Are you building your WooCommerce sites and starting to get the very first sales? Are you already a WooCommerce merchant and find that your current WooCommerce payment gateways cannot satisfy your customers’ needs?

Inappropriate gateways can badly hurt your business. Adopting the right payment gateways can greatly improve your customer experience and ultimately drive conversion. Thus in this article, LitExtension – #1 Shopping Cart Migration Expert will present you with the ultimate list of 8 payment gateways for WooCommerce so that you can focus on other tasks for your business growth.

Let’s dive right in!

8 Best WooCommerce Payment Gateways

#1. WooCommerce Stripe Payment Gateway

As of January 2022, there are over 1,2 million businesses using Stripe as a payment processor. Stripe is a simple way to take payments as it accepts almost all common debit and credit cards as well as local payment options.

With Stripe, rather than being redirected to an externally hosted checkout page, customers can complete their purchases right on your website, which has been shown to increase conversion rates.

Stripe functions as both a payment gateway and a platform for accepting payments.

To use Stripe as a WooCommerce plugin, you need a valid SSL certificate to secure your customer credit card. Yet, this plugin already has Stripe JS tokenized credit card numbers so that the data can remain safe.

Key features

Let’s look at what features Stripe has when working with WooCommerce as a payment gateway:

- Conversion-focused PCI-compliant checkout process

- Local payment options for global customers

- Support for faster checkout options on desktop & mobile

- Offer advanced fraud protection and 3D secure support

- Simple reporting and monitoring system

- Deliver quick payment processing

- Enhance the Strong Customer Authentication (SCA), which is necessary for transactions within the European Economic Area (EEA)

Pros & Cons

[wptb id=42453]

Cost

Stripe as a WooCommerce plugin is free to download. Stripe fees are calculated per transaction. Free updates and customer service are available. The transaction cost for using Stripe as your payment method is 2.9% + 30 cents for each successful card charge.

Find out more about Stripe WooCommerce fees: Stripe Fees – How Much Does Stripe Charge?

Currency & Country supported

WooCommerce Stripe payment gateway is compatible with WooCommerce businesses in over 45 countries/regions with over 130 currencies.

#2. Braintree for WooCommerce

Being appropriate for all kinds of businesses, Braintree has grown in popularity since its first release in 2007.

For eCommerce websites, this payment gateway excels at enabling both web and mobile payments. For WooCommerce store owners, Braintree is undoubtedly an optimal option when it acts as an all-in-one PayPal solution.

To use Braintree for WooCommerce payments, you must have PHP version 5.4 or higher. Strong Customer Authentication (SCA) is another need if you’re selling within the European Economic Area (EEA), and fortunately, PayPal powered by Braintree supports it!

Key features

Here are some features of WooCommerce Braintree payment gateway:

- PCI Compliance meets SAQ-A processes standards

- Accept PayPal and all popular credit and debit cards, such as Visa, Mastercard, American Express, Discover, Diners Club, and JCB

- Braintree’s comprehensive range of fraud capabilities can help you identify and prevent fraud

- PayPal buttons for fast checkout deliver a seamless checkout experience and, thus, improve conversion rates, especially on mobile

- Support Strong Customer Authentication (SCA)

Pros & Cons

[wptb id=42454]

Cost

The cost per wallet- or card-based transaction is 2.9%+ $0.30 if your clients complete the orders in the US using Visa, Mastercard, JCB, etc. The chargeback fee is $15.

Alternative payment options (PayPal, Braintree Apple Pay WooCommerce, Google Pay, etc.) and other nations may have different prices. For further details, please refer to this page.

Currency & Country supported

WooCommerce Braintree payment gateway is compatible with WooCommerce businesses in 47 countries with over 130 currencies.

#3. WooCommerce Payments

WooCommerce Payments is indeed specifically tailored for WooCommerce and is the best WooCommerce payment gateway. Without startup fees or ongoing costs, you securely get access to accept local payment options as well as popular credit and debit cards on your website.

You can boost your earnings by incorporating WooCommerce Subscriptions into the integrations and utilizing the power of recurring revenue. Despite being created in collaboration with Stripe, WooCommerce Payments cannot be integrated with an existing Stripe account. Instead, you can leverage an existing Stripe account on your WooCommerce store by using the Stripe extension.

Key features

What can a customer expect from WooCommerce Payments:

- Seamless experience that will lower your cart abandonment rate because your customers can pay directly on your store rather than being redirected to a third-party checkout page

- No need to manually calculate pricing or verify conversion rates because your customer can view prices and pay in the currency of their choice.

- They can save their credit card information for quicker upcoming checkouts.

What can you get as a WooCommerce merchant:

- No monthly costs

- Built-in support for several currencies

- Payment options including Apple Pay®, Google Pay, giropay, Sofort, iDeal, SEPA, P24, EPS, and Bancontact

- A simplified checkout process will lessen cart abandonment

- Utilize the integrated dashboard to keep track of chargebacks, disputes, and refunds

Pros & Cons

It’s understandable that WooCommerce is the most optimal choice when choosing WooCommerce payment gateways. You’re fully supported, and most importantly, it’s 100% compatible with your WooCommerce store!

Cost

For each transaction, the fee is $2.9 + $0.30, plus an additional 1% for international payments outside of the United States.

If you lose a dispute like a chargeback, there is additionally a $15 cost.

Currency & Country supported

When choosing WooCommerce Payments, the supported currencies are above 135.

This is the list of 10 countries with access to WooCommerce Payments: the U.S., U.K., Ireland, Canada, New Zealand, Australia, Spain, France, Germany, and Italy.

#4. WooCommerce Square

Square integrates flawlessly with the WooCommerce system. The payment gateway not only enables online payment for goods and services, but it also accepts credit and debit cards for mobile devices, online invoicing, and transactions in physical stores. These excellent utilities can all be installed without cost.

Below are what you need to use Square WooCommerce payment:

- A valid SSL certificate

- A Square account

- WooCommerce version 3.0 or higher

Key features

- Accept payments at any time and anywhere by accepting payments online, offline, or on the go

- Be accepted by all popular credit and debit cards

- Quick deposits within 1-2 business days

- Offer PCI-DSS compliant payment processing and end-to-end encryption without charging PCI or security fees

- Security of your account is always under review by Square’s fraud prevention team.

Pros & Cons

[wptb id=42456]

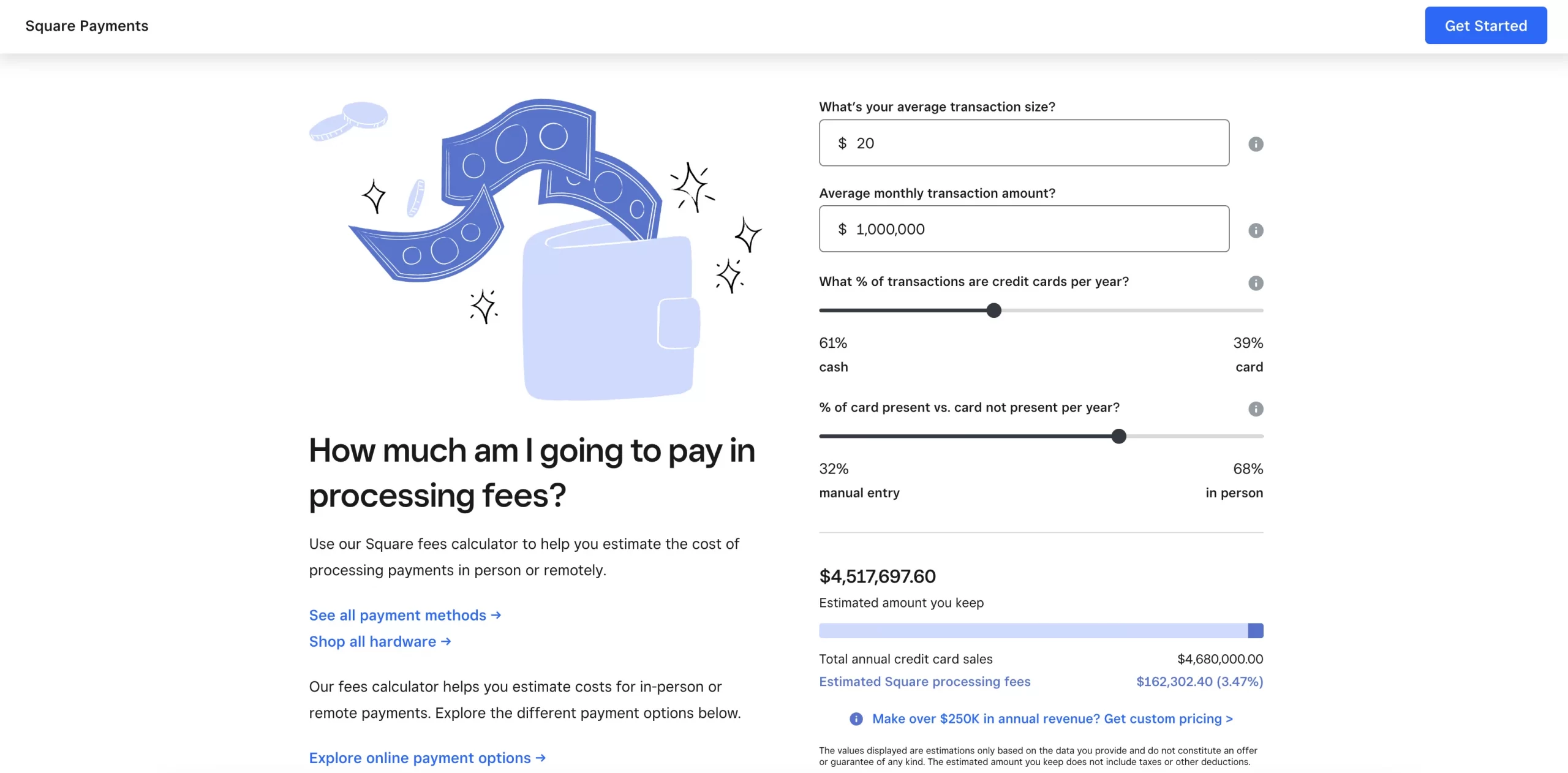

Cost

The cost of processing payments through your WooCommerce online store through Square is 2.9% + $0.30, and the prices will vary among nations. You can check it out right on the Square page for a detailed number.

For businesses with annual revenues above $250K and an average ticket size over $15, there will be a custom charge.

Currency & Country supported

Currently, WooCommerce Square only supports payments in the United States, Canada, Australia, Japan, Ireland, France, Spain, and the United Kingdom. You cannot use Square to handle payments if your shop base address is in different countries.

#5. WooCommerce PayPal Payments

According to PayPal’s company story, in 2021, $1.25 trillion is the total payment volume of PayPal, with 426 million active consumers. It is, therefore, unquestionably a significant player with a high reputation in the WooCommerce payment gateways industry.

💡 Further information: How Does PayPal Work? – The Mechanism Behind PayPal

To use PayPal for WooCommerce payments, you will need:

- WordPress 5.3 or higher version (installed)

- WooCommerce 3.9 or higher version (installed and activated)

- PHP 7.1 or higher version

- PayPal business account

Key features

- Increase sales by combining all popular payment methods into a one checkout solution

- Convert visitors into buyers using Later Pay

- Offer membership fees to encourage recurring business

- Offer 24/7 fraud detection and monitoring tools

- Satisfy worldwide markets with compliance standards like PCI and PSD2

- Compliant with card-based 2-factor authentication (3D Secure)

- No additional cost when upgrading PayPal

Pros & Cons

[wptb id=42455]

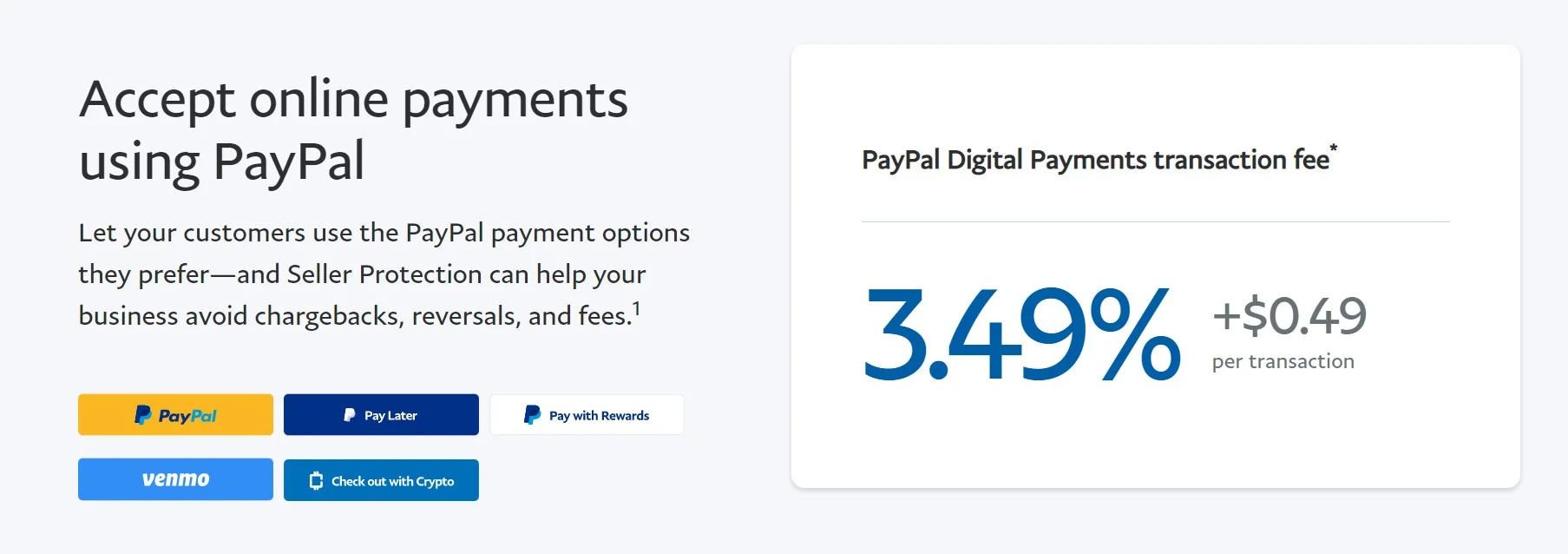

Cost

PayPal itself, as a WooCommerce plugin, is free to download. Like other WooCommerce payment gateways, PayPal charges you for each transaction.

The standard rate for successful credit card or digital wallet transactions with US-based businesses is 3.49% + 0.49 USD. The fee may vary among countries and nations. You can visit this guide to know how much you have to pay for PayPal in advance.

Currency & Country supported

PayPal supports the following currencies for use with payments and as currency balances: USD, THB, GBP,…

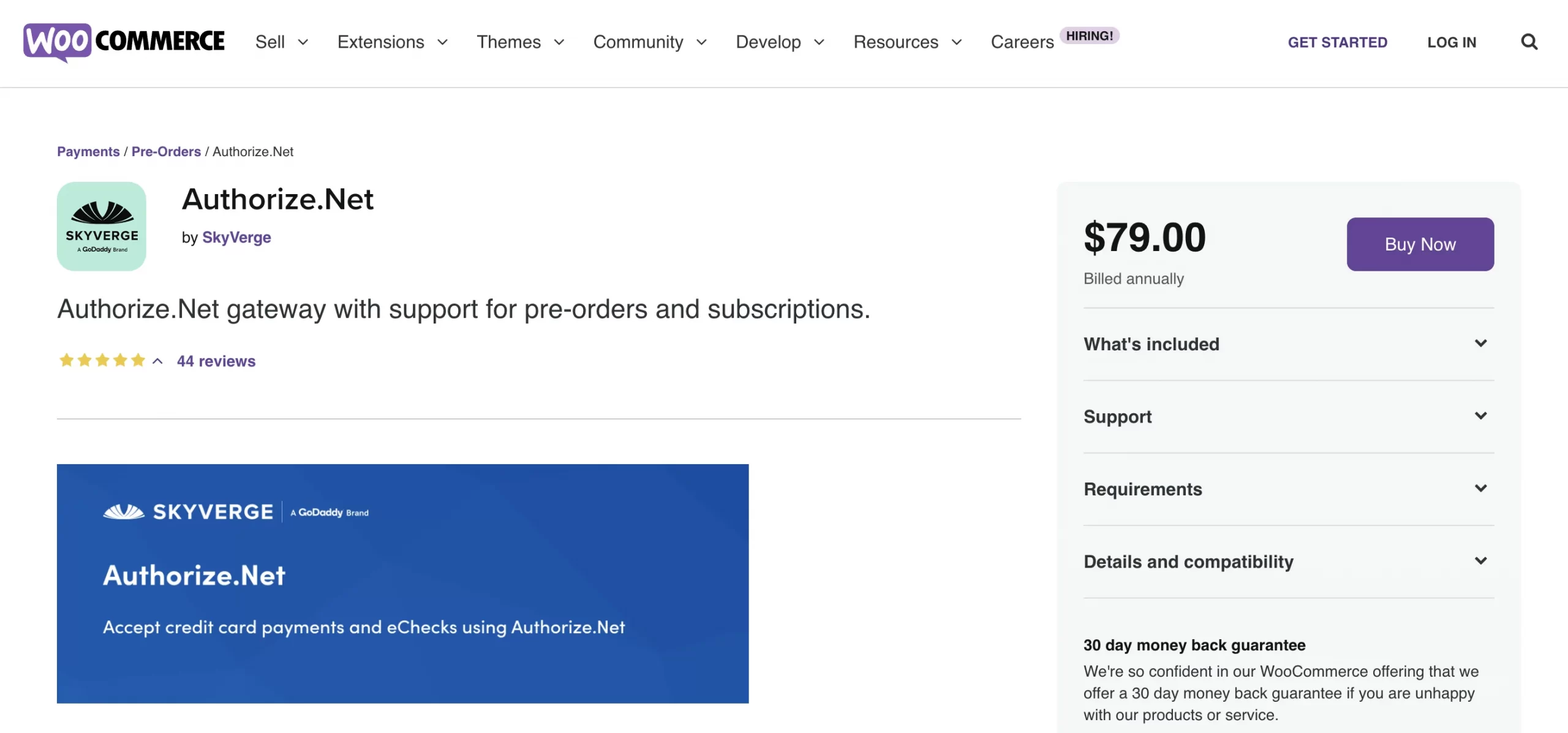

#6. Authorize.Net Payment Gateway For WooCommerce

Authorize.Net is trusted by more than 440,000 merchants and is one of the top payment gateways for WooCommerce.

In order to utilize all services provided by this gateway, your Authorize.Net account must have the CIM service activated.

With Authorize.Net, users can even pay for memberships using an eCheck or a credit card.

Additionally, the gateway fully supports WooCommerce pre-orders, allowing you to collect a customer’s payment information up front and charge it when the pre-order is made available.

Key features

- Complete assistance with Authorize.Net eCheck.

- Run complicated reports and receive a simple list of transactions by directly capturing charges from WooCommerce

- Authorize.Net Reporting is a tool that lets you quickly get access to WooCommerce store data by receiving a daily email with a CSV attachment with a list of all of your Authorize.net transactions

Pros & Cons

[wptb id=42457]

Cost

Like other WooCommerce payment gateways, this plugin is not free to download.

Initially, you need to pay $79.00 (annual billing) for installing it. Don’t worry because after 30 days of using Authorize.Net, if you are unhappy with products or services, you can get a money-back guarantee.

The transaction fee of Authorize.Net is 2.9% + 0.30 per transaction.

Currency & Country supported

If you’re selling in the United States, Australia and Canada, you can definitely process transactions via Authorize.net.

#7. WooCommerce Amazon Pay

Being launched in 2007, Amazon Payment is among the most dominant WooCommerce payment gateways in the marketplace. Amazon offers its customers a quick and secure checkout process, your customer can process payment, so they don’t have to leave your website.

Key features

- Integrated support for Strong Customer Authentication (SCA)

- Let customers use local currency throughout the shopping process

- Support for recurring payments via WooCommerce Subscription

- Offer policy for Payment Protection (Available for qualified physical goods purchases only)

- Offer Amazon Pay A-to-z Guarantee for Customers that further assurance to customers about the timeliness of delivery and order

Pros & Cons

[wptb id=42458]

Cost

Amazon Pay charges a domestic processing fee of 2.9% and an authorization fee of $0.30, plus tax where applicable.

For a more detailed fee, please visit: Amazon Pay fees

Currency & Country supported

Amazon is only available in the USA, UK, Germany, France, Italy, Ireland, Spain, Luxembourg, Austria, Belgium, Cyprus, Netherlands, Sweden, Portugal, Hungary, Denmark and Japan.

However, you can convert from almost all the dominant countries worldwide. Here is the list of countries and currencies supported by Amazon with estimated shipping windows.

#8. Paystack WooCommerce Payment Gateway

Paystack dominates online payment in Nigeria, Ghana, and South Africa. With this plugin, WooCommerce merchants can easily accept secure payments from various regional and international payment channels. By utilizing a cutting-edge, secure payment gateway, Paystack helps over 60,000 companies of all sizes receive payments.

Key features

- Offer a seamless WooCommerce checkout page by directly accepting payments on your website

- WooCommerce Subscriptions plugin and recurring payments

- 24/7 accessibility to attentive, responsive customer service

- Free updates as new features and payment methods are introduced

- APIs with clear documentation to create your own unique payment experiences

If you want the WooCommerce Subscriptions integration, your current WooCommerce version must be 2.6 or above. And if you want to use WooCommerce Subscriptions, your WooCommerce version must be 2.0 and above.

Pros & Cons

[wptb id=42461]

Cost

Paystack imposes a local transaction fee of 1.5% + NGN 100.

Your clients can pay from anywhere in the world. The exchange rate for foreign transactions will be 3.9% + NGN 100. By entering a value into the calculator here, Paystack allows you to see how much it costs to utilize the service.

Currency & Country supported

This is the list of Paystack-supported countries: Nigeria, Ghana, South Africa. However, Paystack is gradually expanding all over Africa.

What to Consider When Choosing WooCommerce Payment Gateways?

Cost

Each WooCommerce payment gateway will have a distinct start-up and recurring charges that include:

- Fee to buy a payment gateway extension/plugin (if it is not free)

- A sign-up fee by the payment gateway provider or processor

- Annual or monthly subscription costs

- Fees for each transaction (which may vary among countries)

Other WooCommerce resources that you shouldn’t miss out on:

Location (Currency & Available regions)

Currency and store location should be taken into consideration while choosing WooCommerce payment gateways. If the store is in the US and only accepts payment within the US, Canadian and European business owners cannot use it.

Security

Sensitive client data, such as email addresses, shipping addresses, and billing information, must be protected by store owners that accept payments.

Best payment gateway for WooCommerce needs an SSL certificate to accomplish this. This encrypts correspondence between your website and users as well as between your website and the payment processor. Another and additional way to better secure the store data is to apply Payment Card Industry Data Security Standard (PCI-DSS).

Fraud & International Suspicious Payment

Due to uncertainty around payments as well as the unpredictability of receiving the goods, selling internationally carries some additional risk. Merchants should care about these factors when choosing WooCommerce payment gateways.

Taxes & Duties

Based on which nation you are selling to, the tax will be differently imposed on the items you sell. VAT (value-added tax), which is levied by the majority of Europe, Canada, China, India, the majority of South America and Africa, among other nations, is the most prevalent international tax.

A tariff or tax known as a customs duty is levied on products that are carried across borders. By regulating the flow of imports, the intention is to protect the economy, jobs, etc. of the importing nation. You must examine the duty for each item you sell because each imported good has a distinct duty amount attached to it.

What is A Payment Gateway?

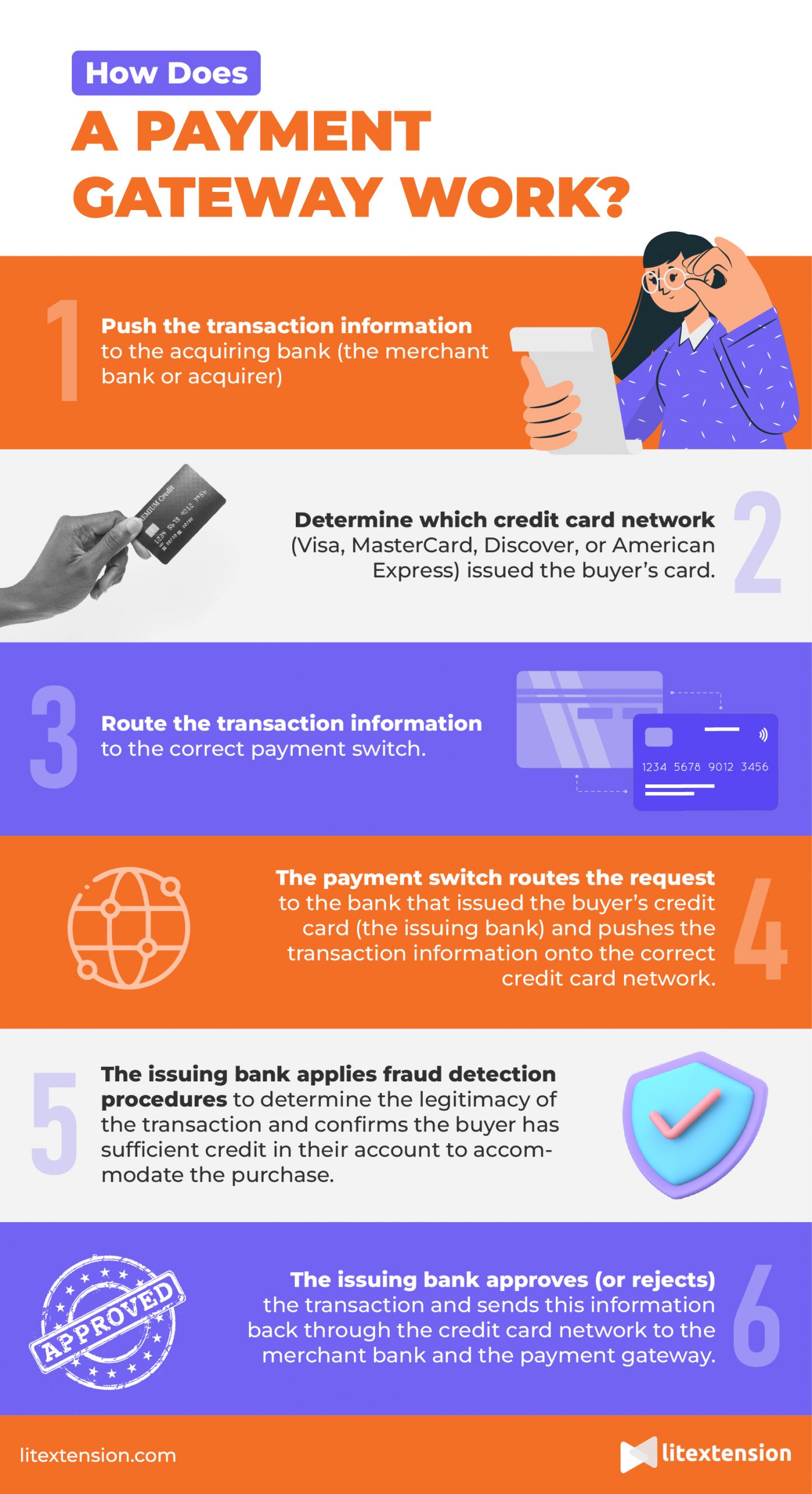

A payment gateway essentially acts as a middleman between sellers and their customers. It links the acquirers (the bank account for the merchant) and the processors (the bank account for the customer’s credit card).

The payment gateway will handle the payment request when a consumer makes a purchase on your eCommerce site, providing secure and practical online transactions. All of the steps in the payment procedure will be completed by a payment gateway.

How Does a Payment Gateway Work?

Instead of using a credit card reader, when a customer uses a credit card to make a virtual purchase, the card’s information is encrypted using digital capture files. A payment gateway will work throughout the payment process.

WooCommerce Payment Gateways – FAQs

[sp_easyaccordion id=”47171″]

What is Best WooCommerce Gateways – It’s a Wrap!

Customers and businesses can both benefit from a suitable payment gateway. It helps customers to check out swiftly and reduces cart abandonment rate for retailers. Hope that with the details in this article, you’re able to find the most suitable WooCommerce payment options for your business.

If you intend to migrate your store to WooCommerce, LitExtension is here to help. With 200,000+ successful migrations for 100,000+ worldwide customers, LitExtension can transfer all your data automatically and accurately.

Last but not least, please join our Facebook Community for exchanging and updating eCommerce news!