To assist businesses to thrive in eCommerce battle, safe and hassle-free checkout is a must-have feature. This is where payment processors and payment gateways come in handy. Apart from plenty of renowned payment gateways, Stripe steals the show thanks to its great features, products, and transparent pricing structure. With numerous payment fees shown on Stripe’s website, it will take you lots of effort to determine how much Stripe fees will be. Don’t sweat. This guide will help you out!

In this article, LitExtension – The #1 Shopping Cart Migration Expert will walk you through:

- What are Stripe fees?

- A breakdown of Stripe pricing plans and fees

- Pros and cons of Stripe pricing structure

- Is Stripe right for your business?

- Alternatives to Stripe

Let’s get the ball rolling!

Need Help to Migrate Your Store?

If you are intending to another eCommerce platform, LitExtension offers a great migration service that helps you transfer your data from the current eCommerce platform to a new one accurately and seamlessly with utmost security.

What Is Stripe?

In the simplest terms, Stripe allows a business to take payments from customers safely and conveniently and then transfer those payments directly into the business bank account.

In fact, Stripe serves as both a payment processing platform and a payment gateway. Stripe makes it easier for businesses to process payments by developing a suite of products that can save many hours, money, and resources that otherwise will be spent on setting up an in-house online payment processor.

Founded in 2010, Stripe has been helping millions of businesses of all sizes to accept payments, increase their revenue, and create new business opportunities.

In 2022, it’s recorded that 3.3 million sites across the globe which include some of the biggest brands from Amazon to Google, have been using Stripe. As Stripe can handle over 135 currencies, it is now a top-of-mind payment processor for companies that wish to do business internationally.

With Stripe software and APIs, businesses can also make one-time or subscription payments and other services such as billing, invoicing, sales tax automation, etc. Stripe is pretty straightforward to use at reasonable prices.

Stripe offers a wide range of products and services, and the associated fee can range widely. Here’s how it breaks down.

What Are Stripe Fees?

Stripe offers payment solutions for online and in-store merchants, subscription businesses, eCommerce platforms, and marketplaces. They assist companies in combating fraud, invoicing, financing, issuing cards, and much more.

So, how much does Stripe charge? All these solutions come with a flat-rate processing fee for each transaction. In this way, businesses will always know how much Stripe costs, and then they can choose the pricing plan suitable for themselves.

Stripe’s Business Pricing Plans

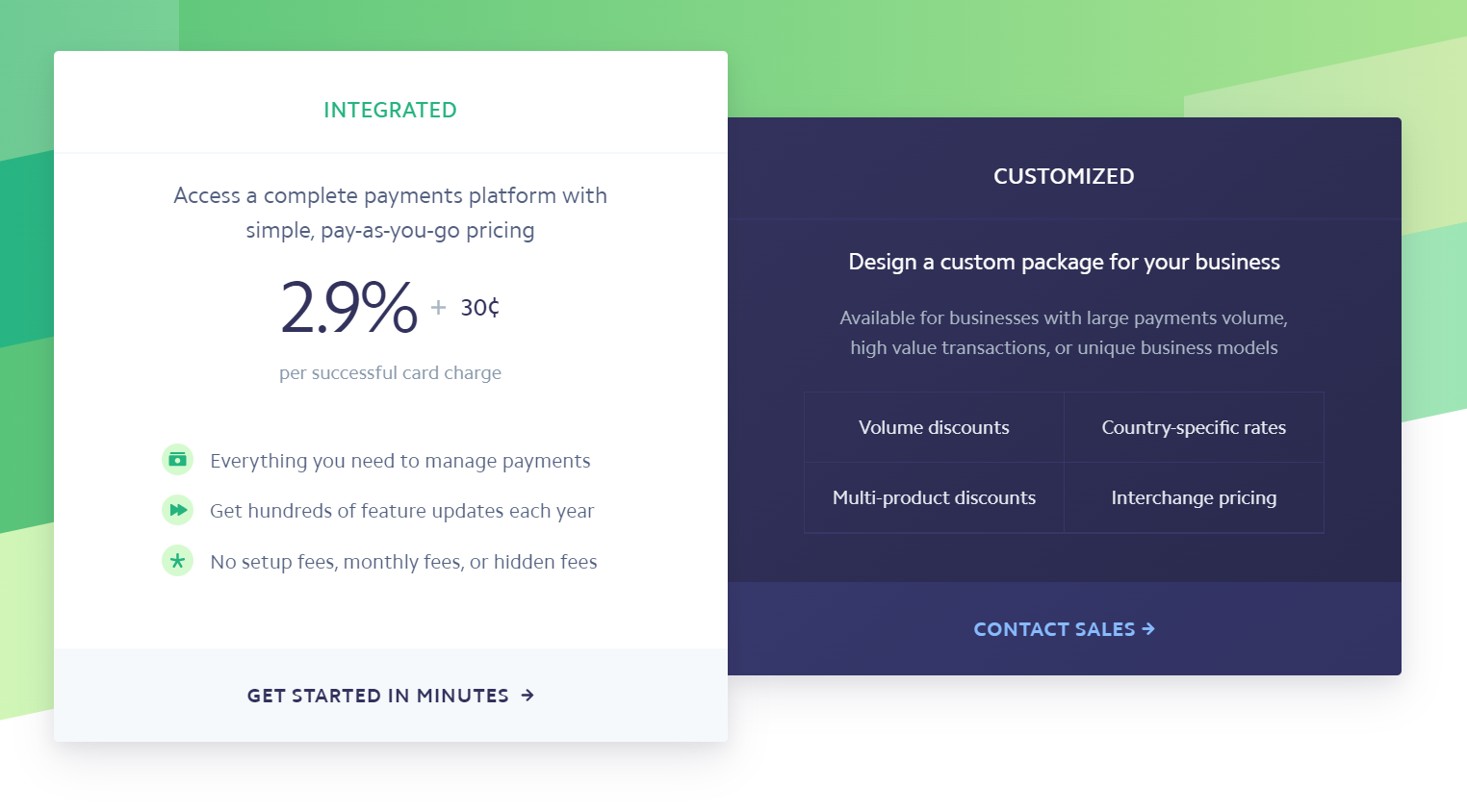

Stripe provides various payment options, with prices varying based on chosen payment method. Despite that, Stripe fees has streamlined its options into two simple pricing plans: Integrated plan and customized plan.

For integrated pricing plan, it offers simple per-transaction pricing with no Stripe monthly fees of setup fees: 2.9% + 30¢ per successful card charge.

For businesses with large payments volume, Stripe offers customized pricing plan with:

- Volume discounts

- Country-specific rates

- Multi-product discounts

- Interchange pricing

If your eCommerce business has just started out, the integrated pricing plan would be a perfect choice for you. It’s an ideal starting point for any business looking for an easy, streamlined solution to process customer payments.

How Are Stripe Fees Calculated?

Before implementing Stripe, you need to determine how it will fit into your business model. Thus, it’s essential to understand how Stripe fees are calculated so that you can set the price of your products accordingly and avoid incurring extra charges yourself:

Stripe fees calculation formula:

A percentage of the transaction amount (2.9%) + A fixed fee (30¢) = Stripe fees

For example, let’s say you want to process a $50 transaction. Since Stripe online payment fees are 2.9% + 30¢ (US Stripe credit card processing fees), your charges will be calculated as below:

$50 x 2.9% + 30¢ = $1.75

In this case, you will eventually receive $48.25. Thus, if you opt to have your customers pay the cost of this processing fee, you should ask for $51.80.

How Does Stripe Charge Its Fees?

Businesses will directly pay the fees to Stripe from the total upon every successful transaction. Stripe will automatically deduct its costs as it processes transactions.

However, you can pass the Stripe costs on to your customers by including the fees into the final charge amount.

Note: Charging processing fees to your customers is prohibited by law in some jurisdictions.

Stripe Payment Processing Fees: A Complete Guide

We know how painful and time-consuming it is to go through every documentation page just to work out how much fees you will be paying. Here is a complete guide to Stripe payment processing fees to make things easier for you:

Cards & Wallets

Stripe offers integrated per-transaction pricing per successful card charge. Customers can make online purchases through Stripe credit cards, debit cards, and wallets (Apple Pay, Google Pay, Alipay, Click to Pay, and WeChat Pay):

(Total Transaction Value) x 2.9% + 30¢

If customers make in-person payments through Terminal, the fee formula is:

(Total Transaction Value) x 2.7% + 5¢

Note: Keep scrolling to read more about Stripe Terminal in Stripe fees for other products.

Stripe ACH Fees, Wire Fees & Checks (Bank Debits & Transfers)

No cards? No problems because Stripe also supports traditional payment methods such as bank transfers, wire transfers or checks:

| ACH Credit | $1.00 per payment |

| Wire | $8.00 per transfer |

| Checks | $5.00 per individual check

$15.00 per bounced check |

| ACH Direct Debit | 0.8% + $5.00 cap

1.2% for a two-day settlement $1.50 per instant bank account validation $4.00 for failed payments $15.00 for disputed payments. |

International Payment Methods (Additional Payment Methods)

With Stripe integration, businesses can accept standard payment methods worldwide. It manages all-cross border money transfers and currency conversions.

Stripe international payments incur a 1.5% charge. If local currency conversion is required, there will be an extra 1% cost.

| Bancontact (Belgium) | 1.4% + 30¢ |

| EPS (Austria) | 1.6% + 30¢ |

| giropay (Germany) | 1.4% + 30¢ |

| iDEAL (Netherlands) | 80¢ |

| Multibanco (Portugal) | 2.95% + 30¢ |

| Pre-authorized debits in Canada | 1% + 30¢ capped at $4.00

+80¢ fee applies per instant verification. We charge $4.00 for failed or disputed pre-authorized debit payments. |

| Przelewy24 (Poland) | 2.2% + 30¢ |

| SEPA Direct Debit (European Union) | 0.8% + 30¢ capped at $6.00

We charge $10.00 for failed or disputed SEPA Direct Debit payments. |

| Sofort (Europe) | 1.4% + 30¢ |

Note: Additional payment methods are also known as international payment methods for US Stripe merchants.

Afterpay & Klarna

Buy now and pay later apps are becoming more popular than ever, with Klarna and Afterpay being two of the most popular choices. These apps allow consumers to purchase items without paying up-front, while merchants still get paid in full.

Customers can pay the money back in four interest-free weekly installments or in full within 30 days. Larger items can be financed for 6 to 36 months with interests.

Fortunately, Stripe is fully compatible with these two apps and accepts these payment options below for a fee:

| Afterpay (or Clearpay in the EU) | Pay in 4 installments | 6% + 30¢ |

| Klarna | Pay in 4 installments | 5.99% + 30¢ |

| Financing | 2.99% + 30¢ |

Custom Account Fees (Customized Pricing Plan)

3D secure authentication

3D Secure is an additional layer of authentication used to validate a customer’s identification before making an online card transaction.

Stripe charges 3¢ per 3D Secure attempt for accounts on customized pricing plan.

Card account updater

Stripe automatically updates expired or renewed card information for saved customers.

Stripe charges 25¢ per update for accounts on customized pricing plan.

Note: These fees are free of charge for businesses that opt for integrated pricing plan.

Stripe Payout Fees

Stripe makes payouts to your bank account for you to receive funds. There are two options of Stripe payout to choose: Standard and Instant.

Standard payout is free of charge while still offering an automatic daily schedule in supported countries.

Instant payout enables businesses to send available funds to a supported card or bank account. Businesses can request Instant Payouts at any time with a 1% fee of instant payout volume and a minimum fee of 50¢.

Refund Fees

In fact, there are no fees to refund payments. However, Stripe fees are non-refundable.

Discount Rates

In addition to the flat-rate integrated plan, Stripe provides customizable pricing to businesses with high payment volume or specific business strategies. Unfortunately, Stripe does not disclose any specifics unless you talk to them directly.

Additional Fees

The following extra costs may be applied to card, digital wallet, and bank transactions:

|

International cards and currency conversion (for cross-border transactions, additional fee currency conversion is necessary) |

1% + 30¢ |

| Failed ACH direct debit transaction | $4.00 |

| Disputed ACH direct debit transaction | $15.00 |

| Disputed transaction on issued cards | $15.00 |

| Returned (bounced) check |

$15.00 |

If you have further questions about your additional fees, reach out to your Stripe sales representative to get advice.

Looking for a Platform Supporting Stripe?

The answer is WooCommerce; expand your possibilities when integrating with Stripe’s numerous features. LitExtension provides an excellent migration solution to assist you in making the switch to a platform that supports Stripe (such as WooCommerce). Rest knowing that your data is in good hands!

Stripe Fees for Other Products

The following products are available for all types of businesses looking for ancillary services. Here’s a brief overview of these products and how much they charge. Take your time, have a cup of coffee, and enjoy our detailed explanation.

Stripe Terminal

Terminal allows you to create your in-person checkout to accept payments. With this product, you can unify your online and physical stores with flexible developer tools, pre-certified car readers, and cloud-based hardware management. In short, it helps you build your exquisite point of sale (POS).

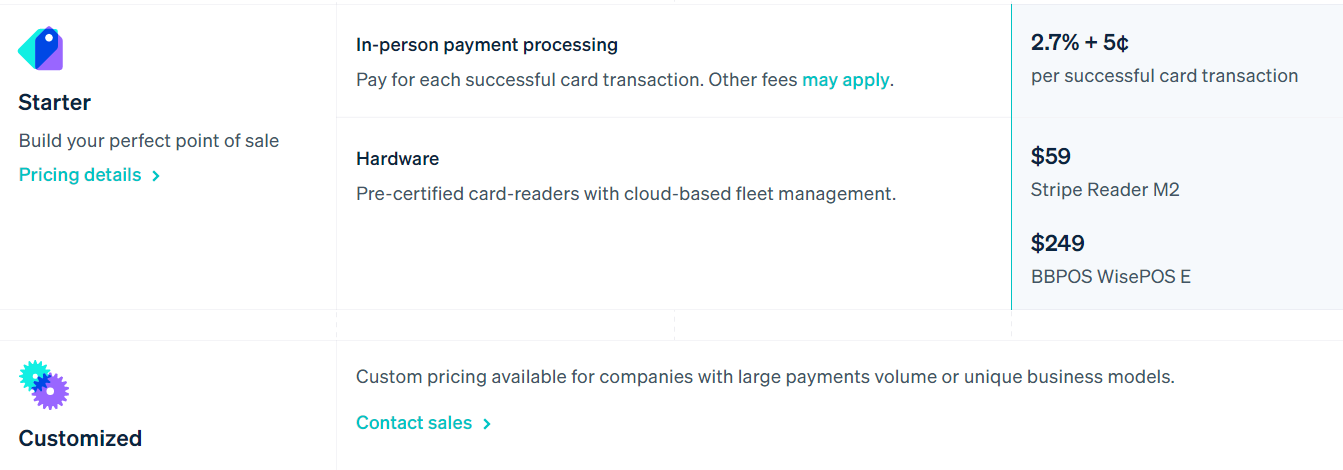

There are two main pricing plans, including:

For starter,

- In-person payment processing: 2.7% + 5¢ per successful card transaction.

- Hardware: $59 (Stripe Reader M2), $249 (BBPOS WisePOS E)

For customized plan: contact Stripe sales for more details (available for businesses with large payments volume)

Stripe Billing

Billing is the quickest path for your business to charge customers for Stripe invoices or subscriptions. Increase more revenue, support new products or business models, and accept recurring payments worldwide.

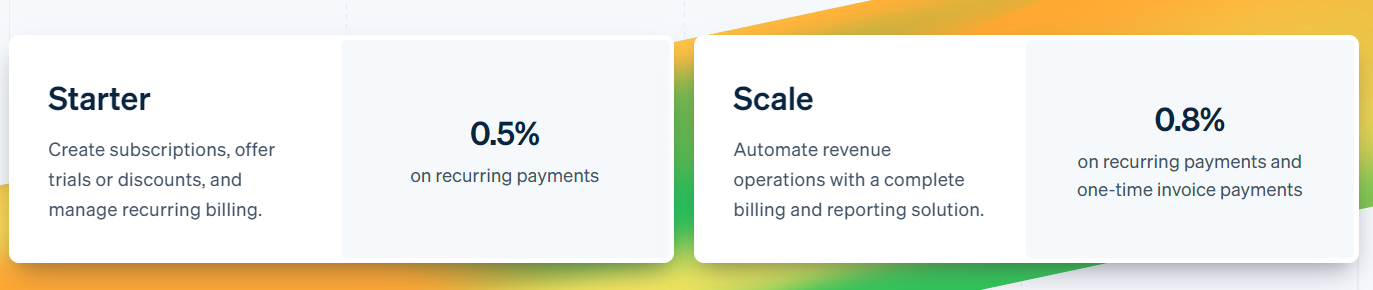

There are two available choices for you:

- Starter: 0.5% on recurring payments.

- Scale: 0.8% on recurring payments and one-time invoice payments.

Note: Contact Stripe sales for other pricing choices (available for businesses with a large payments volume or unique business model).

Stripe Invoicing

Invoicing is a universal product built to save your time and get you paid quicker. It enables you to create, customize and send online invoices to your customers. Or, you can utilize the Invoicing API and advanced features to automate the collection and reconciliation of payments.

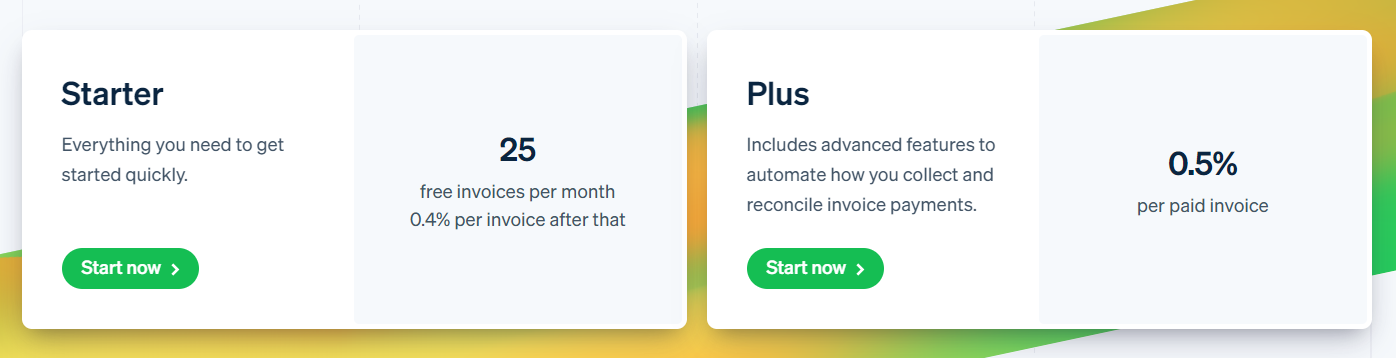

Two available plans are:

- Starter: 0.4% per invoice (after 25 first free invoices per month)

- Plus: 0.5% per paid invoice

Note: Available for businesses with a large payments volume or unique business model, contact Stripe sales to discuss other pricing options.

Stripe Connect

Connect is the quickest and simplest product to integrate payments into software platforms or marketplaces. Stripe’s set of programmable APIs and tools will enable you to create and scale end-to-end payment experiences from immediate onboarding to global payouts, while Stripe handles payments KYC.

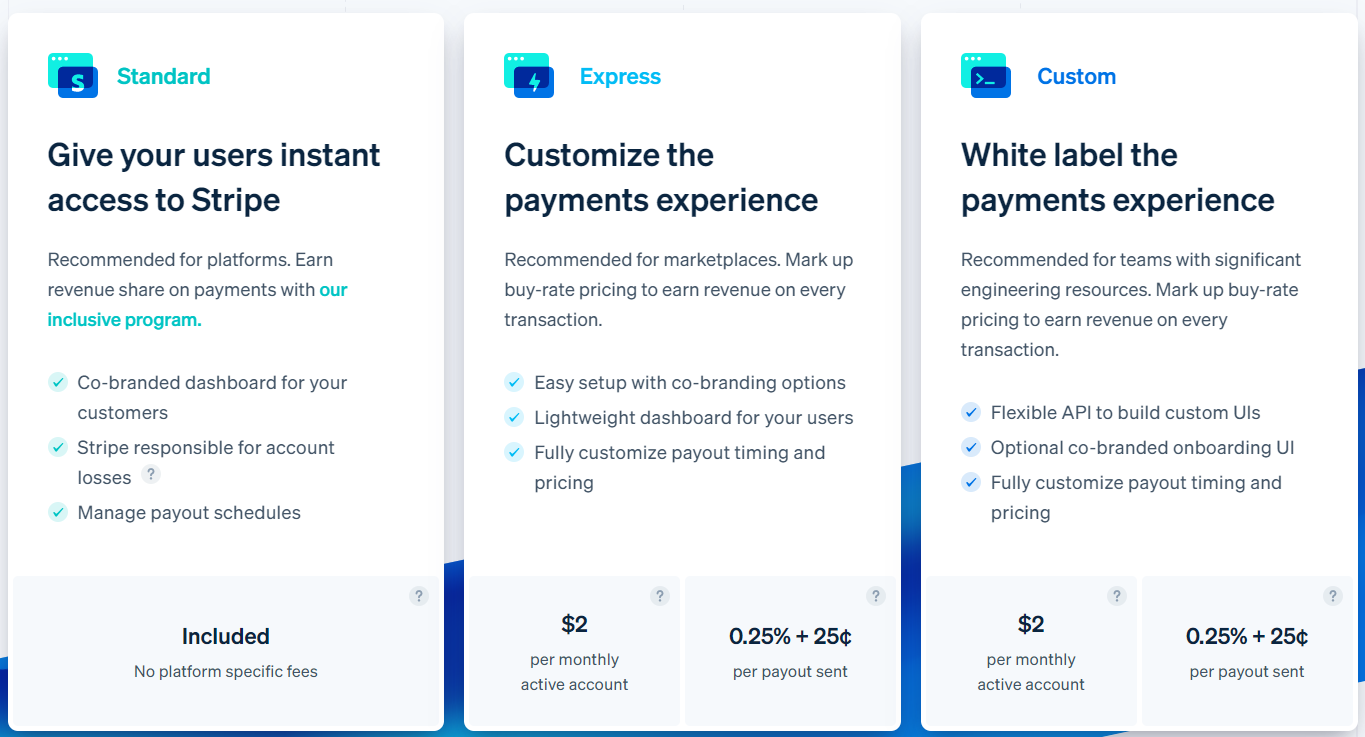

There are three plans:

- Standard: No fees

- Customize the payments experience: $2.00 per monthly active account, 0.25% + 25¢ per sent payout

- White label the payments experience: $2.00 per monthly active account, 0.25% + 25¢ per sent payout

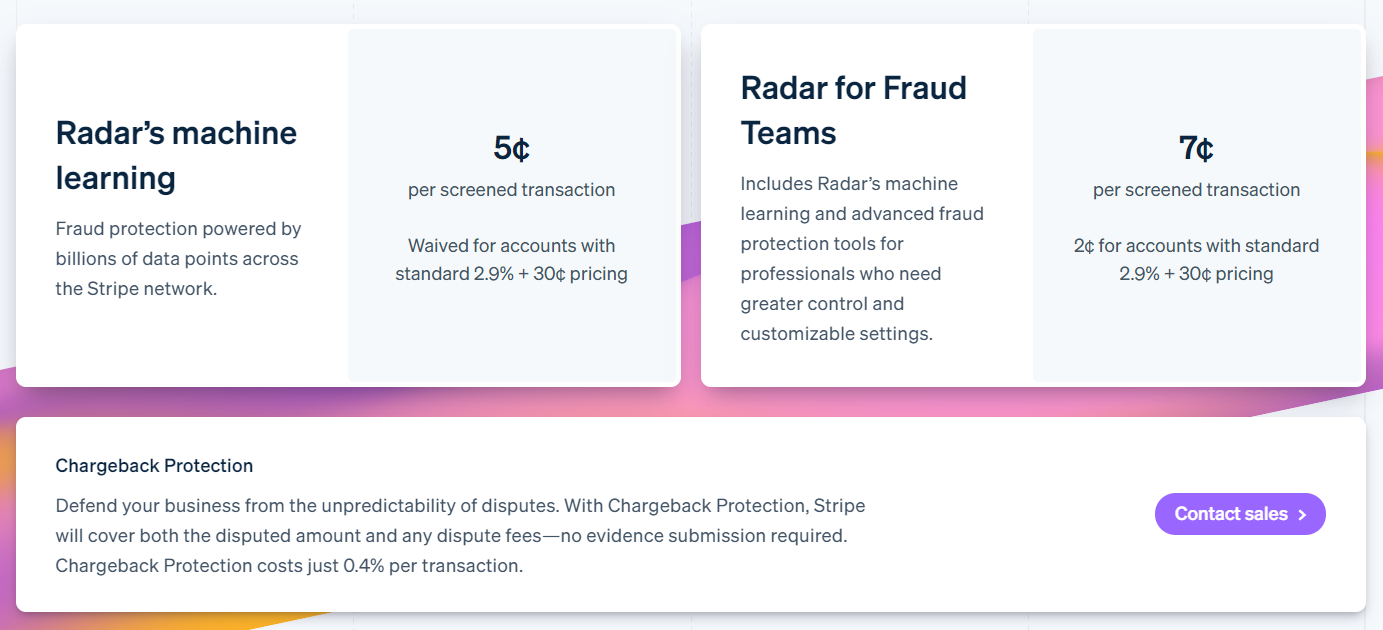

Stripe Radar

Radar offers fraud protection for your business payment processing. It also provides powerful fraud protection tools and disputed protection.

There are three choices for you, which are:

- Machine learning: 5¢ per transaction (waived for accounts with the standard plan)

- Radar for fraud teams: 7¢ per screened transaction (2¢ for the standard plan)

- Chargeback protection: 0.4% per transaction

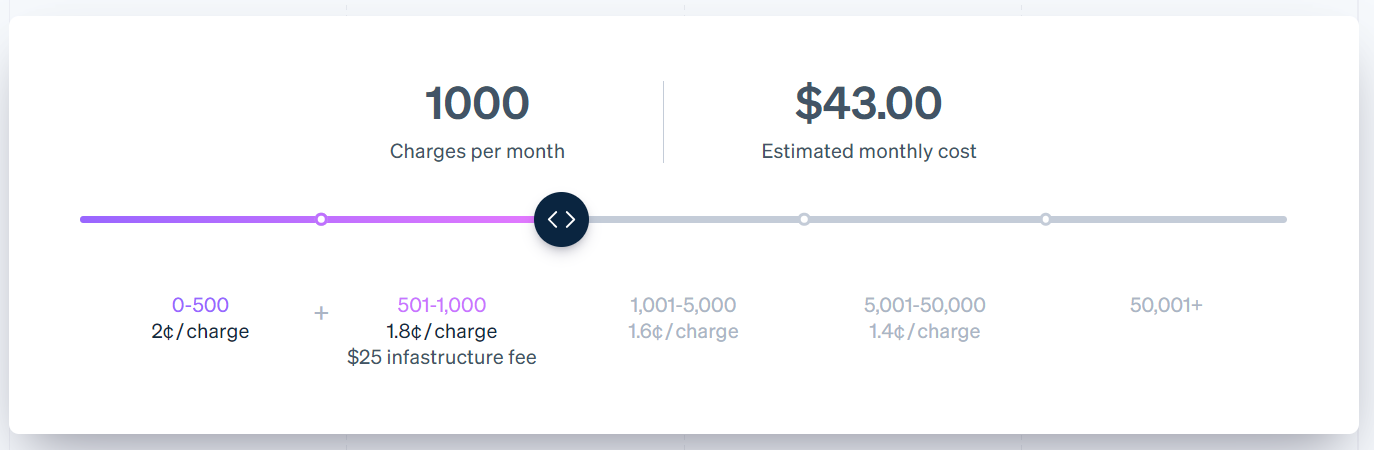

Stripe Sigma

Sigma, an advanced product powered by SQL, assists your business in analyzing your Stripe data and helps you to get faster business insights. Its fees depend on the number of charges, authorizations, and applications.

In short, you can estimate your cost based on your monthly business uses as below:

- 0 to 500 charges: 2¢ per charge + $10 infrastructure fee

- 501 to 1,000 charges: 1.8 cent per charge + $25 infrastructure fee

- 1,001 to 5,000 charges: 1.6¢ per charge + $50 infrastructure fee

- 5,001 to 50,000 charges: 1.4¢ per charge + $100 infrastructure fee

- + 50,001 charges: contact Sales for detail fee.

Unless you are sure how you will be charged, let’s have a glance at this example:

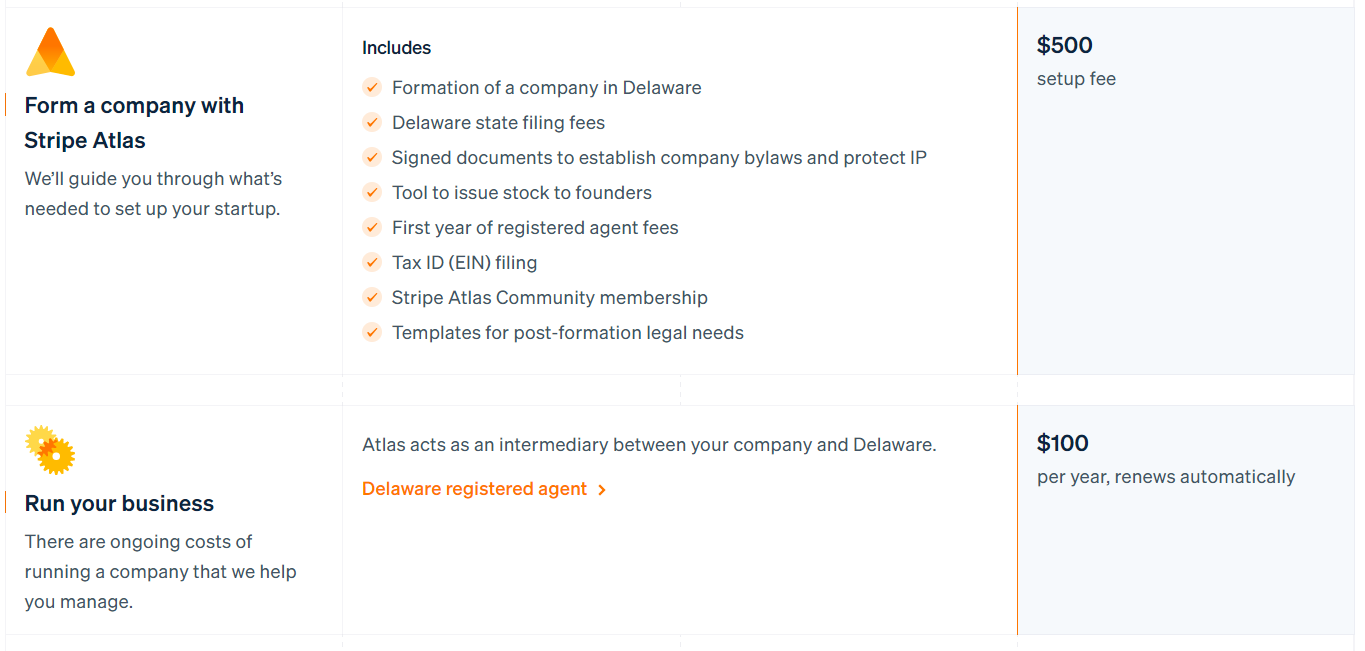

Stripe Atlas

Atlas offers tools and guides to start your business safely and quickly from anywhere in the world.

Here’s what you can do with Atlas plans:

- Form a business: $500 setup

- Run your business: $100 per year, renew automatically

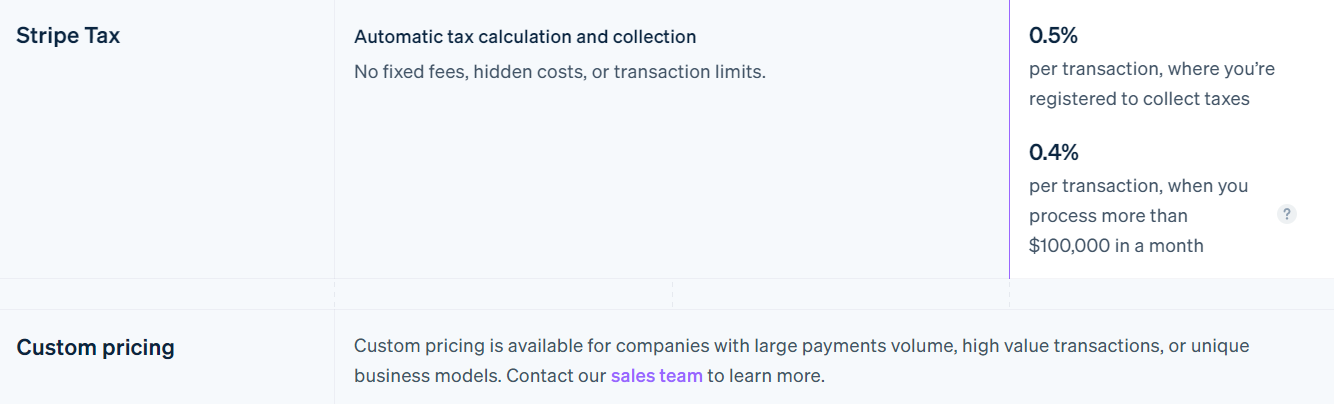

Stripe Tax

Tax allows you to calculate, collect sales tax, VAT, and GST with only one line of code or one click.

Tax fees are simple and transparent as below:

- Standard: 0.5% per transaction in which you’re registered to collect taxes (0.4% for processing volume over $100,000/month)

- Customized: available for companies with large payments volume, high-value transactions, or unique business models. Contact Stripe sales to receive more about fee options.

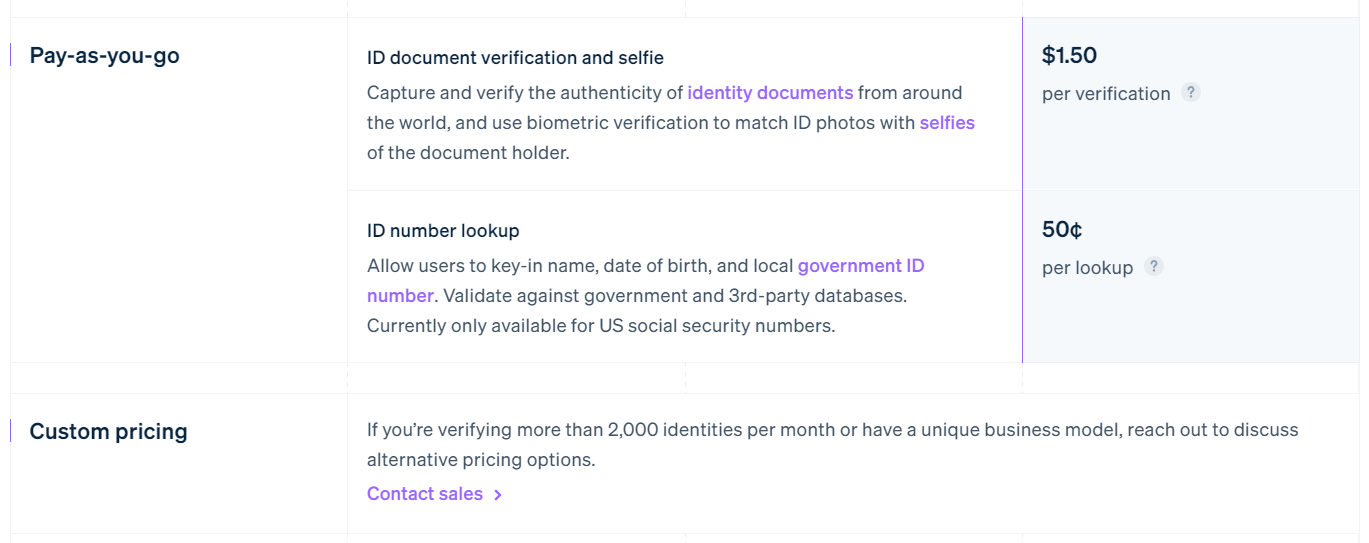

Stripe Identity

Identity assists you in verifying the identity of global users to avoid fraud, improve risk operations, and boost trust and security. You can verify the first 50 identities for free.

For integrated plan:

- ID document verification and selfie: $1.50 per verification

- ID number lookup: 50¢ per lookup

For customized plan: available for businesses that verify more than 2,000 identities per month or have a unique business model, contact Stripe sales to discuss more.

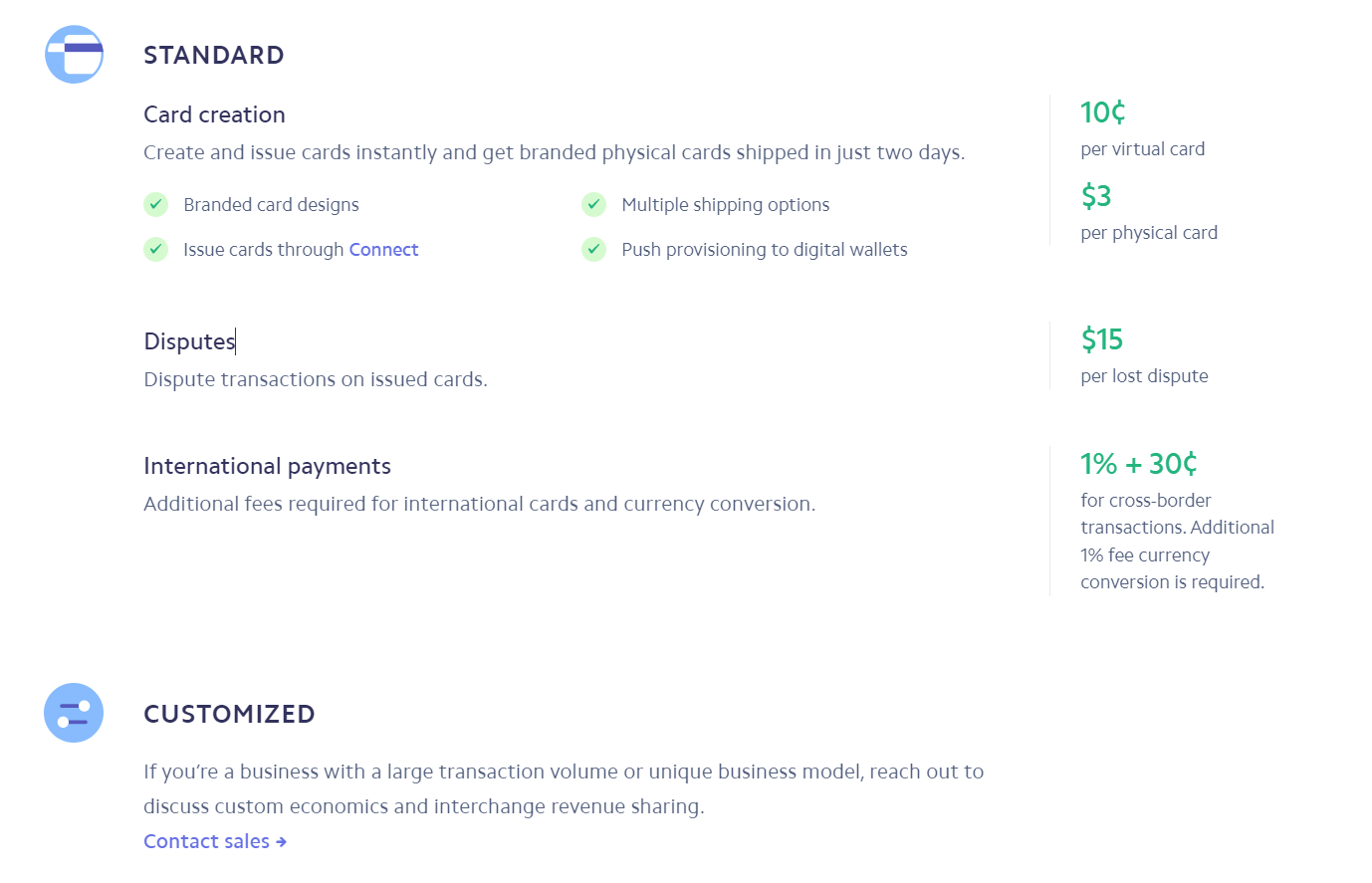

Stripe Issuing

Issuing helps you create, manage, and allocate virtual and physical cards. Manage costs, relieve operational burdens, and even generate new revenue streams.

There are two main pricing plans for Issuing:

For integrated plan:

- Card creation: 10¢ per virtual card and 3¢ per physical card

- Disputes: $15 per lost dispute

- International payments: 1% + 30¢ (for cross-border transactions, 1% additional fee currency conversion)

For customized plan: Contact Stripe sales to discuss more (available for businesses with large-volume transactions or unique business models)

Pros & Cons of Stripe Payments

Stripe is well-known for its highly secure payment processing and transparent charges. For business owners, Stripe payment gateway is undoubtedly a handy payment software. More pros and cons are discussed below. Let’s find out!

| Pros | Cons |

| Discounts for businesses with large payments volume, unique business model | No discounts for small-volume businesses |

| Transparent fees | Requires technical expertise |

| No hidden fees | |

| Universal platform with various payment methods & currencies | |

| Extensive features & services in both pricing plans | |

| Stable platform | |

| Safe & reliable solution | |

| Simple to set up | |

| 24/7 customer support |

Pros

- Discounts for certain types of businesses:

Stripe considers volume discounts for companies that have large payments volume and non-for-profit businesses. For further details, contact Stripe Sales to discuss.

- No hidden fees:

Stripe doesn’t charge any recurring fees or come up with accidental fees. Stripe’s integrated service has already included myriad types of available features and services. This plan also includes PCI compliance, technical support, and many more.

- Extensive features and services:

Both types of Stripe transaction fees (integrated and customized plans) are packed with many features and services that will assist your business in managing your payments seamlessly. Stripe is a perfect match for large companies that strive for more flexible customization and additional features with a customized plan.

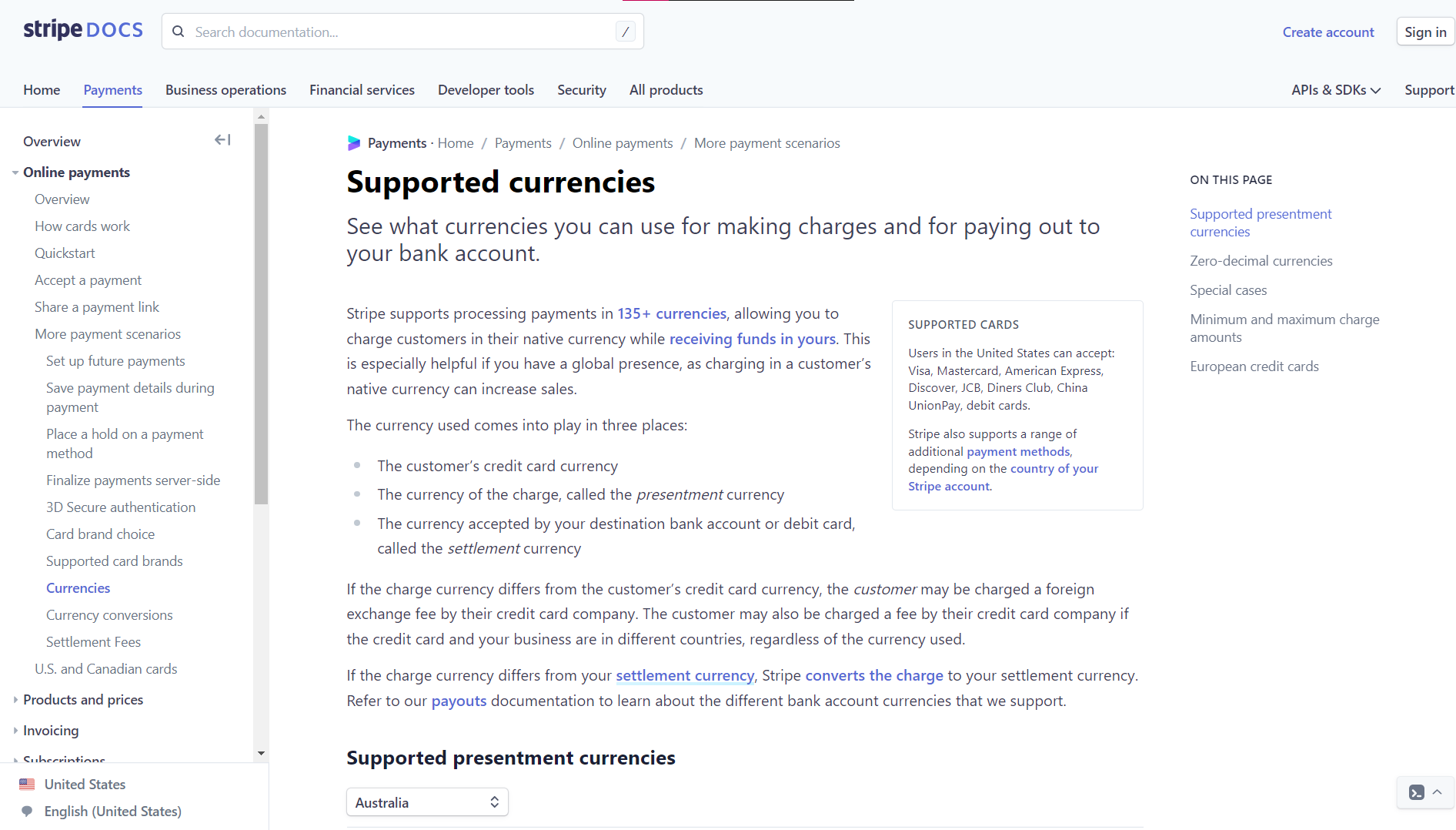

- Universality:

Stripe accepts processing payments over 135 currencies, allowing merchants to charge customers in their native currencies. This will be extremely helpful when you have a universal presence since it improves your customer experiences and ultimately increases sales. Stripe also supports a bunch of different payment methods: Bank transfers; Cards; Bank debits; Buy now, pay later; Bank redirects; Vouchers; Wallets.

- Stability:

Owing to frequent updates & constant testing, the platform processes smoothly, accepting payments without hold-ups or issues.

- High security:

Stripe is highly secure as it possesses the best security tools and practices. It is audited by a PIC-certified auditor and accredited to PIC Service Provider Level 1, the most demanding available certification level in the payments industry.

- Simple setup:

Jumpstart with Stripe payment is easy-peasy with no-coding requirement.

- Responsive customer service:

Fast and free 24/7 phone and live chat and emails for all Stripe users.

Cons

- No discounts for small-volume businesses:

Stripe currently does not have any available discounts for individuals or small-batch businesses.

- Required software development expertise:

You will need to have coding knowledge or coders in your teams, or else, Stripe would be challenging because of APIs features and extensive tools.

Want to Install Stripe in Your Store?

Shopify is one of the eCommerce platforms currently supporting Stripe. If you are intending to migrate to Shopify, LitExtension offers a great migration service that helps you transfer your data to Shopify accurately and seamlessly.

Is Stripe Right for Your Online Business?

Not every business fits the mold of Stripe. It can be seen as the best-in-class solution for fast-growing, tech-savvy online and B2B businesses. This is because Stripe excels in the following tasks:

- Create a completely customizable and secure checkout: Stripe is developer-focused allowing merchants to create the most customizable and scalable solution for designing checkout carts.

- Rapid-growing eCommerce businesses or service providers: Stripe is ideal for fast-growing businesses and service providers who accept recurring online payments, thanks to its highly customizable nature. Software developers can scale their business’ checkout procedure by employing reliable APIs and integrations.

- B2B businesses: Stripe is one of the top-tier B2B payment solutions for online businesses. It processes international transactions in dozens of currencies, from minor to significant amounts.

Overall, if any of the above businesses sound like yours, Stripe would be a “prince charming” for your business. But if not, you may prefer alternatives to Stripe, which will be shown in detail below.

Alternatives to Stripe & Fees Comparison

As we said, there is no one-size-fits-all solution for every business. So, if you are on the lookout for Stripe alternatives that can harmoniously fit your business’ needs and budget, check the below comparison. The listed options are very comparable to Stripe in terms of features, global reach, pricing, etc.

Nevertheless, since this article focuses on fees, we will only mention types of businesses they will fit and how much they will charge you.

| Stripe | Square | Paypal | Stax | Payment Cloud | |

| Online transaction fees | 2.9% + 30¢ | 2.9% + 30¢ | 3.49% + 49¢ | Interchange + 15¢ | 2.69% – 4.25% |

| Monthly fees | $0 | $0 | $0 | $99–199 | $25–$30 |

| Chargeback fees | $15 | $0 | $20 | $25 | $25 |

| Invoicing | Yes | Yes | Yes | Yes | Yes |

| Best for | Large, fast-growing, B2B businesses | Best alternative to Stripe | Value-added payment solutions for eCommerce | High-volume sales | High-risk businesses |

If you are not too wild about these softwares, you can try other remarkable POS systems. These unified platforms can handle more aspects of your online business involving sales, payment processing, inventory control, and other post-purchase steps.

Stripe Fees – FAQs

#1: Is Stripe free?

Although Stripe will not charge you monthly or annual fees, you still have to pay 2.9% plus 30¢ for every online transaction to accept card payments and 2.7% plus 5¢ for in-person payments.

#2: Does Stripe have hidden fees?

No, there are no hidden fees. You don’t need to worry about recurring and incident fees that happen to add up to your account.

#3: Will Stripe’s pricing save you money?

It depends on what you want for your business. Stripe provides rich developer tools that let business owners customize payments flexibly, which might be costly. However, in general, Stripe is one of the cheapest payment processors. Moreover, discounts are available to certain types of businesses. Contact Stripe Sales team for further information.

#4: Is Stripe cheaper than Paypal?

Stripe’s credit card processing fees are cheaper than PayPal’s in most cases. While Stripe charges 2.9% + $0.30, PayPal charges 3.49% + $0.49 per transaction.

#5: How can I reduce my Stripe fees?

As we mentioned, typically, Stripe considers discounts for businesses that have large-volume, non-profit, and maybe more. Contact Stripe sales for further support if you are in one of these business models.

#6: How long do payouts take?

Payout arrival dates depend on your industry and the country where you operate. In most circumstances, you won’t get your first payout from 2 – 4 business days after receiving your first successful payment. The initial payout may take longer for various reasons, such as your nation or being in a high-risk industry.

#7: How do refunds work?

Once you start a refund, Stripe submits refund requests to your customer’s bank or card issuer. Your customer will get the return as a credit in 5-10 business days, depending on the bank. If a consumer does not get a refund, they may contact you.

That’s a Wrap

We hope that you now get the total picture of Stripe fees. This article walks you through every crucial pricing plan and fee you need to be aware of when using Stripe. We will be thrilled if you find this article helpful.

Please contact our 24/7 customer support team to resolve your problems if you have any questions.

Please join our Facebook Community and visit LitExtension Blog section to discuss more eCommerce payment software or any eCommerce news.