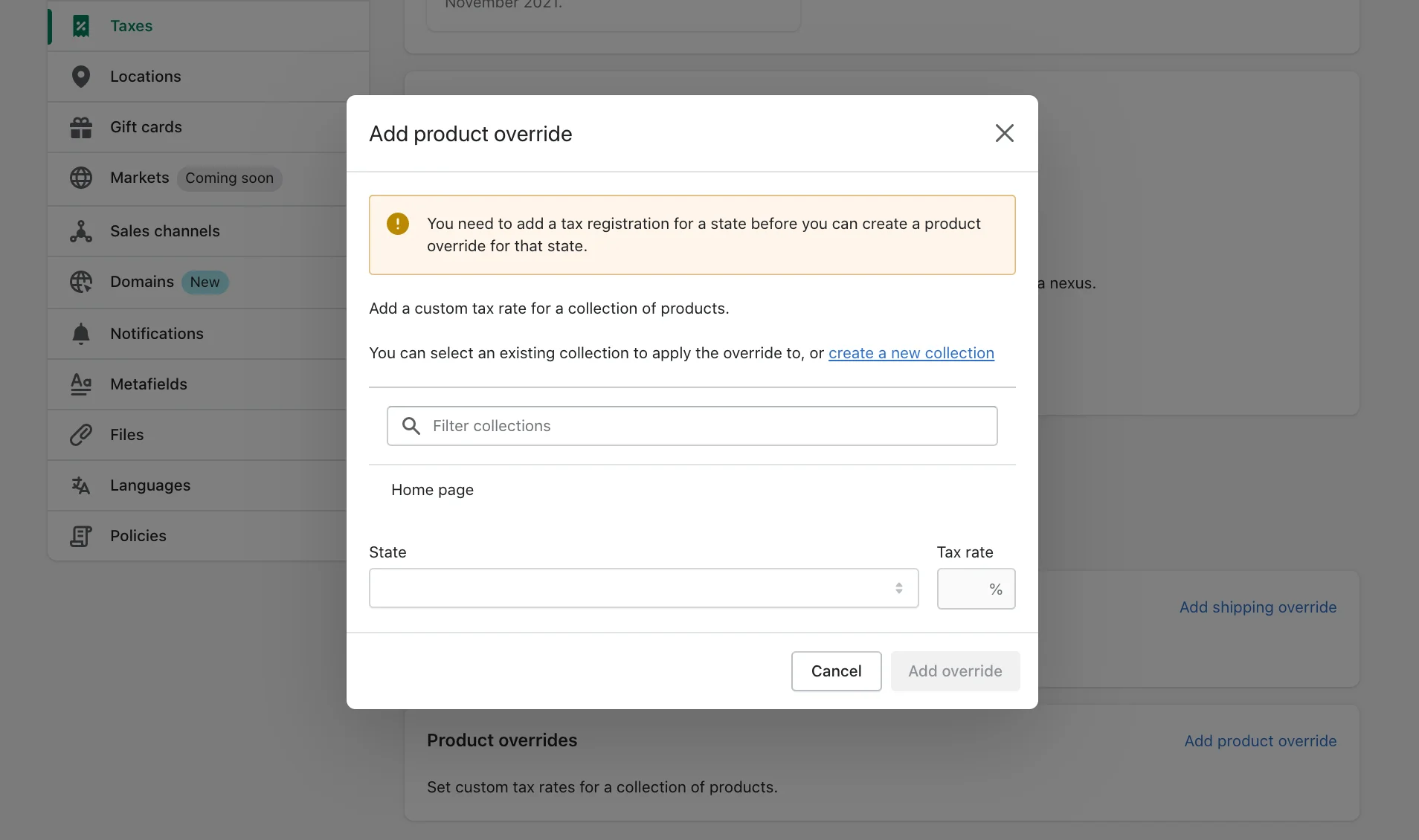

3. Set Up Tax Overrides

Sometimes, the default tax rates don’t apply to certain products. For example, certain types of children’s clothing might be exempt from tax or have a lower tax rate. If the default rates don’t apply, then you need to create an override.

Creating an override for products is a two-step process. First, you create a collection that includes the products that have different tax rates. Then, you specify to which region the override applies, and the tax rate to use.

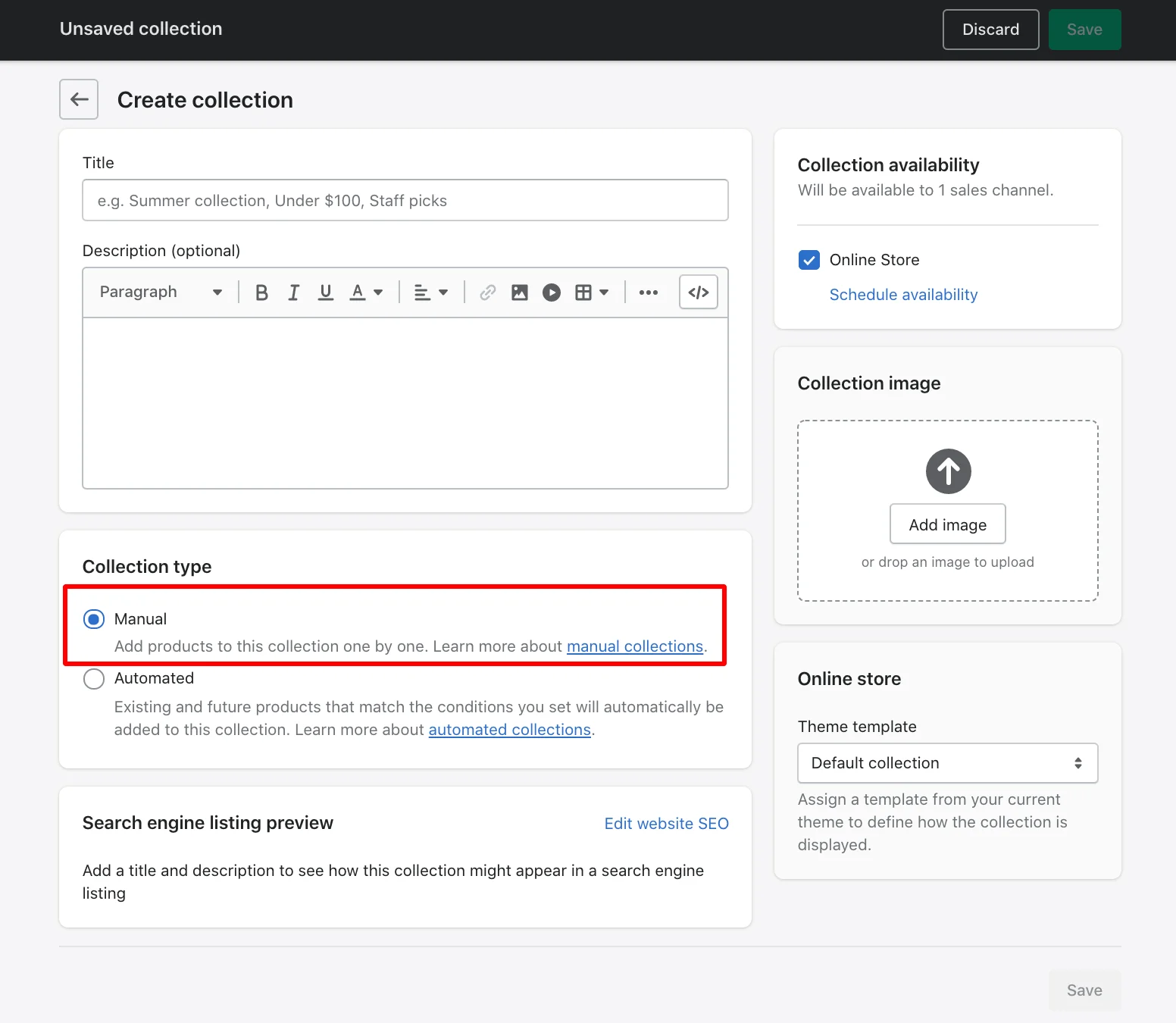

3.1 Create A Collection

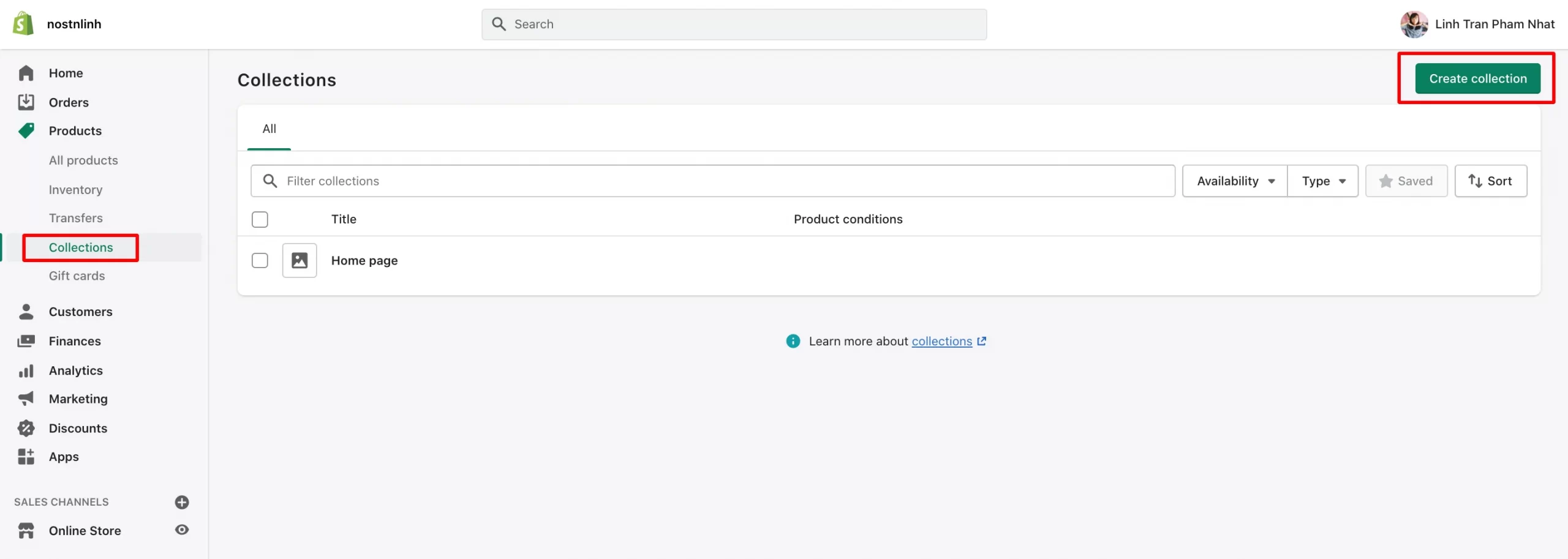

- From your Shopify admin, go to Products > Collections. Next, click on Create collection – the green button on the left.

- Name your collection. Under Collection type, choose Manual.

- Click Save to finish.

3.2 Create the override

- Go to Settings, then navigate to Taxes > Tax overrides section.

- There, click on Add product override.

- Next, you need to select the collection you’ve just created and choose the region where the override applies.

- To finish, enter the tax rate for the collection in that region.

Need Help To Migrate Your Store?

LitExtension provides a well-optimized Cart to Cart migration service that will help you transfer all your data accurately, painlessly with utmost security.

3 Best Shopify Tax Apps in 2023

Tax is not fun. Who wants to go through all of those tax documents after such a long day or give up a full Sunday to get tax reports together? Well, you gotta do it anyway.

But fret not, my friends! These handy tax apps will help you out.

1. TaxJar

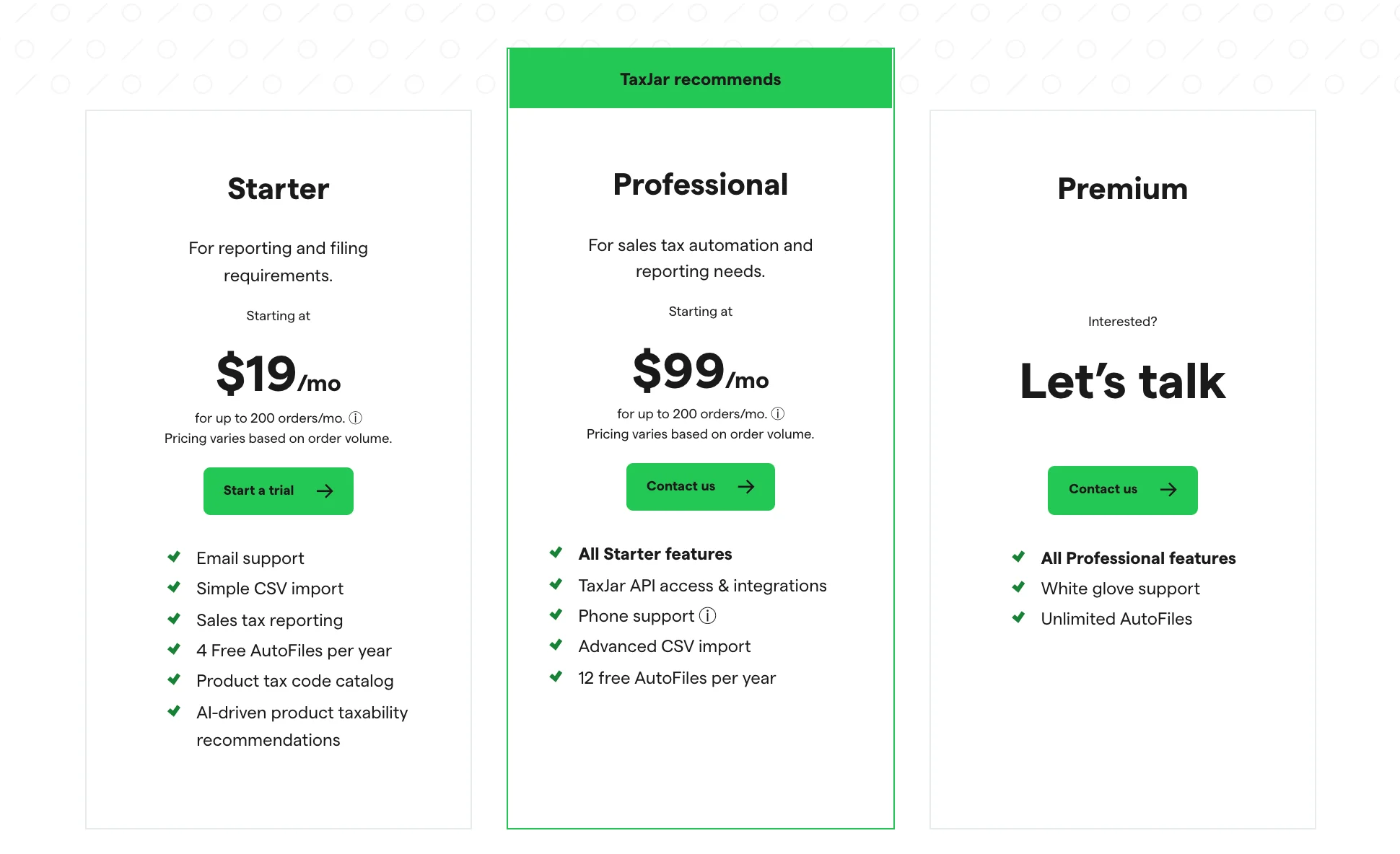

TaxJar or TaxJar Sales Tax Automation is a simple, reliable sales tax compliance for Shopify. This Shopify sales tax app is rated 4.7 out of 5 on G2 and is recognized as the G2 Crowd High Performer for sales tax compliance and corporate tax.

Currently, TaxJar has 3 pricing plans: Starter, Professional, and Premium. You can first make use of a 30-day free trial. And then, with as low as $19/month for the cheapest plan, you can start using TaxJar and let this Shopify tax app take care of all your tax things.

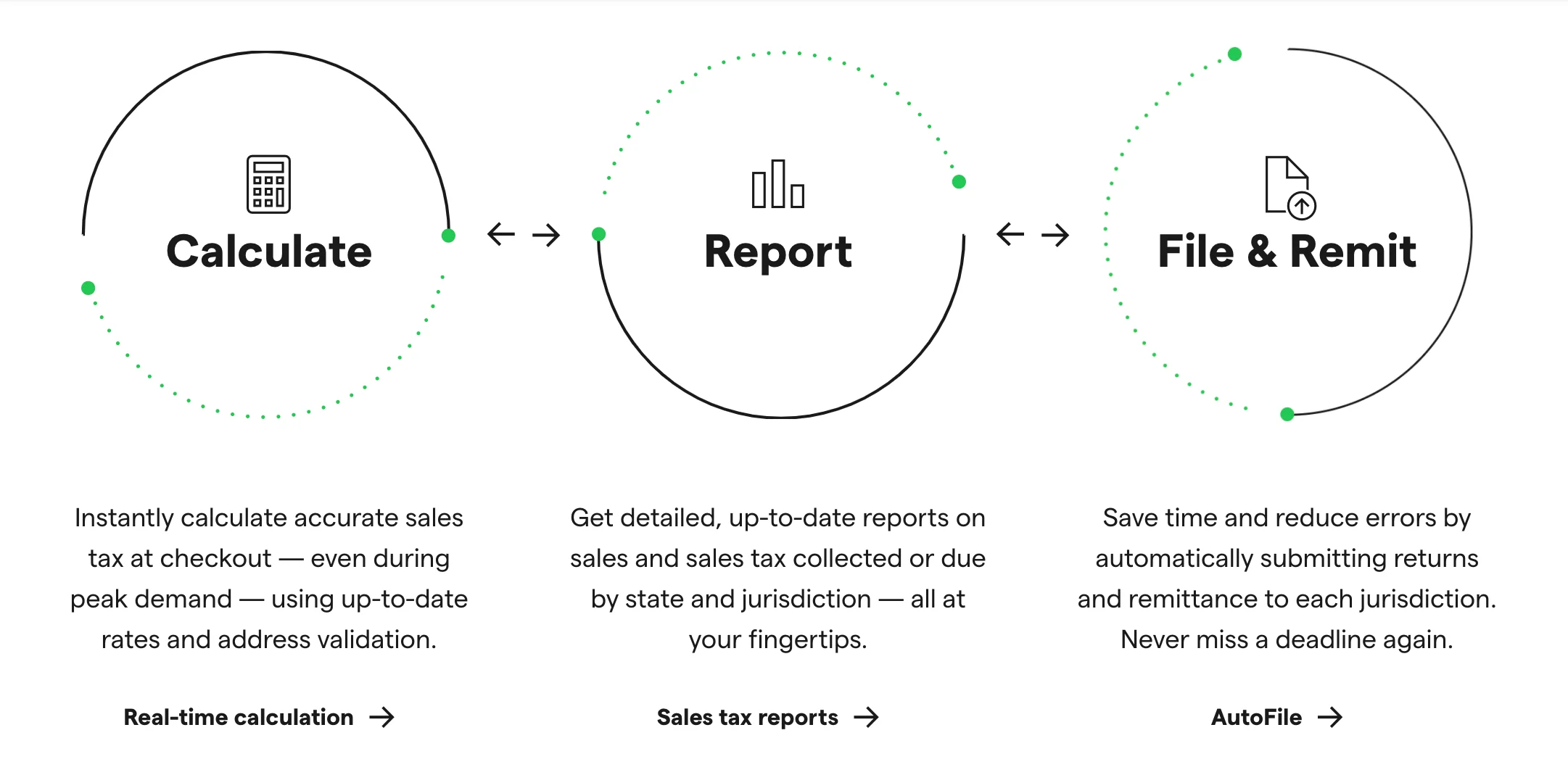

This is how TaxJar for Shopify works:

- Connect TaxJar to your Shopify online store

- Prepare your Shopify sales tax report

- View the report and AutoFile your sales tax forms

Please note again that Shopify’s built-in tax engine currently powers real-time calculations for Shopify stores at checkout but does not remit or file taxes for you. TaxJar can help to export the collected sales tax, recalculate it within your TaxJar dashboard for guaranteed accuracy and provide seamless, automatic filing.

Not having to file manually in 42 states, that’s where we save a lot of time. We save money by not having to hire a full-time sales tax person.

Vu Nguyen, Co-founder & COO of Beautylish.

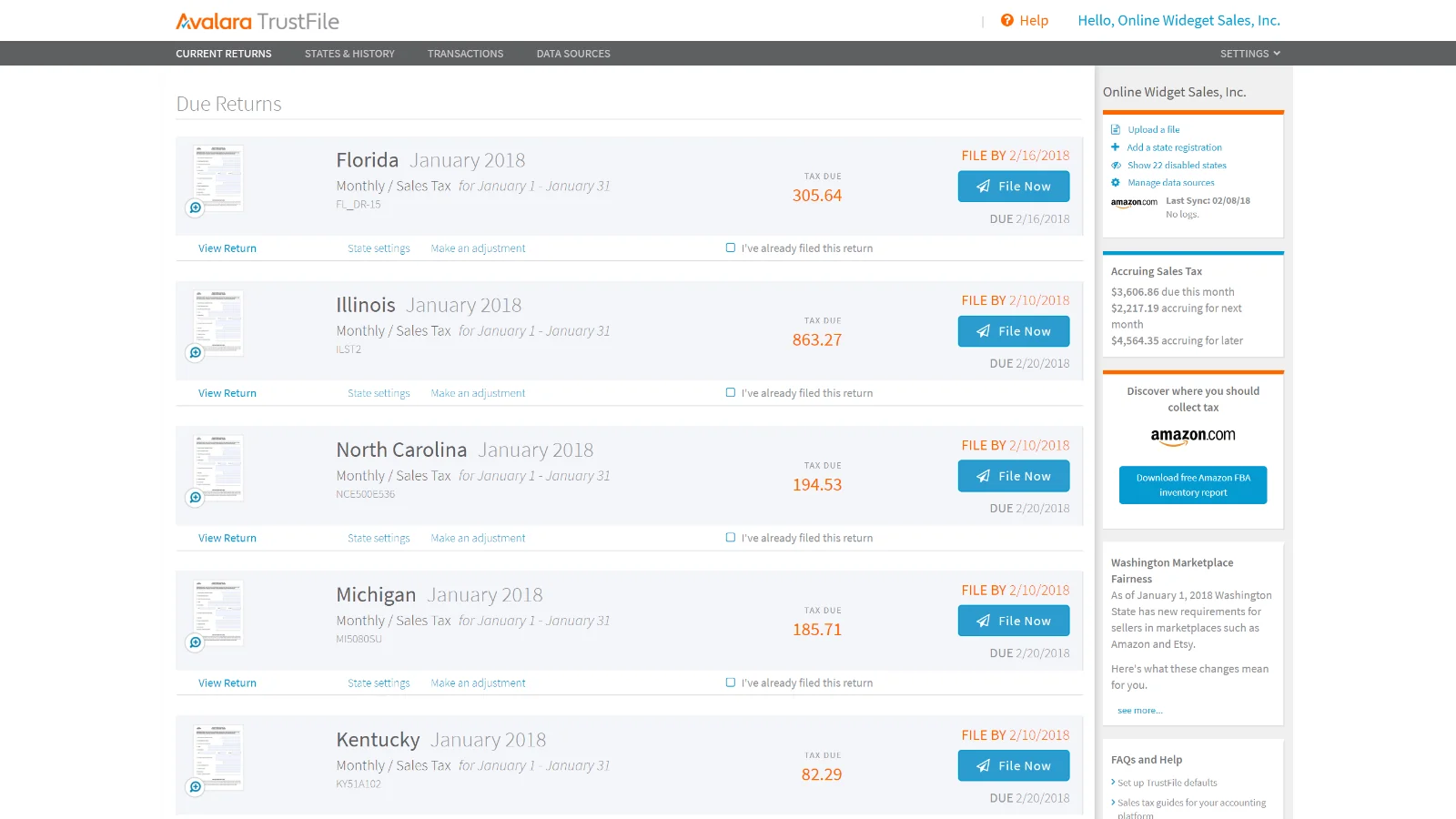

2. Avalara TrustFile

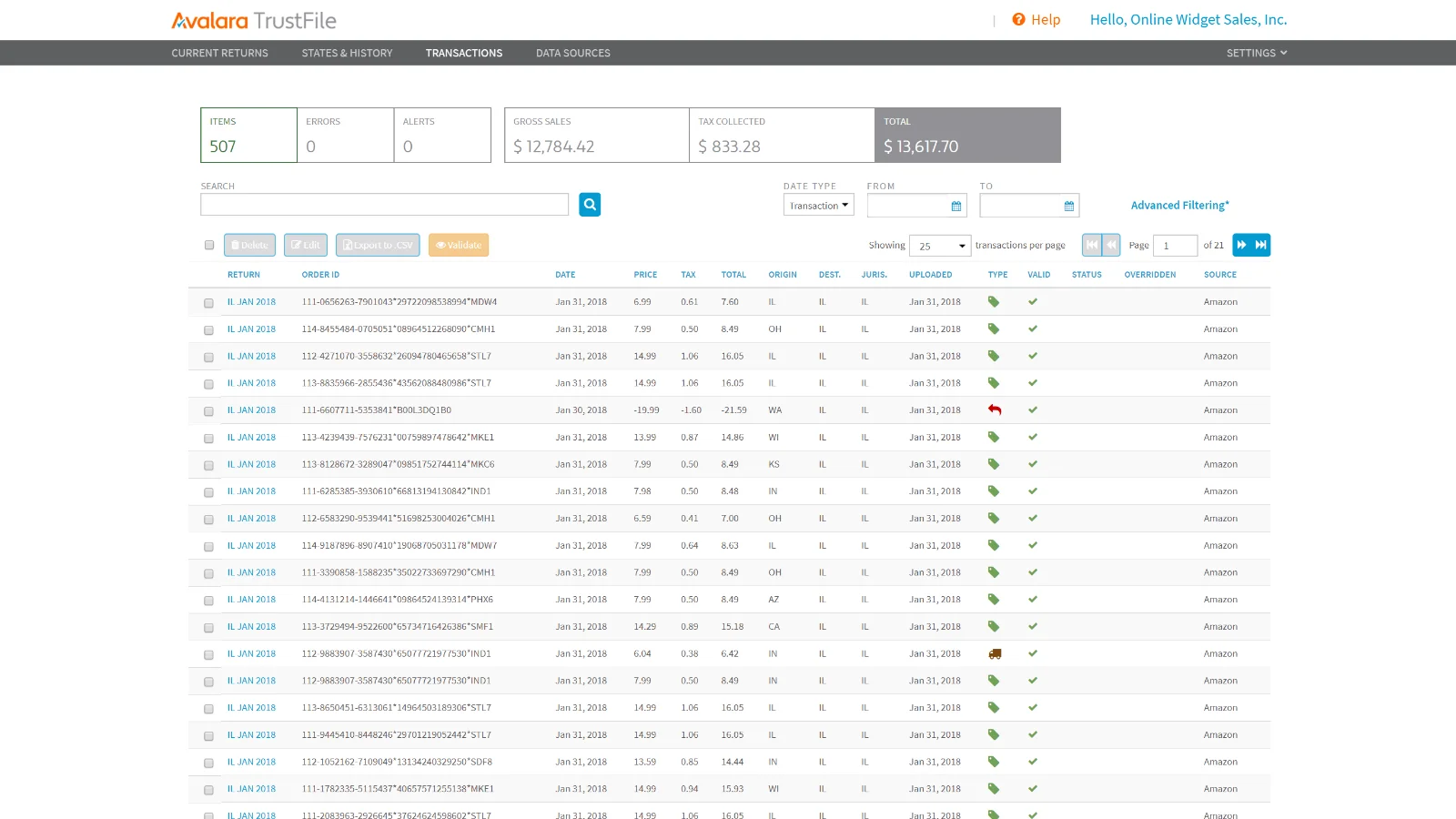

If you’re researching Shopify sales tax, there’s a good chance that you’ve heard of Avalara TrustFile – a sales tax software that automates tax calculations and the tax filing process. With the help of Avalara, you can check Shopify sales tax off your to-do list and get back to increasing your sales volume.

Avalara will cost you $24 per month – $5 more expensive than the TaxJar’s Starter plan, but way cheaper than the Professional plan of TaxJar. The thing is Avalara gives you unlimited customer support. Meanwhile, in the case of TaxJar, you only get support via phone if you pay at least $99 per month for the Professional plan.

But just like TaxJar, you’ll also have a one-month free trial to explore Avalara TrustFile before deciding to commit.

Let’s see how Avalara TrustFile helps your business stay in compliance with up-to-date data for a great degree of accuracy

- Integrate with your Shopify online store and automatically apply different tax rates

- Follow rate changes for every address with geospatial targeting

- Track nexus and get alerts in each state with the interactive map

- Export and create consolidated sales tax liabilities and exemptions

However, as great as Avalara TrustFile can be, it’s not going to be the perfect Shopify tax app for every online seller. In fact, some of our customers complained that they once experienced downtime when using Avalara.

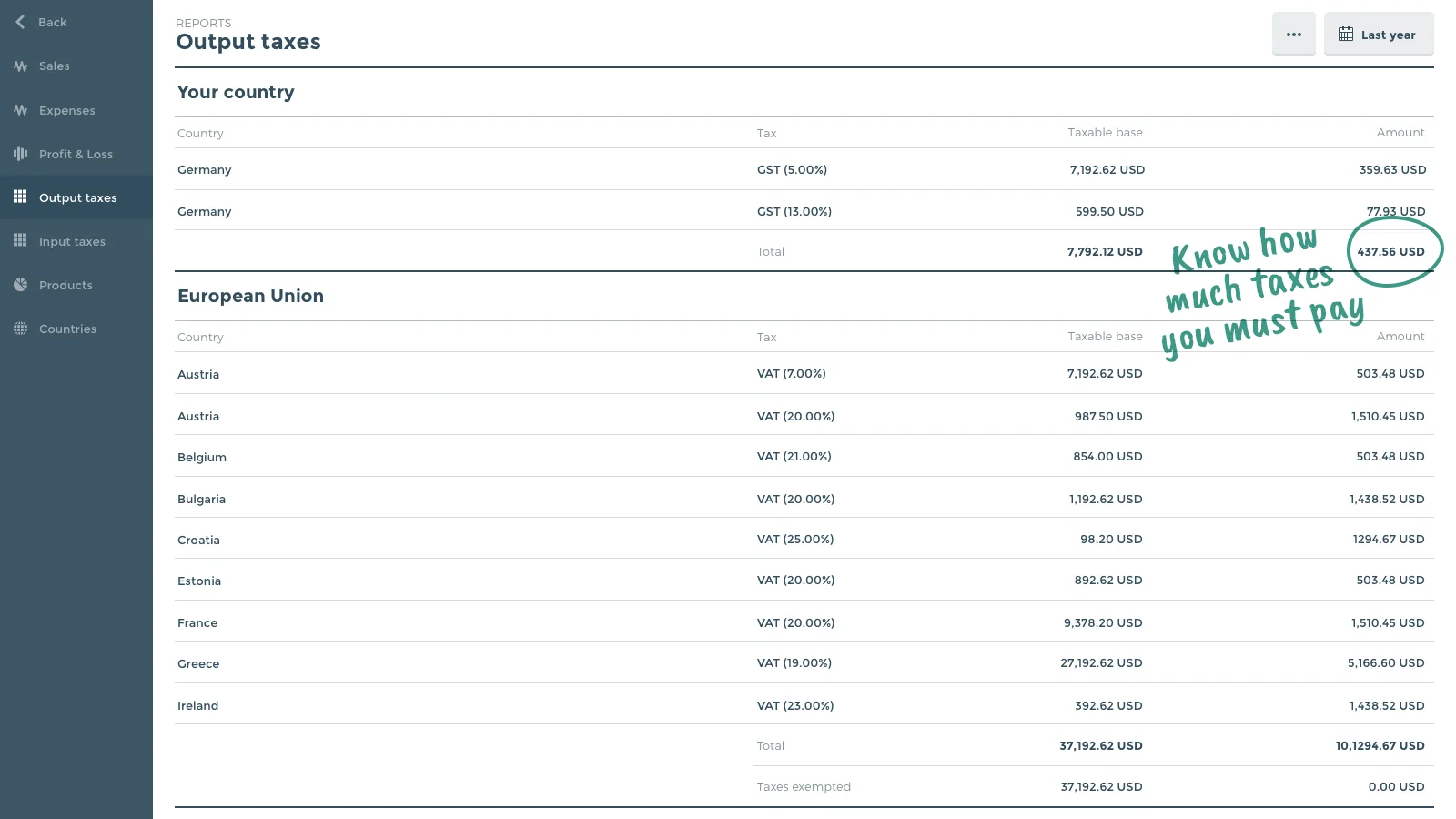

3. Quaderno

Really, there’s just no reason to stress over tax when it can be automated by friendly, robust software. It’s Quaderno!

This tax app is born to hand over all your concerns about tax compliance, proper invoicing, bookkeeping services and filing taxes.

One of the things that separate Quaderno from the two above-suggested apps is that all Quaderno pricing plans are based on the number of transactions per month. Therefore, Quaderno is a good fit for all-size businesses.

All these Quaderno plans include Worldwide tax compliance, automatic tax receipts, multichannel tax reports, international tax alerts, unlimited users, and first-class support. The free trial period lasts for 7 days – a little bit short yet enough for you to explore Quaderno’s outstanding features.

Quaderno tax features are very valuable for us. As we grow, we are able to have more resources dedicated to control taxes.

Ashley Sachs, Customer Support Manager at Whereby.

How Quaderno works with Shopify

- Quaderno integrates harmoniously with Shopify to collect your sales data in real time and begin automating your Shopify sales tax processes in a couple of minutes.

- It automatically calculates the correct tax rate on every transaction based on the data provided by Shopify and issues a receipt for the sale that is customized to your brand, in the customer’s native language, and locally tax compliant in their country or region.

- Quaderno provides all of your financial data in easy-to-read reports ready to share with your trusted tax advisor. So you can finish the quarter celebrating, not slaving over returns.

Why Shopify?

That you’re here researching Shopify sales tax means you’ve already chosen Shopify as the trusted home base for your online store. Anyway, let’s spend some more time looking through some of the most outstanding features of Shopify – just to reassure you that you’d never have to say “if only” because you chose to go with Shopify!

But should you feel tired of these walls of text, this Shopify review video has come to the rescue. All Shopify features are well analyzed by our Shopify expert, check it out!

#1. What is Shopify?

Shopify is an all-in-one solution to host and manage an online store that doesn’t take much muscle and technical expertise.

Instead of having to get yourself a host and dealing with technical stuff, you just need to go to the main website and create an account and you’re good to go. Thanks to its ease of use, Shopify is ideal for those who just dip their toes into the eCommerce world.

However, if your store has grown out of what Shopify has to offer, switch to its tailor-made version for enterprises – Shopify Plus.

Bonus Reading: Shopify Plus vs BigCommerce Enterprise

#2. Shopify Features

Shopify’s pricing structure is quite clear and straightforward. You can choose from the three Shopify pricing tiers with additional features depending on which plan you are on.

[wptb id=48766]

If you’re wavering between Shopify and other top eCommerce platforms, let’s make use of a 3-day free trial to try out Shopify yourself before making up your mind. And for more information about how much money you should prepare to open and manage your Shopify store, please take a glance at our Shopify pricing evaluation.

Yes, a platform can be reasonably priced and easy to use. But if it lacks business-crucial functionalities, it can’t be a good home base for your online store.

Fortunately, Shopify is a user-friendly yet powerful eCommerce platform. This hosted solution arms its users with over 6000 Shopify apps available on the Shopify marketplace as well as a wide range of stylish, mobile-optimized themes. All +100 themes on Shopify Theme Store are tailor-made for eCommerce business and strictly evaluated by the Shopify team.

What does this mean? It means you have plenty of materials to build up an online store the way you and your customers both love!

Bonus Reading:

The greatest thing when you go with Shopify (or other hosted solutions like BigCommerce, Wix or Squarespace) is that the platform takes all the security-related tasks off your plate. Also, you’ll always have access to dedicated customer support – available 24/7 via phone, email and live chat.

Shopify Sales Tax: Recaps

We’ve come a long way to learn how to add taxes on Shopify. Also, we’ve gone through the curated list of the best Shopify tax apps in 2023. Now, it’s time for some recaps!

- Shopify will handle your problem with an automatic sales tax calculation. You can also set up tax overrides to address unique tax laws and situations.

- However, this eCommerce platform won’t help you file or remit your sales taxes.

- You technically don’t own any sales tax you collect. Shopify sales tax is typically collected from shoppers, by the seller, and then passed on to that state.

- TaxJar, Avalara TrustFile, and Quaderno are the three most popular tax apps for Shopify. We recommend you start a free trial with all these apps so that you can play around with them and make a well-informed decision.

FAQs about Shopify Sales Tax

- Does Shopify pay my sales tax?

No. Shopify can be set up to automatically handle the most common sales tax calculations. However, it’s not the platform’s responsibility to remit these taxes for you.

- Does Shopify report sales to IRS?

Yes. Shopify reports to the IRS about all of their account owners and their transactions, on an annual basis.

- How much tax does Shopify charge?

- Do I need a seller permit to sell on Shopify?

No. Shopify does not require you to have a business license in order to sell on this platform.

Bottom Line

In this world, nothing is certain but death and taxes.

Benjamin Franklin

Taxes are loathed but unavoidable. Whether you hate them or not, it’s always there.

After reaching these very final lines, we don’t expect you to think of tax as a daydream, but at least not a nightmare. Hopefully, this article has brought some clarity to all the questions related to Shopify sales tax you might have.

By the way, if you’re looking for more helpful eCommerce tips & tricks, let’s join our Facebook community.

We wish you tons of luck on your eCommerce journey!